HDB launches four Prime projects in October BTO exercise, with highest subsidy clawback of 14%

The Berlayar Residences, located at the former Keppel Club site, will have the highest subsidy clawback among Prime projects in Bishan, Bukit Merah and Toa Payoh.

An artist's impression of the Berlayar Residences housing project in Bukit Merah. (Image: Housing and Development Board)

This audio is generated by an AI tool.

SINGAPORE: The Housing and Development Board (HDB) on Wednesday (Oct 15) launched four Prime projects for sale in Bishan, Bukit Merah and Toa Payoh as part of its October Build-to-Order (BTO) exercise.

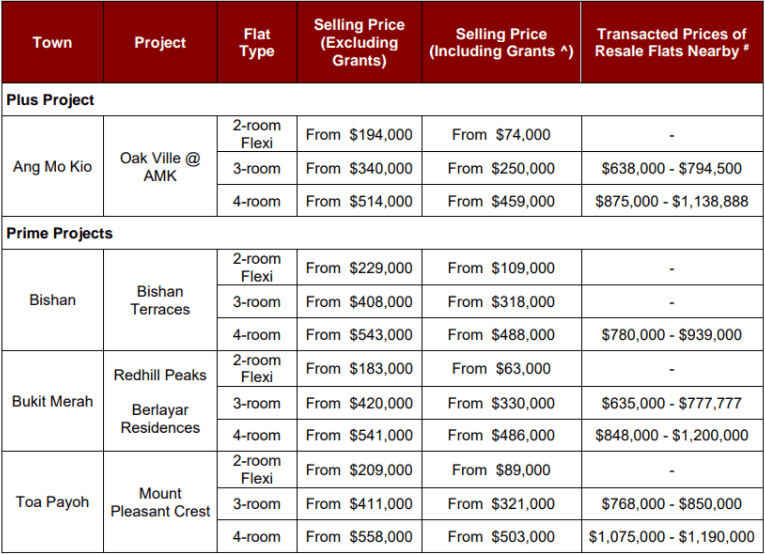

Among the four, Berlayar Residences, located at the site of the former Keppel Club, will have a subsidy clawback rate of 14 per cent, the highest to date. It is the first BTO project to be launched in this new housing estate at the Greater Southern Waterfront.

Redhill Peaks in Bukit Merah and Mount Pleasant Crest in Toa Payoh come with a subsidy clawback rate of 12 per cent, while the figure is 10 per cent for the Bishan Terraces project.

More than 9,100 flats across 10 projects were launched for sale on Wednesday, including community care apartments in Sengkang.

About 3,300 BTO flats, in Bedok, Sengkang and Yishun, are expected to have shorter wait times of less than three years.

This is the first BTO exercise where the new Family Care Scheme (Joint Balloting) is being rolled out, which enables parents and their children, regardless of marital status, to jointly apply for two units in the same housing project, where there are two-room Flexi or three-room flats offered.

PLUS AND PRIME FLATS

A Plus project in Ang Mo Kio was also launched for sale, with a subsidy clawback rate of 7 per cent upon resale.

Plus and Prime flats are located in places where they would eventually command higher market values. As such, they are priced with additional subsidies to keep them affordable. They also come with tighter sale conditions, such as a 10-year minimum occupation period.

"The subsidy recovery rates are commensurate with the extent of the additional subsidies provided for the respective projects," said HDB.

ERA Singapore's key executive officer Eugene Lim noted that the 14 per cent subsidy clawback rate for Berlayar Residences is more than double the 6 per cent seen when Prime flats were first introduced in 2022.

"This would encourage long-term occupancy, especially considering the generous subsidies and grants offered under the PLH (Prime Location Housing) model, as well as a first-mover’s advantage to brand new housing precincts," he said.

The higher clawback rate of 14 per cent is not unexpected, said Mohan Sandrasegeran, Singapore Realtors Inc's (SRI) head of research and data analytics, citing Berlayar Residences' "exceptional location and the transformative potential of the surrounding precinct".

The launch of Berlayar Residences - the first public housing project within the Greater Southern Waterfront - is a "historic milestone", he said.

"Future homeowners stand to benefit from strong capital appreciation over time. The elevated clawback rate ensures that these gains are equitably balanced against the substantial subsidies provided at launch."

The level of demand would have an impact on private homes and HDB resale flats in the area, said Ms Christine Sun, chief researcher and strategist of Realion (OrangeTee & ETC) Group.

"For instance, if demand is exceptionally high, those who are unsuccessful in securing a BTO flat may turn to the secondary market," she added.

Analysts also drew attention to the first BTO project to be launched in the new Mount Pleasant housing estate.

ERA's Mr Lim said Mount Pleasant falls within the residential town of Toa Payoh, "which has historically experienced high resale transaction prices due to its advantageous location on the city fringe".

“The future precinct will be served by a fully completed Mount Pleasant MRT station on the Thomson-East Coast Line."

COMMUNITY CARE APARTMENTS

To support seniors in ageing independently in the community, HDB will offer 207 community care apartments at Fernvale Plains in Sengkang.

This is the fifth Community Care Apartment project to be launched.

Eligible seniors who want to buy a community care apartment or two-room Flexi flat may apply for the enhanced Silver Housing Bonus of up to S$40,000 when the enhancement takes effect in December.

"This enhanced bonus provides greater support to seniors who choose to right-size and supplement their retirement income," said HDB, adding that seniors who buy a three-room flat in this BTO exercise are eligible for a cash bonus of up to S$30,000.

NEW FAMILY CARE SCHEME

Under the new Family Care Scheme, up to 15 per cent of the two-room Flexi and three-room flats will be set aside for parents, while up to 15 per cent of the two-room Flexi to five-room flats will be set aside for their children.

The scheme allows eligible parents and their children, regardless of marital status, to jointly apply for two units in the same BTO project.

Those who wish to buy a home in the October BTO exercise must have a valid HDB Flat Eligibility (HFE) letter when they submit their flat application.

In total, HDB has launched 29,975 new flats in 2025, comprising 19,723 BTO flats and 10,252 units under the Sale of Balance Flats exercises.

This brings the total BTO supply from 2021 to 2025 to about 102,400 flats, which HDB said exceeds its earlier commitment of 100,000 new flats over the five-year period.

In the next BTO exercise in February 2026, HDB is expected to launch about 4,600 flats in places like Sembawang, Tampines and Toa Payoh.

"The ramp-up in BTO and Sale of Balance Flats (SBF) supply is playing an important role in moderating the resale market," said SRI's Mr Sandrasegeran.

"With more new flats entering the supply pipeline, particularly those with shorter waiting times, some demand is being diverted away from resale flats."