OCBC digital banking services resume after 'technical issues' affect PayNow, funds transfers

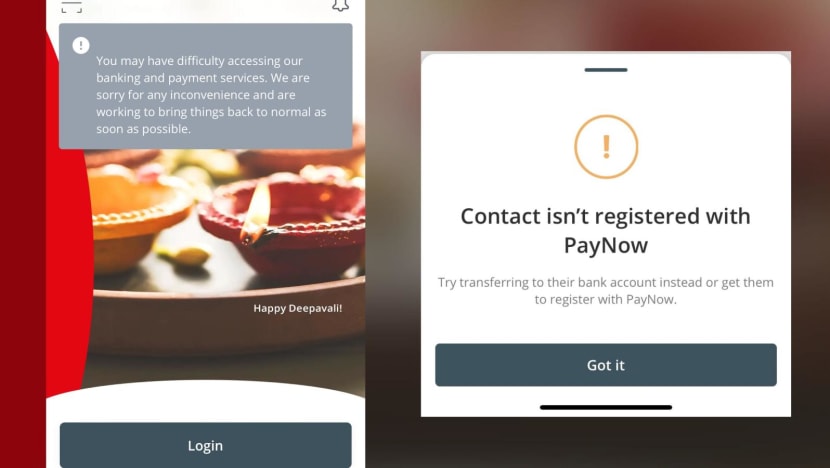

Screenshots of the OCBC banking mobile app and its PayNow page on Nov 7, 2023.

This audio is generated by an AI tool.

SINGAPORE: OCBC digital banking services resumed on Tuesday (Nov 7) after "technical issues" affected customers for more than two hours.

The bank said in response to queries from CNA that the issues struck at about 12pm.

"We experienced technical issues affecting Funds Transfer and PayNow services on the OCBC Digital app and Internet Banking platform from around 12 noon today.

These services were restored at about 2.30pm. We apologise for the inconvenience caused and thank our customers for their patience," it said.

Some customers were earlier unable to access OCBC's digital banking services or use its PayNow platform. The bank had cited "intermittent technical issues" in response to complaints left on its Facebook page.

An error message on its app also said customers "may have difficulty accessing our banking and payment services".

For some users attempting PayNow transfers, they were unable to select recipients and were instead told that their chosen contacts were not registered with the service.

"OCBC digital banking seems to be down again? Can’t open the app and Pay Anyone now decommissioned," said Facebook user Joe Sin, in reference to the bank's recently discontinued standalone payments app.

Facebook user Gary Liew said the SMS one-time passcode (OTP) was not working for him while Reddit user SlaySlavery also encountered an issue with transferring money.

The lunchtime service disruption on Tuesday was the latest in a string of separate digital banking disruptions or service outages this year.

Connectivity issues caused NETS-related services to go down briefly on Nov 3, with some users having problems with their payments not reflecting or being charged multiple times.

DBS and Citibank were hit by an hours-long outage on Oct 14, affecting online banking and payment services. It was said in parliament that these disruptions prevented about 2.5 million payment and ATM transactions from being completed.

DBS itself has suffered multiple service disruptions this year, with a day-long service outage in March and digital banking services and ATMs also going down in May.

OCBC suffered a morning outage on Aug 28 due to a “technical problem”. The affected services included its internet and mobile banking platforms, PayNow, ATMs, cards and Velocity, the bank's digital business banking platform