Resale restrictions for Plus, Prime flats may slow growing number of million-dollar HDB deals: Analyst

Potential buyers at the HDB Hub. (Photo: TODAY/Raj Nadarajan)

SINGAPORE: With longer minimum occupation periods (MOP) for new Housing Board flats in desirable locations, the number of million-dollar resale flat transactions could be crimped in time to come, said an analyst.

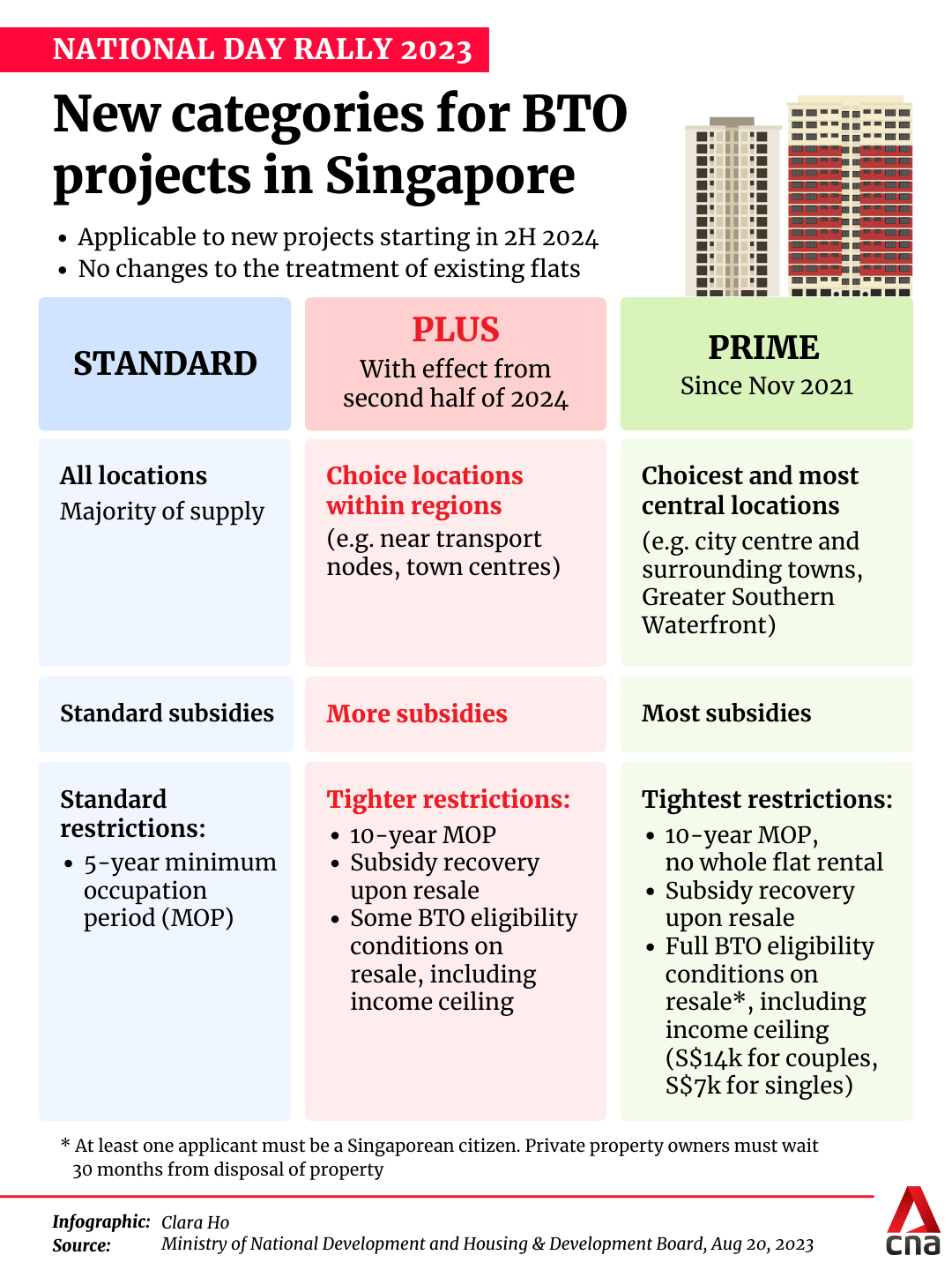

Prime Minister Lee Hsien Loong announced on Sunday (Aug 20) a major shift to how HDB flats are classified, with Build-to-Order (BTO) projects eventually dropping the mature/non-mature tags.

From the second half of 2024, flats will be categorised as Standard, Plus or Prime. Owners of Plus and Prime flats, which will be in choicer locations, will have to wait 10, instead of the usual five, years before selling their units. They will also be bound by stricter resale conditions.

Prime flats, which are in towns near the city centre, are the most highly subsidised and the first owners will have to pay back a portion of the subsidies if they sell the flat. Such flats can also only be sold to buyers who meet HDB's BTO eligibility criteria, including the income ceiling, currently set at S$14,000 (US$10,000) for couples and S$7,000 for singles.

The new Plus category of flats, which can also be found outside the central region, will be characterised by their choice locations within a region, such as proximity to near transport nodes or town centres.

To keep the selling price low, these flats will get more subsidies and buyers will similarly face clawback of these subsidies when they sell the flat. The amount and other details have yet to be announced.

Finally, Standard flats will have the same resale conditions as most flats now - a five-year MOP and no income ceiling on the buyers on resale.

"LOTTERY EFFECT"

Ms Christine Sun, OrangeTee and Tie's senior vice president of research and analytics, said that data shows a growing number of young Singaporeans selling their flats shortly after MOP.

The number of flats sold within two years of MOP or flats aged seven years and below has ballooned 733 per cent from 743 units in 2014 to 6,189 units in 2022. She noted that more newly MOP-ed flats were sold for at least a million dollars.

In 2022, 63 million-dollar flats were seven years old and below, constituting 17.1 per cent of all million-dollar flats transacted that year. Comparatively, no flats of that age range were sold for at least a million dollars in 2014.

"A rising number of such transactions may distort the price expectation of other sellers and fuel the heated million-dollar flat market," said Ms Sun.

"Lengthening the holding period of a property can delay the ‘lottery effect’ and reduce the number of people purchasing flats in prime locations for short-term gains," she said.

This may then stabilise the prices of private homes, especially in the suburbs, where demand is largely driven by HDB upgraders who may have gained a windfall from selling their flats.

HOLDING PERIOD "ONEROUS"

While most analysts said the changes were necessary given Singapore's evolving housing landscape, some pointed out potential downsides of having a longer MOP.

Mogul.sg chief research officer Nicholas Mak called the 10-year MOP "onerous" for many homebuyers. He noted that with the 3.5 to 4.5 years needed to construct the BTO flats, the flat buyer would have to wait about 14 to 15 years from the time of the BTO application to sell the flat.

In the meantime, the needs and circumstances of the household could change significantly.

"By restricting the geographical mobility of this family, it would restrict their choice of primary schools for the children because the family could not move to another location that is nearer to their preferred primary schools," said Mr Mak.

"The flat owner may need to move to another location due to other reasons during the longer MOP, such as a change of work locations or to move closer to their ageing parents. However, the longer MOP would restrict their mobility."

But Mr Lee Sze Teck, Huttons' senior director of data analytics, said that by offering more subsidies for flats in choice locations, the government can ensure a good social mix, ensure affordability and fairness.

Ms Sun said that the MOP may be acceptable to many buyers as past sales data show that the majority of flats are sold after 10 years.

In 2022, 73.1 per cent of resale transactions were for flats that were at least 10 years old, she said.

"The new PLH model flats, which require a 10-year MOP, were probably used as a test bed to assess market acceptance of premium flats that entail a longer MOP," said Ms Sun.

"Based on the robust number of applicants for PLH model flats, the results have been positive, indicating that many buyers are receptive to buying flats with longer MOP."

MOVING UP THE HOUSING LADDER

Analysts had different views of how the new Plus category would affect demand and prices in the property market.

Huttons' Mr Lee said that the supply of resale flats might be reduced in the areas where Plus flats are located as these flats have a longer MOP, leading to a rise in the price of resale flats in these areas. It may also push demand to Standard resale flats, which do not have the same restrictions as Plus flats.

And while the new framework will moderate the lottery effect for young couples who ballot successfully for BTO flats in central areas, existing homes that are at the fringe of Plus projects could enjoy a "more robust resale price", said Dr Leong Chan Hoong, head of policy development, evaluation and data analytics at Kantar Public.

Mr Lee added the resale restrictions may create difficulties in moving up the housing ladder as it will take longer for owners of HDB flats to realise substantial capital gains.

"The proportion of buyers with a HDB address buying a private property has declined in recent years and more are relying on intergenerational wealth transfer to do so. This may exacerbate the haves and have-nots in society," he said.

Mr Mak said that the 10-year MOP could reduce the resale demand and limit the capital appreciation for such flats, compared to flats with a five-year MOP, thus potentially limiting the buyers' "financial mobility".

Still, the changes may lead to a stable HDB market in the long run, said Mr Lee.

RECLASSIFICATION "LONG OVERDUE"

CEO of PropNex Ismail Gafoor called the reclassification of new HDB flats "long overdue".

"We believe the longer MOP and additional restrictions for the Plus and Prime flats will support home ownership and make public housing fair and equitable since the buyers enjoy more subsidies and will likely see healthy upside potential for their flats in the resale market later on," he said.

Dr Leong said that there is a trend towards gentrification and socio-economic segregation when home buyers who are assigned a flat in a highly desired location, such as the Pinnacle in Tanjong Pagar, enjoy a windfall in the resale market after fulfilling the MOP.

Subsequent home buyers in the same location would need strong financial backing to purchase an apartment here – this means that over time the neighbourhood is exclusive to middle-upper income households, he said.

"The change to a new framework is a difficult but essential one, and it is good that PM has addressed it decisively as he prepares (to hand over) leadership to the 4G," said Dr Leong.

On where future Plus projects could be located, Ms Sun said that future projects could be in Toa Payoh, Mount Pleasant and the old Turf Club at Bukit Timah.

The Celia Moh Chair Professor of Economics at Singapore Management University Phang Sock Yong said that HDB estates have been socially designed to be diverse and inclusive in ethnic and income mix at the outset.

But the high resale prices in choice locations have led to more income-segregated HDB estates.

"This was already recognised when the Prime Location Public Housing model was introduced in 2021. The Plus Model can be considered a lower-tier version of the Prime Location Model."

Dr Phang said that it is possible that future resale prices of flats in choice locations could be the same, or even lower than resale prices of Standard flats, as permanent residents and households not eligible for BTO flats would not be able to buy resale flats categorised as Prime and Plus.