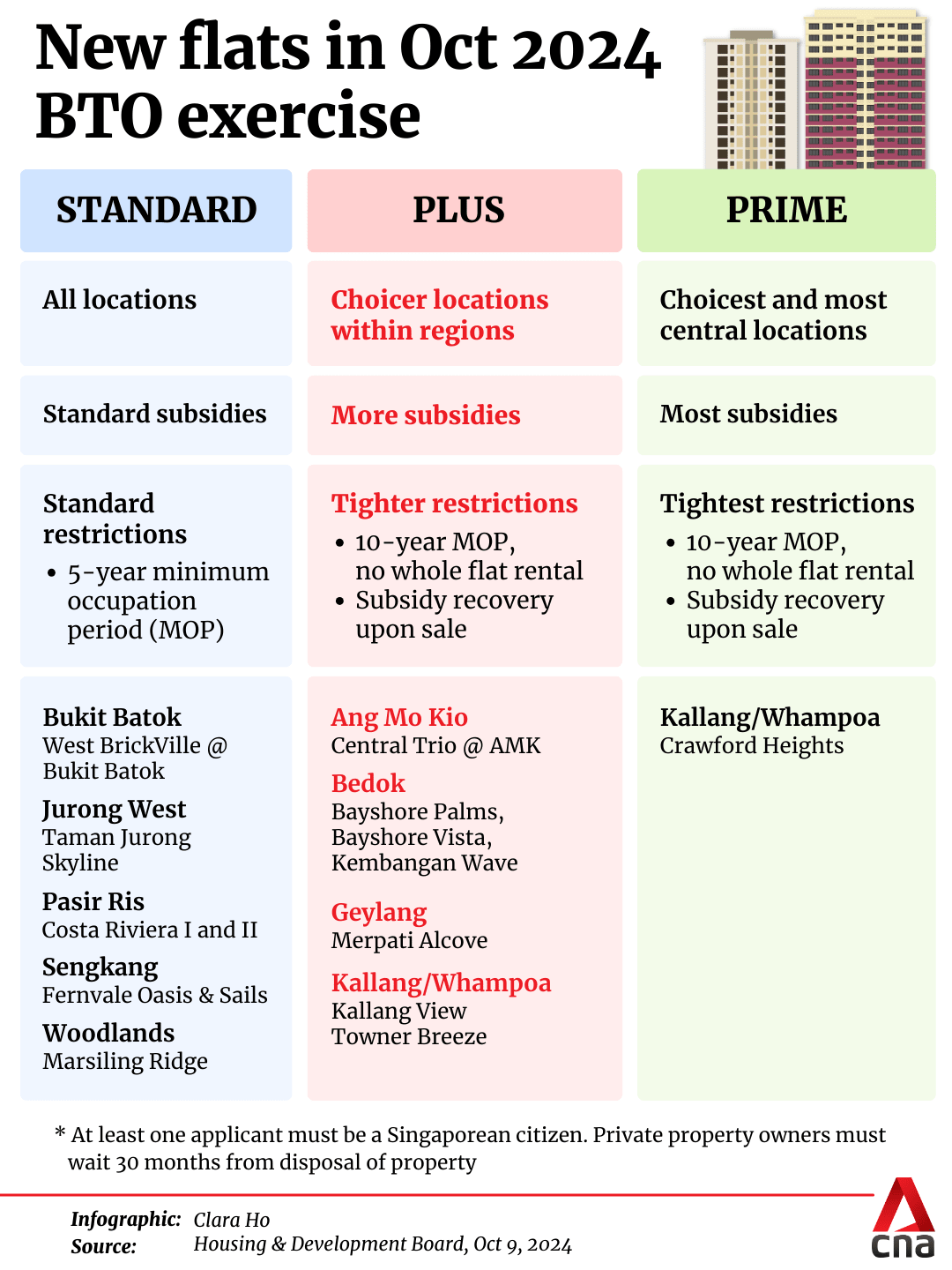

October BTO launch: Plus and Prime flats to have 6-9% subsidy recovery rates

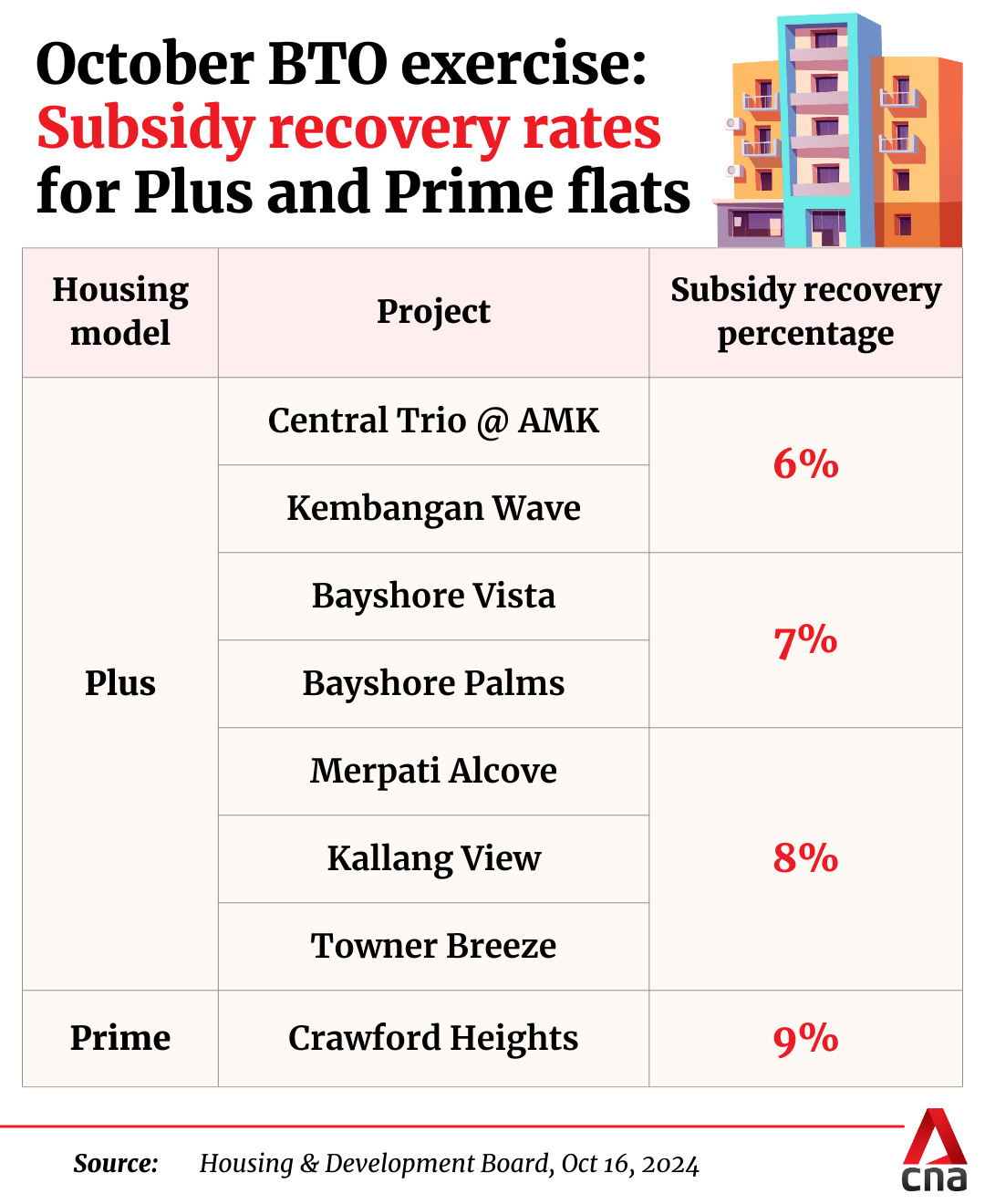

Subsidy recovery rates are set at 6 to 8 per cent for the seven Plus projects, and 9 per cent for the sole Prime project.

An artist's impression of Bayshore Palms, one of the Plus projects launched in the October 2024 BTO exercise. (Image: HDB)

This audio is generated by an AI tool.

SINGAPORE: Home buyers purchasing Plus and Prime flats launched on Wednesday (Oct 16) will be subject to subsidy recovery rates ranging from 6 to 9 per cent.

This is the amount owners of these flats will have to pay back to the Housing and Development Board (HDB) when they sell their homes upon reaching the 10-year minimum occupation period.

HDB on Wednesday launched more than 8,000 new flats across 15 projects - the most in a Build-to-Order (BTO) sales exercise to date.

Seven of the projects are under the Plus category, one in Prime and seven are classified as Standard projects. This is the first time that BTO flats are grouped this way, instead of being considered as being located in mature or non-mature estates.

In general, Prime and Plus flats are those with superior locational attributes. They are priced with more subsidies than Standard flats to ensure affordability but also come with tighter restrictions on resale and rental to reduce the “lottery effect”.

The subsidy clawback – derived as a percentage of the flat’s resale or valuation price, whichever is higher – is one such restriction, and will range from 6 to 8 per cent for the newly launched Plus flats.

The clawback for the sales exercise’s sole Prime project – Crawford Heights in Kallang/Whampoa – is set at 9 per cent, in line with that of recent projects launched in June under the Prime Location Public Housing (PLH) model.

When deciding the clawback rates for the Plus flats, HDB said it considered the extra subsidies needed to maintain the affordability of these projects which have varying market values.

For example, while Kembangan Wave, Bayshore Vista and Bayshore Palms are all located in Bedok, the latter two are set in the new housing area of Bayshore, which is “more favourably located near East Coast Park and a proposed sports and recreation facility”.

“As their more favourable locations command higher market values, higher additional subsidies are required to lower their flat prices so that they are more affordable to a wider range of Singaporeans,” HDB said.

This is why a higher subsidy recovery rate of 7 per cent is set for Bayshore Vista and Bayshore Palms, compared to the 6 per cent for Kembangan Wave, it added.

In the case of Merpati Alcove in Geylang, the project is located next to Mattar MRT station and nearer to the city centre. An 8 per cent subsidy recovery rate is hence determined to be commensurate with the higher level of additional subsidies provided, HDB said.

This project also offers 265 community care apartments that integrate senior-friendly housing design with on-site care and social services. This will be the fourth such assisted living project for seniors in Singapore.

A LOOK AT THE SELLING PRICES

HDB said all new flats on offer have been “priced with significant market discounts” and are “considerably lower than the transacted prices of comparable resale flats”.

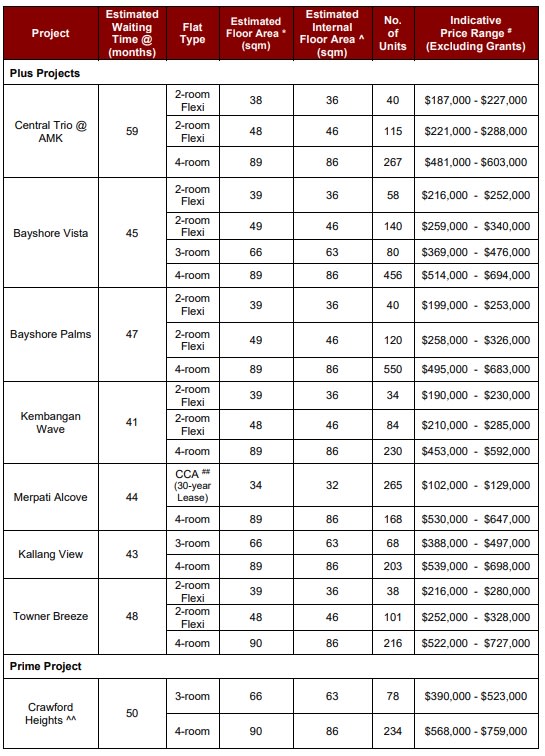

Take for example the Prime project Crawford Heights in Kallang/Whampoa, which will have a mix of three-room and four-room flats on a site near Lavender MRT station.

Prices, excluding grants, will range from S$390,000 to S$523,000 for a three-room unit, and S$568,000 to S$759,000 for a four-room flat. By comparison, four-room resale flats nearby cost between S$890,000 and S$938,000.

Crawford Heights is also where “white flats”, or HDB flats with a new open-concept layout, will be piloted. Home buyers can indicate their preference when they are invited to book a flat.

Prices for the “white flats” will be lower – by S$6,000 for three-room and S$8,600 for four-room flats - to account for the non-provision of internal partition walls and some electrical points, HDB said.

Kallang/Whampoa will have two Plus projects on offer.

Kallang View, for instance, is about a 10-minute walk from both Geylang Bahru and Kallang MRT stations. Prices for three-room units range from S$388,000 to S$497,000, while four-room flats are going for S$539,000 to S$698,000. All prices exclude any grants given.

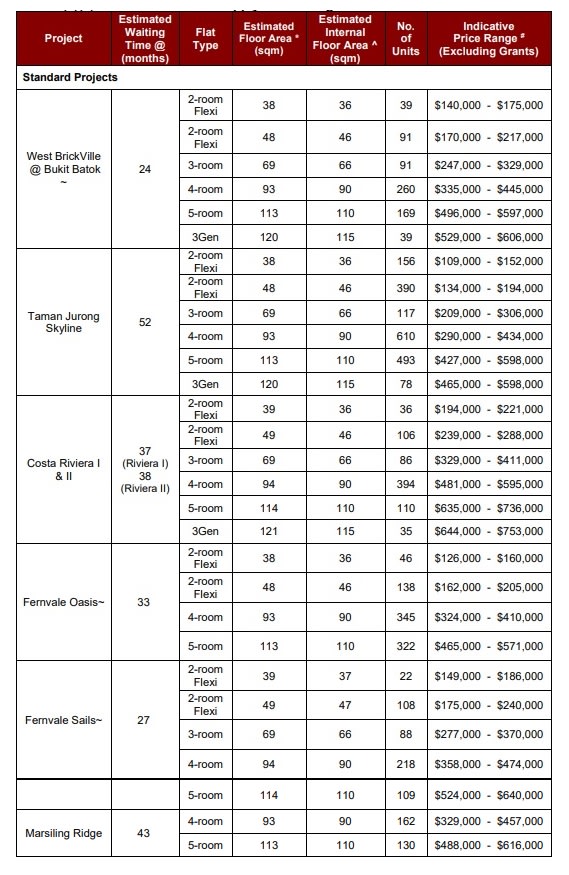

Among the Standard projects, Costa Riviera I and II in Pasir Ris are the priciest. These two projects will offer a total of 767 units on a plot near Pasir Ris MRT station.

Prices range from S$194,000 to S$288,000 for a two-room Flexi flat, S$329,000 to S$411,000 for a three-room flat and S$481,000 to S$595,000 for a four-room flat.

For the bigger flat types in this project, a five-room flat is going for S$635,000 to S$736,000, and a 3Gen flat for S$644,000 to S$753,000.

MORE OPTIONS FOR SINGLES, SHORTER WAITING TIMES

Apart from the roll-out of a new housing classification system, October’s BTO sales exercise, which is the final launch of new HDB flats for 2024, also marks the first time that singles are allowed to apply for two-room Flexi flats in all locations across Singapore.

Previously, eligible singles above 35 could only apply for such flats in non-mature estates.

Nearly 2,000 two-room Flexi units are on offer across 10 projects this time, namely Ang Mo Kio, Bedok, Bukit Batok, Jurong West, Kallang/Whampoa, Pasir Ris and Sengkang.

HDB said of the 8,573 flats up for sale in October, around 70 per cent will have a waiting time of four years or less.

These include the 2,085 flats located across three projects in Bukit Batok and Sengkang with a waiting time of less than three years. Another 767 flats at Costa Riviera I & II will have a waiting time of slightly over three years.

For the year, close to seven in 10 of the flats launched have a waiting time of four years or less.

HDB said it is committed to offering more BTO flats with waiting times of three to four years, in addition to its target of launching 2,000 to 3,000 flats with shorter waiting times each year.

Home buyers must have valid HDB flat eligibility (HFE) letters to participate in the BTO sales exercise. Applications can be made online via the HDB Flat Portal from Wednesday until Oct 23.

Flat applicants were also advised to take into consideration the lowering of the maximum loan that home buyers can take from HDB.

From Aug 20, the loan-to-value limit for HDB housing loans was tightened from 80 per cent to 75 per cent. The cooling measure was aimed at encouraging more prudent borrowing and dampening demand at the higher end of the public housing resale market.

The next BTO sales exercise is set for February 2025, when about 5,000 flats in Kallang/Whampoa, Queenstown, Woodlands and Yishun will be launched.

“The supply will be subject to review as project details are firmed up closer to the launch date,” the housing authority said, adding that more information, including the classification of the different projects, will be revealed at the launch.