Commentary: Ever sent money to the wrong person? Here’s why you’re not to blame

Given the importance of day-to-day digital transactions, there may be opportunities for e-payment apps to better understand human behaviour and prevent slips, says R/GA’s Joschka Wolf.

SINGAPORE: Have you ever triple checked a PayNow transaction form - only to end up wondering if you sent money to the right person just after the confirmation screen popped up? Or actually ended up transferring money to a wrong recipient and blaming yourself for it?

You’re not alone, as recent incidents in Singapore show. A diner in January paid S$450 (US$340) instead of S$4.50 to a ban mian stall. In February, a woman transferred S$2,888 to a florist instead of her own savings account after keying in the wrong bank account number.

Digital products have long been designed around the requirements of systems and technology, but not people. Great product design considers real-life environments and the user behaviour that comes with them.

LISTEN - Money Talks: Is it time to ditch cash for multi-currency apps when travelling?

To create better products, designers and researchers must observe and ask questions to uncover the underlying reasons for human error.

DON’T BLAME YOURSELF, BLAME THE DESIGN

Psychology professor James Reason and user-centred design pioneer Don Norman categorise human errors as mistakes and slips, distinguished by differences in intention.

Mistakes happen when all actions towards a goal are taken correctly, but still lead to errors due to an inadequate plan.

For example, you want to arrive early for dinner so you take a cab to get there faster. You get ready, order the ride, leave the house, get in the car - and end up at dinner extra late because you haven’t considered rush hour. All steps were correctly performed, but the intentional choice of transport wasn’t adequate for the time of day.

In case of payments gone wrong, we’re mostly talking about slips. Unlike mistakes, slips happen when the plan is adequate, but the actions towards it are not executed properly, and hence lead to error. Slips are unintentional, and often happen to those well-versed in what they’re doing.

Slips can be either memory-based, like turning on the gas but forgetting to turn it off after cooking. Or action-based, like reaching for your phone to respond to an email but ending up on Instagram instead. Correct plans, but spoiled unintentionally by actions performed poorly.

Most slips do not have devastating effects - but in cases of gas burners or financial matters, they carry more weight. When investigating serious slips, the line of thinking often stops once “human error” has been found as a reason - and the blame is swiftly shifted to the user. Case closed. No improvements needed.

If I may suggest a different verdict: Slips happen when we’re in a hurry, in a busy environment, on auto-pilot, or multitasking. But products can be designed to minimise slips. Not recognising the responsibility of design will only lead to inaction on improvement - and therefore more slips.

DESIGNING FOR AND AROUND PEOPLE

Thankfully today, great experience design means great business. Before Apple launched the iPhone, digital product design was not quite mass marketed. But by placing human-centric design at the heart of their process, Apple now stands for sleek and intuitive products, and even became the first trillion-dollar company in 2018.

Others are following suit and we’re seeing more refined digital experiences - such as being able to book a ride with a few taps, as well as comfortably sending and receiving money on banking apps.

Given the importance of day-to-day transactions, there are opportunities to understand the situation of people using e-payment services and design accordingly to prevent slips. For instance, apps could require users to confirm QR code payments over a certain or unusual threshold.

A great local example of human-centred design is the “Insights” feature on the DBS digibank mobile app. It analyses transactions and proactively offers intelligent suggestions aimed at preventing slips, like informing customers of suspected duplicate transactions or sending a notification in case a NETS transaction is higher than usual.

USE CREATIVITY TO OVERCOME RESTRICTIONS

Banks have the highest standards of security and use tried-and-tested systems that can take years to establish and adjust. It’s worth acknowledging the efforts gone into the underlying technology that makes it possible for us to transfer money within seconds, simply via phone number or a QR code.

But there’s always room to do more. We frequently work with clients who feel restricted by existing tech systems, which, if unaddressed, may lead to a degraded product experience. And that’s where creative design comes in.

Here is an example: The ability to “undo” a sent email. Emails, much like bank transfers, are technically impossible to recall once sent. So how is it possible?

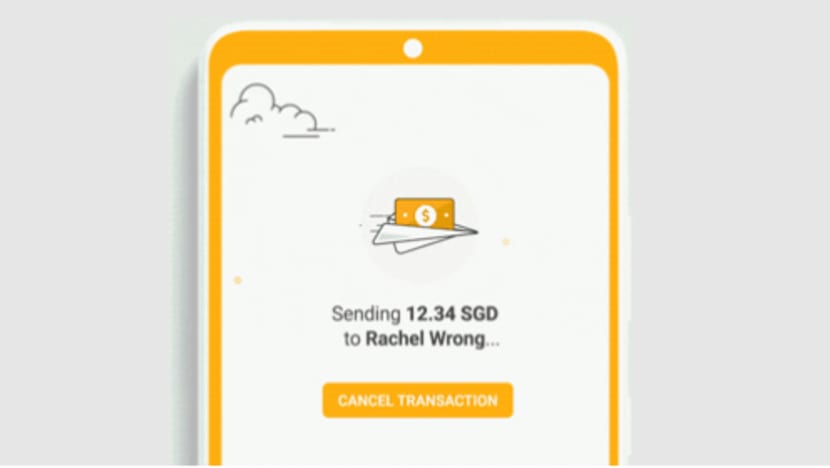

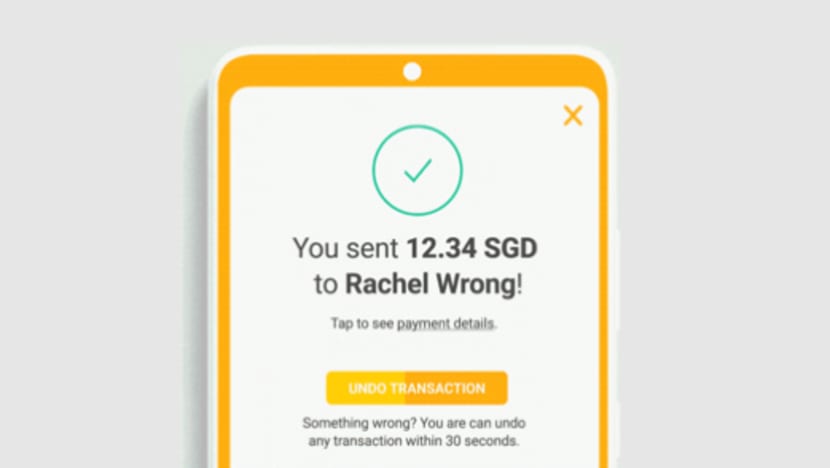

Through an illusion: Despite the application telling you so, the email hasn’t actually been sent as long as the Undo button is displayed. What really happens is that sending that mail is delayed until the Undo button disappears or the sender decides to click it, which would prevent the email from being sent.

Giving people extra time to re-read their emails - and therefore empowering them to realise a slip and reconsider - is incredibly effective.

Perhaps such “undo” functionality might be a great addition to PayNow too. That said, let’s not jump to well-meant but hasty armchair conclusions about what can stop users from sending wrong payments. Thorough investigation and analysis need to be done to uncover contributing factors, be they cognitive or environmental.

To create a desirable yet feasible product, these findings need to be blended with the legal and technological guardrails of electronic fund transfer services in Singapore.

To get there, product designers often apply “design thinking”, which consists of five stages: Empathise, define, ideate, prototype and test. Those phases are interlinked, empowering teams to move back and forth so that the solutions can be adjusted to learnings along the way.

It’s encouraging to see more discussion online about product design and where it can go wrong, with users sharing their lived experiences and suggested improvements. More can and will be done to smoothen the experience of sending and receiving money in the future.

Joschka Wolf is Group Creative Director, Head of Experience Design at brand, product and communications company R/GA Singapore.