‘I’m so in debt’: China’s personal loan subsidy draws scepticism as financial strain grows among youth

China is offering interest subsidies on personal loans starting this month, in its latest bid to spur spending. But some tell CNA they fear the new subsidies may deepen debt burdens.

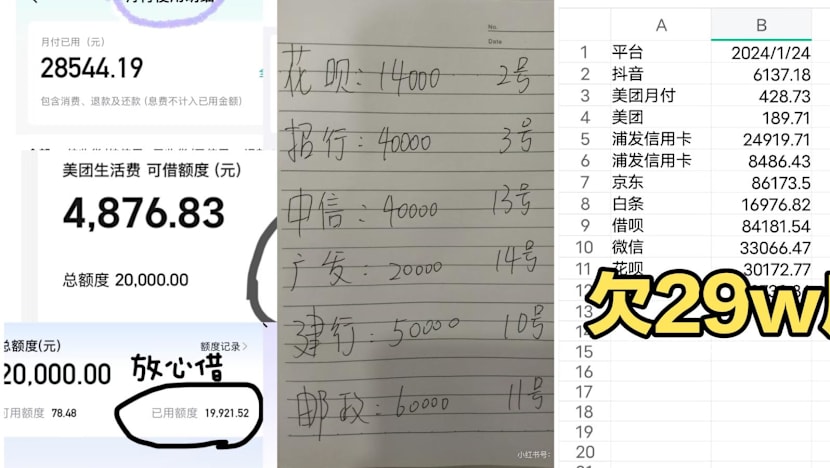

A collage of screenshots from a Chinese social media platform shows young Chinese users sharing the number of micro-debts they have accumulated. (Image: Xiaohongshu)

This audio is generated by an AI tool.

SHENZHEN: Saving money was top of mind when 34-year-old software engineer Li Zi decided to buy an electric car.

The Nanjing native, who declined to give her real name, preordered a new car, priced at around 285,000 yuan (US$43,900), planning to pay part upfront and finance the rest with a loan.

To ease the burden further, she’s considering a new government interest subsidy on personal consumption loans, available from September for a year.

Dubbed the first of its kind in China at the central government level, according to Vice Finance Minister Liao Min, the government’s loan interest subsidy is meant to lift household spending and revive domestic consumption.

It applies to purchases under 50,000 yuan, and to bigger-ticket items in priority sectors like automobiles, elderly care, childbirth support, education, healthcare, electronics and home renovation.

Borrowers get a one-percentage-point cut in loan interest for a year, capped at half the original rate - but it only applies to the first 50,000 yuan of any transaction, even for big-ticket items.

For Li Zi, that means about 500 yuan in subsidies on her car loan - 1 per cent of the 50,000 yuan cap.

If an individual takes out loans for several personal consumption items, the subsidies can be added up, but are capped at 1,000 yuan for smaller purchases and 3,000 yuan for big-ticket goods.

The latest loan interest subsidy comes on top of a 300 billion yuan trade-in programme, childcare subsidies and a phased rollout of free preschool education, which analysts also see as measures to boost household spending.

Hannah Liu, China economist at Nomura, called the loan subsidy “well-intentioned” but limited in impact. Nomura estimates about 500 billion yuan in new eligible consumer loans each year, meaning the total subsidy amount - at most 5 billion yuan - is negligible.

Tian Xuan, vice dean at Tsinghua University’s PBC School of Finance, said the scheme could help unlock pent-up demand for big-ticket items and restore confidence. But the benefits may be uneven.

“Higher-income households with good credit records are more likely to benefit, while lower-income groups may find it harder to access such loans,” he said.

Data from the People’s Bank of China show that from 2021 to 2024, household savings surged nearly 48 per cent to 151.25 trillion yuan - underscoring families’ preference to save rather than spend.

At the other end of the spectrum, credit card debt overdue for more than six months rose 44 per cent to 123.96 billion yuan over the same period - highlighting rising debt burdens and financial strain among vulnerable groups, including the youth.

Some consumers CNA spoke to said they fear the new loan interest subsidies could worsen debt burdens rather than relieve them.

“In the longer run, the impact (of the loan subsidies on consumption) will depend on income expectations, job stability and consumer sentiment,” Tian added.

“Some households may treat the subsidy as extra savings rather than (using it for) immediate spending, which would weaken its effect.”

CONSUMERS REMAIN HESITANT

With no official figures yet, early signs show buyers remain cautious.

“There are at least six people calling or coming in person to ask about the subsidy in the first week of September," said a client service manager at a Bank of China branch in Shandong, who asked to be identified only as Wang.

“But none has actually applied,” he added, citing reasons such as loans not meeting eligibility requirements or customers only seeking more information.

The subsidy is available through 23 designated banks and finance firms.

A CNA check found interest rates at participating banks for consumer loans hovering above 3 per cent.

Before granting the loan, banks conduct standard credit checks on income, repayment history and risk profile. Once approved, borrowers sign a short add-on agreement. Banks then verify spending through transaction records and apply the interest subsidy to repayments automatically.

For Caibao, a 22-year-old content creator in Beijing who asked to be identified by his nickname, jobs matter far more than any new loan interest subsidy.

“With the economy weak and young people struggling to find work, the government should be helping people earn money and boosting growth. Instead, it launched a consumer loan policy,” he said.

A regular user of microloans, he first borrowed to buy a handheld camera while still in school. It cost 3,500 yuan and he took on a loan to repay around 1,000 yuan per month over three months. Though he has never defaulted, repayment deadlines remain a source of stress.

Microloans refer to purchase-based loans like Ant Group’s Huabei or JD Baitiao, which pay shops directly, and cash loans like Ant Group’s Jiebei or Tencent’s Weilidai, which deposit money straight into accounts.

“I still depend on my family for living expenses so I have to be frugal, eat less or take on part-time gigs,” he said.

“When the repayment date came close and I didn’t have enough in my wallet, it was frightening.”

He said he would not consider the new subsidy, arguing that online platforms already offer easier credit.

“On e-commerce sites, the threshold is lower. Sometimes you can pay in instalments, other times they just lend based on your credit. For the smaller amounts I usually borrow, that makes more sense,” he said.

Joe Zhou, 42, a senior director at a communications firm in Guangzhou, said he prefers subsidies that cut product prices directly.

“If the price of an appliance is reduced, I might buy something I don’t really need or stretch my budget from 1,000 yuan to 1,500 yuan. But an interest subsidy doesn’t have the same effect.”

Others are wary of debt itself. “No matter the policy, loans still have to be repaid. It creates a mental burden, and I also worry about what happens if my income becomes unstable in the future,” said Huang Yi, 33, an executive secretary in Shenzhen.

TARGETING BIG-TICKET SPENDING

China’s new loan subsidy includes a split between borrowing above and below 50,000 yuan - something analysts say is designed in part to spur car sales.

Shoppers can accumulate up to 3,000 yuan in interest subsidies from each lending institution, but for loans under 50,000 yuan, the maximum benefit is capped at 1,000 yuan.

Cai from SWUFE said the differentiated scheme favours big-ticket items such as vehicles. But he cautioned that a 3,000 yuan subsidy cap may have limited influence on buyers, especially those considering higher-end models.

He pointed to lessons from the government’s trade-in programme, which offered subsidies of up to 20,000 yuan for new energy vehicles (NEVs). That scheme initially lifted demand, but sales growth has since cooled.

According to the China Association of Automobile Manufacturers, monthly growth in NEV sales slowed from 87 per cent at the start of the year to 27.4 per cent in July.

BYD’s August sales were flat year-on-year at 373,600 units - evidence, analysts say, that subsidies alone cannot sustain momentum for market leaders.

Cai estimated the new loan subsidy could lift NEV sales by 5 to 8 percentage points, contributing about 0.5 percentage points to overall retail sales growth.

“To achieve a stronger impact, the policy needs to be combined with carmaker discounts, investment in charging infrastructure and supportive licence plate rules,” he added.

David Zhang, secretary-general of the International Intelligent Vehicle Engineering Association, said the subsidy not only eases borrowing costs for households but also supports banks and manufacturers.

“This is a good move because it lowers consumer debt burdens, boosts the circulation of funds, and helps companies expand sales channels - all of which benefit economic growth,” he told CNA.

Alongside household loans, Beijing has launched a separate subsidy scheme for service-sector firms. Covering eight areas - catering, healthcare, childcare, elderly care, household services, tourism, culture and sports - it lets companies borrow up to 1 million yuan, with interest subsidies capped at 10,000 yuan.

Officials say the measure is intended to cut financing costs, encourage investment in services and support jobs in labour-intensive industries.

Wang Bo, deputy director of the department of trade in services and commercial services at the Ministry of Commerce, said the policy works on both the demand and supply side.

“It will enhance households’ ability to consume while also expanding the supply of quality services. In particular, it is expected to boost sectors closely tied to daily life such as healthcare, elderly care and childcare,” he said.

MORE DEBT? THE KNOCK-ON EFFECTS OF EASY CREDIT

“I’m so in debt I find there is no hope in life,” said a 25-year-old nurse in Beijing, who asked to be identified only as Xiao Ai and said her bills began piling up almost as soon as she started work.

Within a year, she had borrowed 10,000 yuan across 10 short-term consumer loan providers such as Huabei, Jiebei and JD Finance. The money went towards seemingly practical purchases - an eye mask, a massage device, guides for better care - all linked to her job.

But by her own count, she had spent 30,000 yuan over the year, nearly half her annual income.

“The more I counted, the more scared I felt. At work, I can’t focus on writing nursing notes, and at night, I wake up at the sound of a phone notification (fearing it is a debt notice) … I really feel I can’t hold on much longer,” she said.

Her case is not unique. Research firm Gavekal Dragonomics estimates that 25 million to 34 million people in China defaulted on personal loans last year - about double the level in 2019.

Young people are especially exposed. A report released in early 2025 by the Institute of Finance at the Chinese Academy of Social Sciences (CASS) found that the debt ratio among those born in the 1990s, referring to those aged between 26 and 35 this year, has climbed to 78.3 per cent, with an average liability of 121,000 yuan.

By comparison, those in their 40s and 50s carried higher debts on average, but more than 80 per cent were mortgages and only 8.2 per cent were consumer loans, according to the same report.

WILL THE NEW LOAN SUBSIDY SPUR SPENDING?

Jia Meili, a 30-year-old mother in Jiangsu with an eight-year-old son, struggles with daily expenses while battling an autoimmune disease. Her husband works as a factory labourer.

“I need money, so I wanted to check it out when I saw the announcement,” she said.

Her conclusion? “The subsidies lean towards economic goals, but they don’t solve people’s livelihood issues.”

She spends thousands of yuan each year on her son’s medical bills and hobby classes.

“You need to have money first before you can spend money,” she said.

Analysts believe the consumer scepticism reflects deeper structural problems.

“China needs to raise wages, improve income distribution, expand healthcare and pension coverage, and create a safer consumption environment,” Tian told CNA.

Such steps, he said, would give people “the means, the confidence and the willingness to spend”.

Economists say the caution reflects a broader challenge. The trade-in programme, for instance, helped lift sales of cars, appliances and other goods to 1.6 trillion yuan in the first six months of this year - already above the total for 2024.

Yet despite this relative success, it has not been enough to reverse the slowdown in retail sales growth.

Retail sales growth, a key gauge of confidence, has slowed: 3.7 per cent year-on-year in July, down from 4.8 per cent in June and well below May’s 6.4 per cent.

Cai Dongliang, professor of theoretical economics at Southwestern University of Finance and Economics (SWUFE), said the new subsidy can lower borrowing costs and help spur demand for daily and durable goods, but its effect will be limited.

“Retail growth still hasn’t returned to the pre-pandemic 8 per cent level, which shows a single policy can’t turn consumption around,” he said.

Nomura’s Liu said Beijing has “exhausted ways to unleash vitality”, but argued that raising pay for lower-income groups, such as through higher basic pensions for retirees and rural elderly, would be more effective, as they are more likely to spend the extra money.

Liu noted that housing makes up 60 to 70 per cent of household balance sheets. “Without stabilisation in real estate, and with average incomes falling, it is hard to see a real turnaround,” she said.

Officials, meanwhile, are hoping the policies will take flight. With the Mid-Autumn Festival and National Day Golden Week around the corner, they see the holidays as a window to ease household pressures and lift spending.

“At present, consumer demand is becoming more multi-layered and diverse,” Vice Finance Minister Liao said at an Aug 13 State Council briefing.

“With summer travel, leisure and learning in full swing - and the Mid-Autumn Festival and Golden Week ahead - we hope this policy can truly help households.”