Google ad bank scam: Victim tells how she was duped of nearly S$20,000 in sophisticated ploy

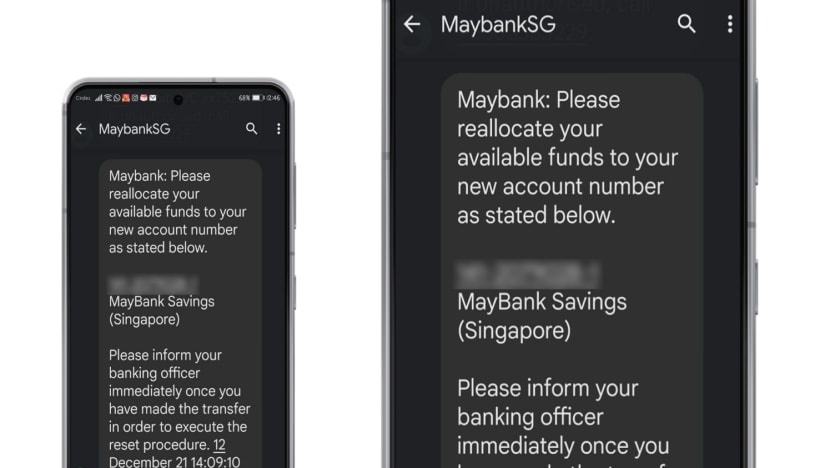

The SMS that Mrs Wong received purportedly from Maybank.

SINGAPORE: The nightmare for Mrs Wong (not her real name) began on Dec 12 last year, when her Grab app notified her that its GrabPay auto top-up function was having problems.

These notifications, which said she had insufficient funds in her bank account, had been popping up for the past few days, Mrs Wong told CNA.

She said her GrabPay wallet was linked to her Maybank credit card. So, she checked her Maybank account and confirmed she had enough money in there.

After this story was published, a Maybank spokesperson said the wallet was linked to Mrs Wong's debit card, not credit card.

That fateful Sunday, Mrs Wong, 48, decided to settle the issue once and for all.

The beauty consultant picked up her handphone and did a Google search for Maybank's customer service number. The number appeared in the first result, which she remembered was not labelled as an advertisement. She insisted that it looked legitimate enough.

The person who picked up the phone identified himself as one "Freddy Heng" from Maybank. Mrs Wong said he sounded professional, listening to her problems and asking the right questions.

He asked for her name, address, birth date, email and where she opened her Maybank account. She gave them all.

"It was exactly how a Maybank (employee) would sound," she said.

Mrs Wong was told that her account was frozen as part of an anti-scam campaign conducted by the police. Grab was not part of this campaign, he said, hence the top-up issue. To resolve this, Mrs Wong would need to transfer her money to another Maybank account, she was told.

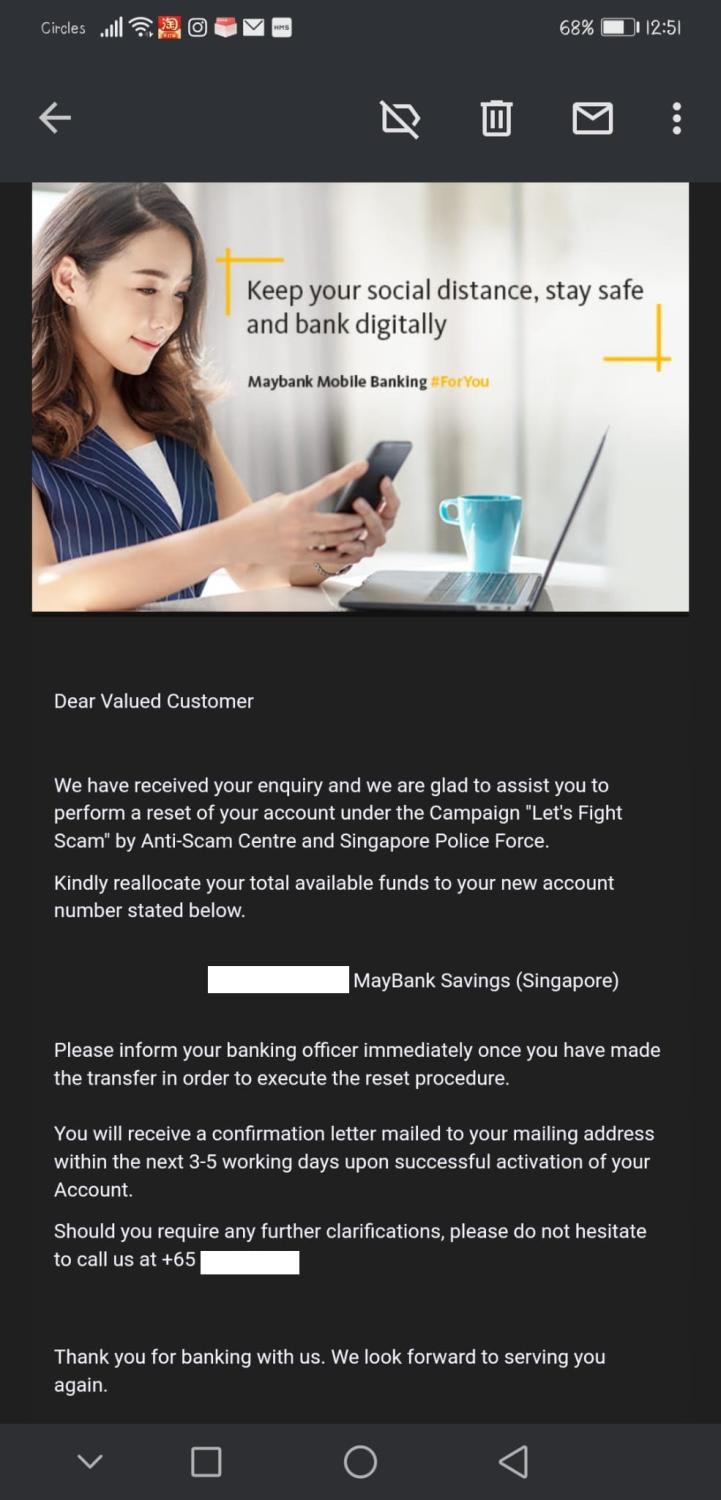

Adding to the air of legitimacy, Freddy Heng did not give any account details over the phone. These would be sent over SMS and email. Mrs Wong got them and gave them a second glance.

The SMS appeared in the same Maybank thread that the bank used to send one-time passwords. The email appeared to be sent by Maybank, with an official-looking header picture, and did not have typographical errors. They looked credible, Mrs Wong thought.

Mrs Wong increased her transfer limit and proceeded to send almost S$19,000 to the other account, which she said had been created under her name. Soon, Freddy Heng called again to confirm the transfer was done. Mrs Wong said yes and went back to work.

"In the evening, I didn't feel so right," she said, crediting her "gut instinct" as doubts crept in. Did the other account really belong to her? "Even if it was under my name, it could just be a nickname; it could be anybody’s account."

Mrs Wong did the same Google search and discovered that the top result had changed. It looked exactly the same, she said, only that the customer service number listed was different. She immediately called the number and relayed what had happened.

It was an actual Maybank employee on the line. "They said it was a scam," Mrs Wong said. "When I tried to share what happened, they just told me it’s my fault. They refused to be helpful, they just asked me to go and make a police report."

The Maybank spokesperson said Mrs Wong called the bank five hours after she made the transfer.

FEELING HELPLESS

Mrs Wong had fallen for a new scam that tricks victims into calling fake bank hotlines found in advertisements on Google searches. At least 15 victims have lost a minimum of S$495,000 to the scam since December last year, police said on Jan 19.

A large spike in scam cases last year has also fuelled a rise in crime levels, where scams made up more than half of reported crime cases in 2021, up from roughly 40 per cent in 2020.

That same evening, Mrs Wong went to the police station to make a report.

First thing the next morning, with report in hand, she headed to a Maybank branch to see if they could do anything for her.

"I'm upset with myself," she said of her feelings then, acknowledging that she had been "foolish" and negligent". "I'm most upset that Maybank pushed everything away."

Bank staff told her she should have realised it was not Maybank's number in the Google search, she said, adding that a manager told her she was not the first victim, making her feel this was more common that she thought.

"But to me, how the hell would I know (about the number)?" she said, suggesting that the average person would not memorise bank customer service numbers.

"What rubbish is this? Does it mean as members of the public, when we put money in bank we (are supposed to be) vulnerable to getting scammed?"

Overall, Mrs Wong felt disappointed at how the bank treated her. "I mean, they should be more understanding that I've been scammed," she added.

When asked to comment on the incident, a Maybank spokesperson told CNA that the bank had advised Mrs Wong to make a police report, saying that the bank fully cooperates with police investigations.

"We deeply empathise with the emotional distraught that scam victims go through. However, the bank does not comment on specific customers while police investigations are ongoing," the spokesperson said.

"The bank prioritises suspected scam cases and handles these in a professional manner, in tandem and in full cooperation with police investigations. We endeavour to ensure that our staff also assist our customers as best we can under these circumstances."

After Mrs Wong made the police report, Maybank also lodged a police report and informed the Infocomm Media Development Authority (IMDA) on the blocking of the spoof phone number, and sent the spoof SMS header to the anti-smishing registry, the spokesperson said.

Smishing refers to the sending of text messages purported to be from reputable companies to get someone to reveal their personal information.

"We are also part of the anti-smishing registry set up by IMDA, which reduces but does not eliminate the possibility of SMS spoofing," the spokesperson said.

Once scammers get hold of victims' funds, they would typically transfer the money immediately or within the next few minutes, the spokesperson said, citing the "instant" nature of such transfers.

"By the time customers make their reports a few hours later, the money is long gone," the spokesperson added.

In the days and months that followed, Mrs Wong felt belittled at home. Her husband and daughter chided her, she said, with the latter asking why "mummy is so stupid".

"Even my loved ones, they don’t empathise with me, yet they mock me. You are suffering, then you get mocked," she added, her voice breaking.

SLIM CHANCES

More despairingly, Mrs Wong said she has yet to hear from the bank about whether her money could be recovered. Police have told her the chances are slim, she said, adding that it could be hundreds of dollars at best.

When the investigating police officer called to ask if she was willing to be interviewed for this story, she thought he had some news. When he said it would be a drawn-out case, she said she hoped to get updates in due course.

Mrs Wong said she is still banking with Maybank in the hope that they could get her money back, although she admitted the chances are slim.

"For me, even if I don't get my money back, I hope he (the scammer) will be caught. This is the least I can concern myself with," she added.

When asked how she felt about OCBC recently making full "goodwill payouts" to scam victims after they lost S$13.7 million through SMS phishing, Mrs Wong said it showed a "loophole" in the banking system as a whole.

"If there is no loophole, why the bank is willing to take the rap?" she asked. "Also because the amount (of money lost) is big. Does Maybank want to wait for the amount to get bigger and more people to be scammed?"

LESSONS LEARNT

Mrs Wong feels Maybank could have done more by putting out public alerts about this particular scam, adding that she has read multiple advisories and news articles about different scams but always thought she would never fall for them.

She advised people not to blindly trust the telephone numbers they see on Google searches and avoid making Internet banking transfers to unknown account numbers.

"Just go down to the bank personally. Maybe it's a bit more troublesome, but then you wouldn't get scammed," she said, adding that she still does not know why her GrabPay wallet had experienced those issues.

Maybank said the online safety of its customers is "important", and that the bank has shared about new scam methods and preventive measures through various communication channels, including Maybank Singapore’s security alert webpage, amid the recent spike in scams.

"Our hotline number 1800-MAYBANK is available on the Maybank Singapore website, ATM machines, and on the back of our cards," its spokesperson said, highlighting that the bank has implemented the new measures announced in January to boost digital banking security.

"We constantly look at enhancements to protect our customers."

Criminals make use of an "entire ecosystem" to conduct scams, the bank said.

"While we strive to boost awareness amongst customers with scam education communications, what is required is a concerted effort by all affected stakeholders to stay vigilant and foil these criminal acts together," the spokesperson added.

Near the end of the interview, Mrs Wong asked if a recording of her voice would be published, saying she did not want her friends to know that she was a victim.

When asked if she felt embarrassed, she replied that "people are not so understanding", pointing to comments she has read about victims of the OCBC scam.

"Rather than they feel sorry for them, they will say, 'Why this person so stupid,'" she said.

"I just want to share (my story) so that people will be smarter – not just a phone call and all their money will be gone."