Batam seeks to boost digital economy with data centres and IT training - but talent gap persists

CNA speaks to local leaders and businesses in Indonesia’s Batam on how Nongsa Digital Park is anchoring the city’s push to become a regional digital economy hub, even as challenges around talent and sustainability remain.

A drone shot of Batam city. (Photo: CNA/Wisnu Agung Prasetyo)

This audio is generated by an AI tool.

BATAM: Jesica Aulia Pardede moved from Medan to Batam in Indonesia’s province of Riau Islands in 2023 when she saw growing opportunities in the digital sector.

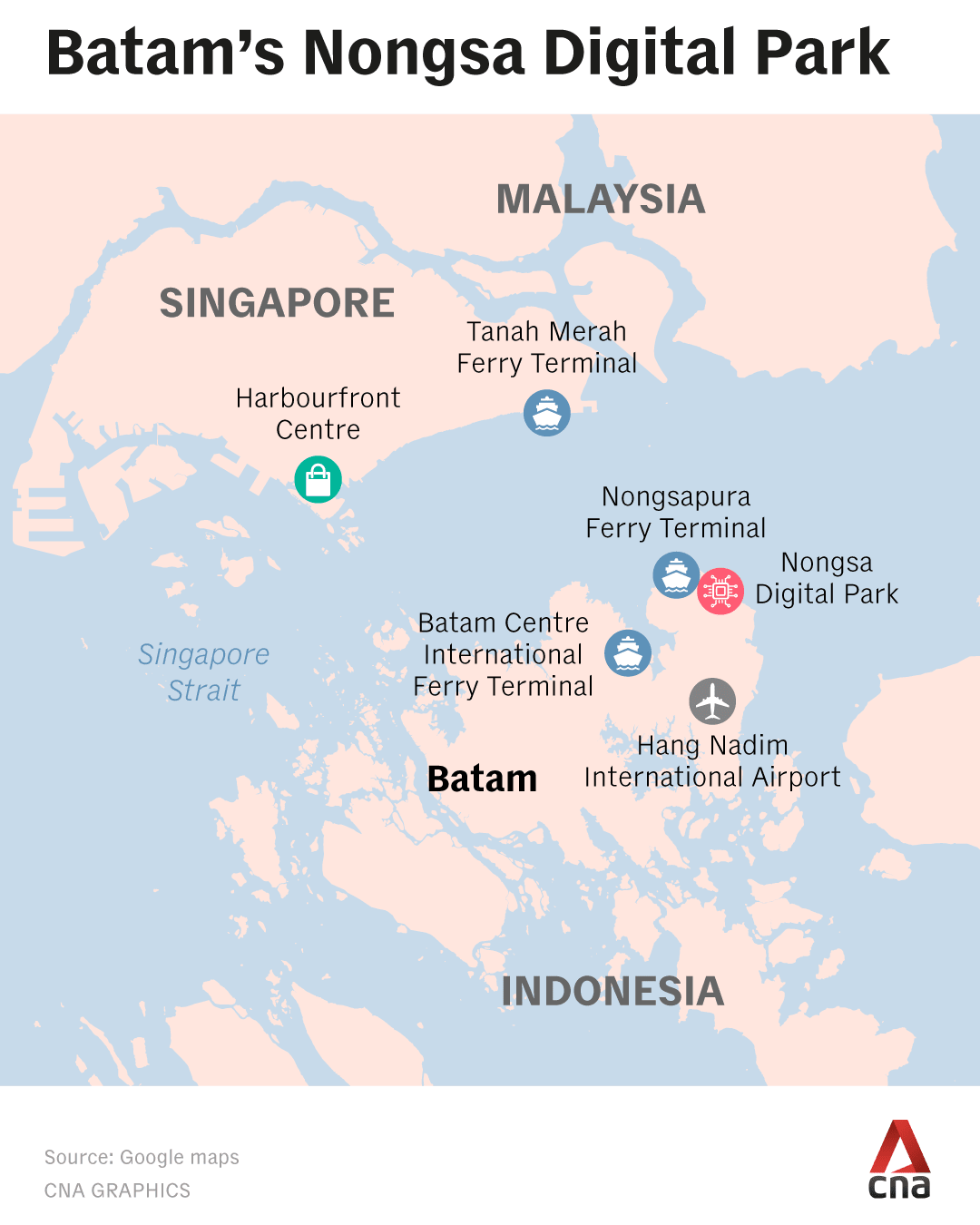

The 24-year-old, who studied Computer Science at the University of North Sumatra, began her career as a web development mentor at Infinite Learning, a digital skills academy based in Nongsa Digital Park - located about a 30-minute drive from the Batam Centre International Ferry Terminal.

Since then, she has watched the digital ecosystem in Nongsa district gain wider recognition, with the academy drawing students not only from Batam but also cities such as Jakarta, Surabaya, Lombok, Aceh and Papua.

“There are a lot of opportunities here in Batam, especially in Nongsa Digital Park,” she told CNA. “We are exposed to global companies, and the digital career pathway here has strong potential to grow.”

Jesica’s determination to develop her career is a direct reflection of Batam’s broader push into the digital economy sector, which seeks to position the city as a major regional data centre hub.

Batam’s information and communication sector has grown from 2.4 per cent of its gross regional domestic product in 2010 to 4.1 per cent in 2024, according to Statistics Indonesia - a government agency which conducts national statistical surveys and data collection.

Experts attribute the growth largely to the expansion of data centres, animation and digital services.

“The acceleration is evident in rising investments, the formation of a digital ecosystem (at Nongsa Digital Park) and the expansion of digital-based public services,” said Rudi Panjaitan, head of the Batam City Office of Communication and Informatics, a local government agency.

More than 500 public services across Batam’s local government agencies have been digitalised as part of its smart city initiative, spanning sectors such as business, healthcare and education, he told CNA.

Local leaders and businesses said the data centre industry and digital education - particularly training in cybersecurity and artificial intelligence (AI) - are among the most promising growth areas that could position Batam as a regional digital economy hub.

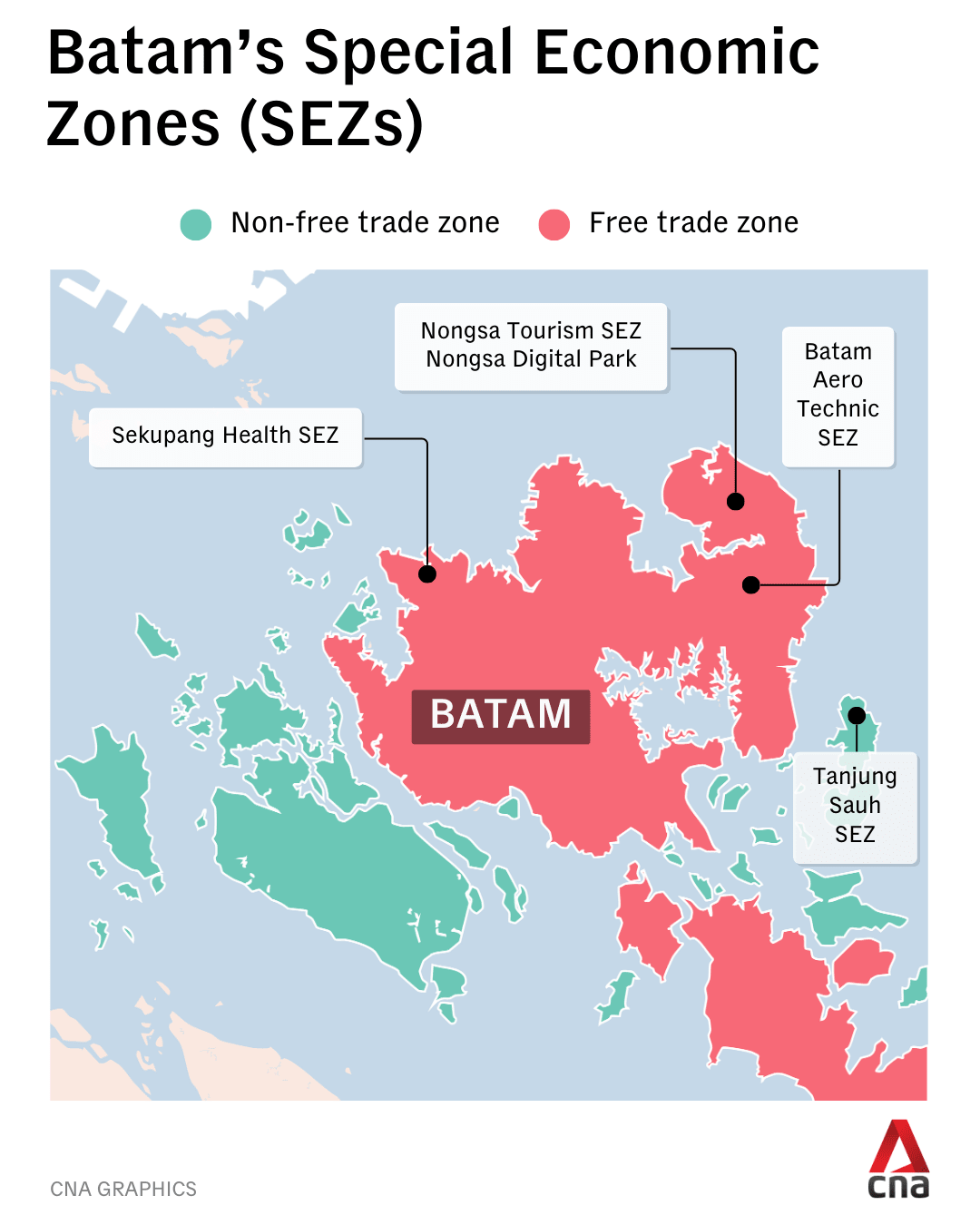

Much of this growth is concentrated in Nongsa Digital Park, a special economic zone (SEZ) that has attracted multinational firms and educational institutions.

But industry players and experts warned that a shortage of skilled workers and environmental pressures due to the proliferation of data centres could constrain Batam’s ambitions if left unaddressed.

DATA CENTRE BOOM

At a business forum on the Batam, Bintan, Karimun region in November last year, Indonesia’s ambassador to Singapore Suryo Pratomo said that the region is undergoing “a significant strategic transformation”, moving beyond traditional manufacturing into high-value sectors.

He pointed to the Nongsa Digital Park - one of the five SEZs in Batam - which he said is rapidly positioning Batam as a data centre hub in Indonesia.

The others are the Batam Aero Technic SEZ, Tanjung Sauh SEZ, Sekupang Health SEZ and Nongsa Tourism SEZ.

Indonesia’s Coordinating Minister for Economic Affairs Airlangga Hartarto echoed this view at the forum, describing the Batam, Bintan, Karimun region as “the place for digital infrastructure” and Batam as a “digital bridge” connecting Indonesia to Singapore, a vision first highlighted by then-president Joko Widodo in 2017.

Batam is about a 50-minute to an hour’s ferry ride from Singapore.

The city’s mayor Amsakar Achmad recently told CNA that Batam offers a “dedicated and integrated ecosystem”, referring to Nongsa Digital Park as a key selling point for investors.

“Batam’s transformation is not an instantaneous shift, but a medium to long-term process,” he said.

“The presence and developments of areas such as the Nongsa Digital Park serve as positive early indicators as they demonstrate investment interest, cross-border partnerships and the growth of activities in the sector.”

How did the Nongsa Digital Park begin?

Since 2005, integrated media entertainment and creative services firm Infinite Studios has operated in the Nongsa area before the site was formalised as Nongsa Digital Park.

Parts of several blockbuster films have been produced at the studio, with thousands of Indonesians forming the bulk of the creative workforce.

The park then launched in 2018, and now hosts a mix of Indonesian firms and international players including Singapore outfits and global tech giants.

It has attracted more than 80 startups and forged partnerships with Apple, IBM, RMIT and Epic Games’ Unreal Engine to deliver tech training programmes.

According to Singapore’s Economic Development Board (EDB), the park was designed to replicate Infinite Studios’ development model to other sectors in the digital industry at a much larger scale.

Indonesian conglomerate Citramas Group began the development of Nongsa Digital Park in March 2018, with support from both the Indonesian and Singapore governments as part of broader bilateral efforts to develop Batam as a digital bridge between the two countries.

Nongsa Digital Park was officially granted SEZ status by the Indonesian government in 2021.

The following year, land acquisitions by leading data centre operators marked the start of its development as a regional data centre hub.

It aims to create 16,500 jobs by 2040, Batam Indonesia Free Zone Authority (BIFZA) told CNA.

“The path has evolved lately … from what it was to what it is right now, it is a very busy operation,” said Khoo Peck Khoon, chief operating officer of Nongsa Digital Park.

Major data centre players in Nongsa include BW Digital, DayOne, Gaw Capital, NeutraDC and Princeton, with operators coming not only from Singapore but also New Zealand, Hong Kong, US and United Kingdom, Khoo told CNA.

As of 2025, cumulative data centre investment in Nongsa Digital Park has reached 11.38 trillion rupiah (US$677,089 million), according to BIFZA.

Amsakar, who also chairs the Batam Indonesia Free Zone Authority (BIFZA), said the facilities in Nongsa Digital Park could serve as secure data hubs for Indonesian ministries and government institutions.

This was echoed by data centre operator BW Digital, which cited data sovereignty as a key growth driver.

“As Indonesian enterprises and government agencies look for infrastructure that supports local data hosting needs, Batam gains strategic relevance domestically as a data centre location,” said Florent Blot, chief business officer of BW Digital.

He added that Batam’s location as a comparatively “hazard-free zone” in relation to earthquakes and flooding makes it a resilient alternative to cities like Jakarta, which currently hosts about 99 data centres - the highest number in Indonesia.

Headquartered in Singapore, BW Digital sees Batam as a complement to Singapore’s established digital infrastructure system.

This is why it is building a data centre facility in Batam which is expected to begin operations this year.

“With a latency of less than two milliseconds, the location allows the campus to operate almost as an extension of Singapore,” Blot told CNA.

“That makes it practical to manage operations, support customer engagement and maintain seamless integration.”

Latency refers to the time delay it takes for data to travel from one point to another across a network. Low latency enables faster data transfers, a key requirement for many businesses.

Connectivity is another factor, said Blot, adding that Batam’s access to multiple subsea cable systems provides strong international reach and carrier diversity.

Beyond digital connectivity, operators say Batam’s physical infrastructure has also matured significantly.

“Ongoing improvements in utilities, road networks, security and campus services have made the environment increasingly suitable for large-scale digital infrastructure projects,” Blot told CNA.

Nongsa Digital Park currently hosts nine data centres including three sites that have completed construction and are in early stages of operation, BIFZA told CNA.

BW Digital’s facility is currently under construction. Meanwhile, three data centres are in preparation for development and another two are “planning to be operational”.

There are also plans to add four more facilities. BIFZA added.

ENVIRONMENT A LIMITING FACTOR?

With Batam positioning itself as a regional data centre hub, Siwage Dharma Negara - co-coordinator of the Indonesia Studies Programme at ISEAS-Yusof Ishak Institute in Singapore - told CNA that water demand and usage is of concern.

Data centres need water primarily for cooling the massive heat generated by servers. Meanwhile, Batam’s water supply depends on rainwater reservoirs and it frequently experiences shortages in certain areas, including reports of intermittent supply in some neighbourhoods.

Local media outlet Batampos had reported disruptions in areas such as Taman Baloi Mas, Tanjungsengkuang and Batuaji in September 2024, with residents staging protests over irregular water flow and ageing pipe infrastructure.

In some areas, water was reported to have run only for a few hours in the early morning.

Since 2015, available capacity has increased only marginally, from about 3,500 to 3,850 litres per second, according to Batampos, even as overall demand has risen.

Environmentalist Gari Dafit Semet, who manages a mangrove ecotourism business in Bakau Serip village in Nongsa, said that his community has not yet been directly affected by shortages, as residents there still rely on well water, which remains “clear and usable”.

However, preserving mangroves and forest cover is critical to maintaining water security on the island, he said, as these ecosystems help to recharge groundwater supplies and prevent saltwater intrusion into freshwater sources.

Siwage added that policymakers need to invest in integrated water resources, expand reservoir capacity and improve distribution networks.

“They also need to provide clear regulatory frameworks and environmental standards to ensure data centre growth does not outpace the limited water supply,” he said.

Beyond water resources, land availability may also emerge as another limiting factor, said Khoo Peck Khoon, chief operating officer of Nongsa Digital Park. According to its website, the park already spans an area of about 188 hectares - roughly the size of around 264 football fields.

“We want to grow but we are limited by the amount of land we have … we need the infrastructure to match that growth.”

Environmental considerations also pose challenges.

“The challenge is in trying to protect the environment, we want to be eco-friendly and make sure that the environment is not destroyed, especially as our data centres sit close to forest areas that we want to protect as much as possible,” he told CNA.

Gari, the environmentalist who lives in a village near Nongsa, told CNA that he has observed more forested land being cleared as the area develops.

“We are not opposed to development but the local government must carefully balance industrial expansion with environmental sustainability,” he told CNA.

LACK OF SKILLED LABOUR ANOTHER CHALLENGE

Beyond land and environmental constraints, businesses and local leaders say a shortage of skilled labour remains a long-standing challenge for Batam’s growing digital sector.

“The availability and readiness of human resources with digital and advanced technology competencies remain one of the challenges that require greater attention,” Amsakar told CNA.

Observers and investors, he said, generally highlight a gap between industry needs and the qualifications of the local workforce.

According to BIFZA, senior high school (SMA) graduates make up the largest share of the unemployed in the industrial city.

As of 2024, 26,162 SMA graduates were unemployed, making up more than half of Batam’s unemployed population.

Experts said that this suggests that many school leavers lack the technical skills sought by local employers.

Siwage told CNA that this means that the industrial parks often had to search for skilled labour outside Batam to meet industry needs.

Khoo of Nongsa Digital Park said that while semi-skilled workers are available, shortages in the number of senior personnel remain - a gap it is trying to address through its digital education institutes, which seek to train locals in areas such as cybersecurity and AI.

“As technology improves and changes very often, skillsets need to develop over time … this is an area we find challenging,” he told CNA.

Amsakar added that the issue is not just about numbers, but also the relevance of skills, certifications and work experience required by global industries.

Echoing this, Ari Nugrahanto - who is the programme director of Infinite Learning - said that companies that are coming into the SEZ “are not only local firms, but global, multinational companies”.

To support them, Batam needs talent with “global-standard skills”, Ari said, pointing to gaps also in soft skills such as language proficiency and workplace confidence.

Still, Ari, along with businesses and local leaders CNA spoke to, are optimistic that the gap can be narrowed through targeted training and tech educational programmes embedded within Batam’s growing digital ecosystem.

Infinite Learning, which offers vocational courses and collaborates with schools and universities across Indonesia, has produced about 8,000 graduates since it was established over five years ago..

Most are now working at multinational companies across the country, Ari claimed.

Jesica, the web development mentor at Infinite Learning, said that while opportunities in Batam’s digital sector are growing, the ecosystem remains “more mature” in larger cities such as Jakarta, where project values are higher and career pathways are clearer.

“Working in major cities or at national-scale companies adds value to your portfolio and opens up longer-term opportunities,” she said.

“In Batam, opportunities in the digital sector do exist but they are less diverse. So offers from overseas or bigger cities are often seen as strategic moves.”

Local news outlet Jakarta Post reported in July 2025 that wage rates in Batam are lower than in neighbouring regions.

While sector-specific wage data for the digital economy is limited, the minimum monthly wage in Batam for 2026 is about 5.36 million rupiah (US$320) according to Jakarta Post, compared to around RM1,700 (US$435) in Johor, including for foreign workers.

In Jakarta, Governor Pramono Anung announced in December last year that the capital’s 2026 provincial minimum wage is set at 5.73 million rupiah - about US$340.

“Our role is not only to educate but to bridge the talent gap, helping students from our academy, universities and vocational schools become industry-ready,” he said.

At the government level, BIFZA in December last year launched the “Batam Talent Management (MANTAB)” digital platform, designed to connect job seekers with industry players through data-driven competency matching.

BIFZA said MANTAB is the first-of-its-kind digital platform in Indonesia which integrates collaboration between educational institutions, local government and the manpower ministry.

Several major firms, including PT Volarex Batam, have already used the platform, recruiting more than 20 employees through it, local media reported.

With such initiatives in place, Amsakar said the labour shortages are no longer viewed solely as an obstacle, but as a “strategic challenge and opportunity” to build a more competitive and sustainable talent ecosystem, supporting Batam’s ambitions to become a regional hub for the digital economy and high-technology industries.

For instance, students from across Indonesia are coming to Batam to take part in programmes run by its digital learning institutes.

Among them are Adithya Firmansyah Putra, 22, and Nuraiza Hafiza Karim, 25, from Jakarta and Solo respectively. They recently graduated from a 10-month programme at the Apple Developer Academy, established in Nongsa Digital Park in collaboration with Infinite Learning.

The programme covers coding fundamentals, as well as design, marketing and project management.

“As Batam is an industrial city, there are many opportunities here, it is also strategically located, which allows for more networking with industry professionals, something I did not have back in my hometown (of Solo),” Nuraiza told CNA.

Using the skills acquired at the academy, Nuraiza and Adithya were part of a five-member team which developed an application called Wikan, which provides Bahasa Indonesia-to-Javanese translations and is available on the Apple App Store.

The app aims to preserve the cultural significance of Indonesia’s largest regional language.

Both students told CNA that the programme at Apple Developer Academy had positively shaped their professional and personal development, particularly by exposing them to industry expectations and career pathways that were not covered in their universities.

TALENT, COLLABORATION AND BATAM’S REGIONAL POSITION

While education initiatives are beginning to narrow the skills gap, industry players say Batam’s long-term success will depend on stronger coordination between government, industry and the educational institutions.

Moving forward, Ari of Infinite Learning said improving accessibility to digital education - through measures such as subsidies, scholarships or free laptops - could help more students benefit from training.

Batam’s government is also working to align curriculum with industry needs through collaborations with institutions such as Batam Polytechnic and Batam University, Amsakar told CNA.

And for data centre operators like BW Digital, a consistent long-term policy framework plays an important role.

“Continued local, national and regional support for the digital infrastructure projects help operators plan with greater certainty and accelerate regional integration,” said Blot of BW Digital.

Some observers have raised concerns that the upcoming Johor-Singapore SEZ could compete with Batam for investments spilling over from Singapore, particularly in electronics, logistics and data infrastructure.

However, Siwage of ISEAS-Yusof Ishak Institute said the relationship need not be “zero-sum”.

While Johor is a strong competitor, Batam competes primarily on the basis of cost, land availability and access to Indonesia’s domestic market.

Together, Johor, Singapore and Riau Islands could form a connected regional data corridor rather than rival hubs, he said.

This aligns with the long-standing Sijori Growth Triangle vision, launched in 1989 to integrate trade and investment across Batam, Bintan and Karimun Islands of Riau Islands, Malaysia’s Johor state and Singapore.

Blot said BW Digital’s Batam campus is part of a broader plan to interconnect data centres between Singapore, Malaysia and Indonesia, subsea cable systems and terrestrial network infrastructure into a unified regional platform.

“This approach moves beyond standalone facilities and instead focuses on creating interconnected digital hubs that allow data, workloads and services to move seamlessly between Singapore, Batam and the wider region,” he said.

Amsakar also echoed this view, saying that a networked model is “highly plausible” where different functions are located in different places depending on business needs such as market access, operational considerations, efficiency and utility requirements.

“Singapore’s strengths lie in its role as a headquarters hub, financial centre and global services provider, Johor offers capacity expansion but Batam also has its own distinct advantages - its free trade zone status, an established industrial ecosystem, logistical capabilities and its close operational proximity to Singapore,” Amsakar told CNA.

“Our goal is for Batam to play a strong, value-adding role - not merely as an alternative location, but as part of an integrated and competitive regional digital and industrial corridor.”

For 24-year-old Jesica - the web development mentor at Batam’s Infinite Learning - her goal is to grow alongside the industry - not merely adapt to change, but actively contribute to it.

“I want to be part of an ecosystem that promotes collaboration, strengthens local talent development and delivers tangible impact to Batam’s digital growth,” she told CNA.

“I would also like to see more young people in Batam move beyond being technology users to becoming creators, innovators, problem-solvers in the digital industry.”