analysis East Asia

China under pressure to retaliate as US tariffs hit harder and faster than expected

Analysts say Beijing is weighing targeted countermeasures, stimulus, and diplomatic outreach as options narrow.

FILE PHOTO: Cars to be exported sit at a terminal in the port of Yantai, Shandong province, China January 10, 2024. China Daily via REUTERS/File Photo

This audio is generated by an AI tool.

SINGAPORE: China is now under pressure to strike back after United States President Donald Trump unleashed sweeping new tariffs on Wednesday (Apr 2), a move which analysts say is not only expected but may also be necessary.

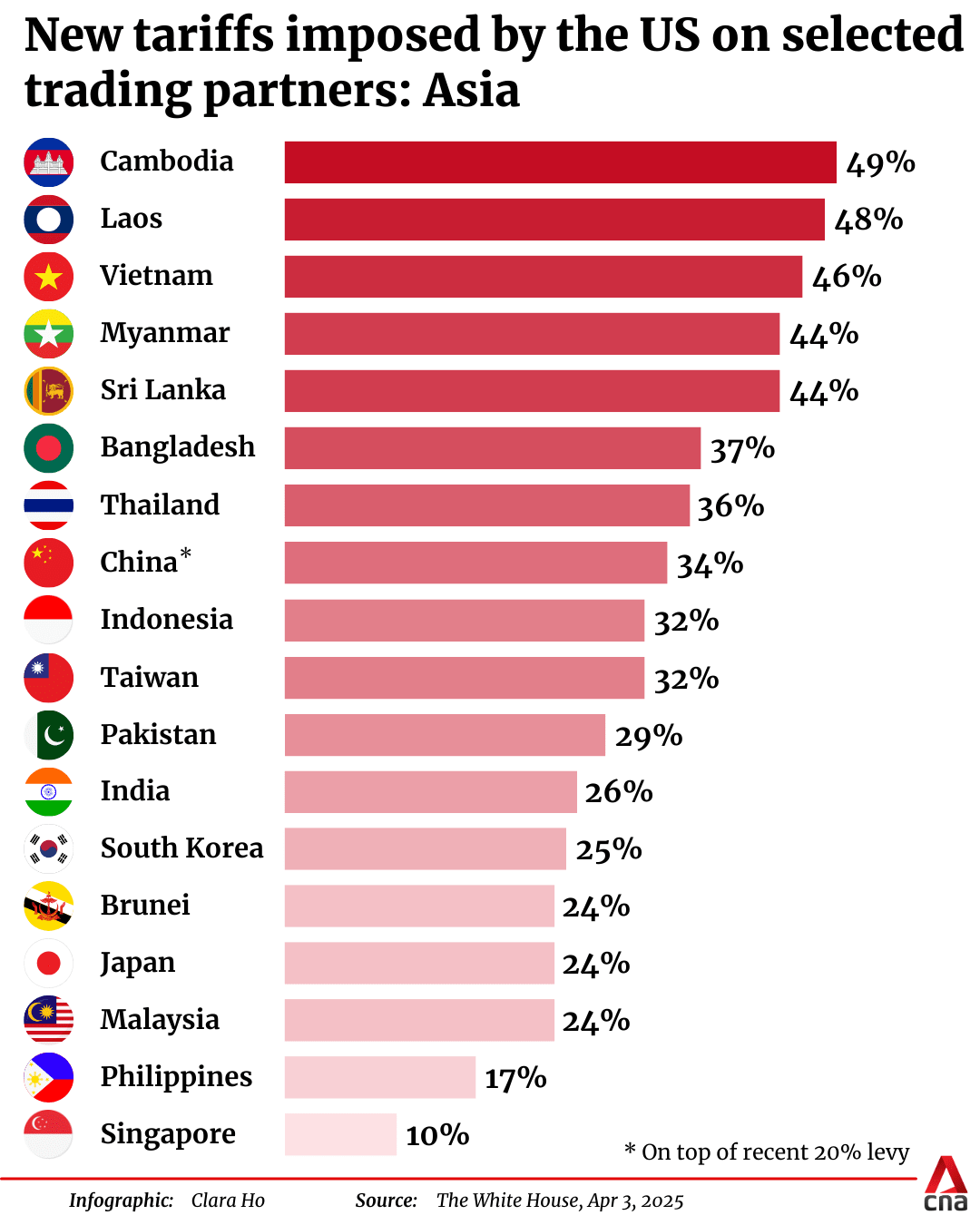

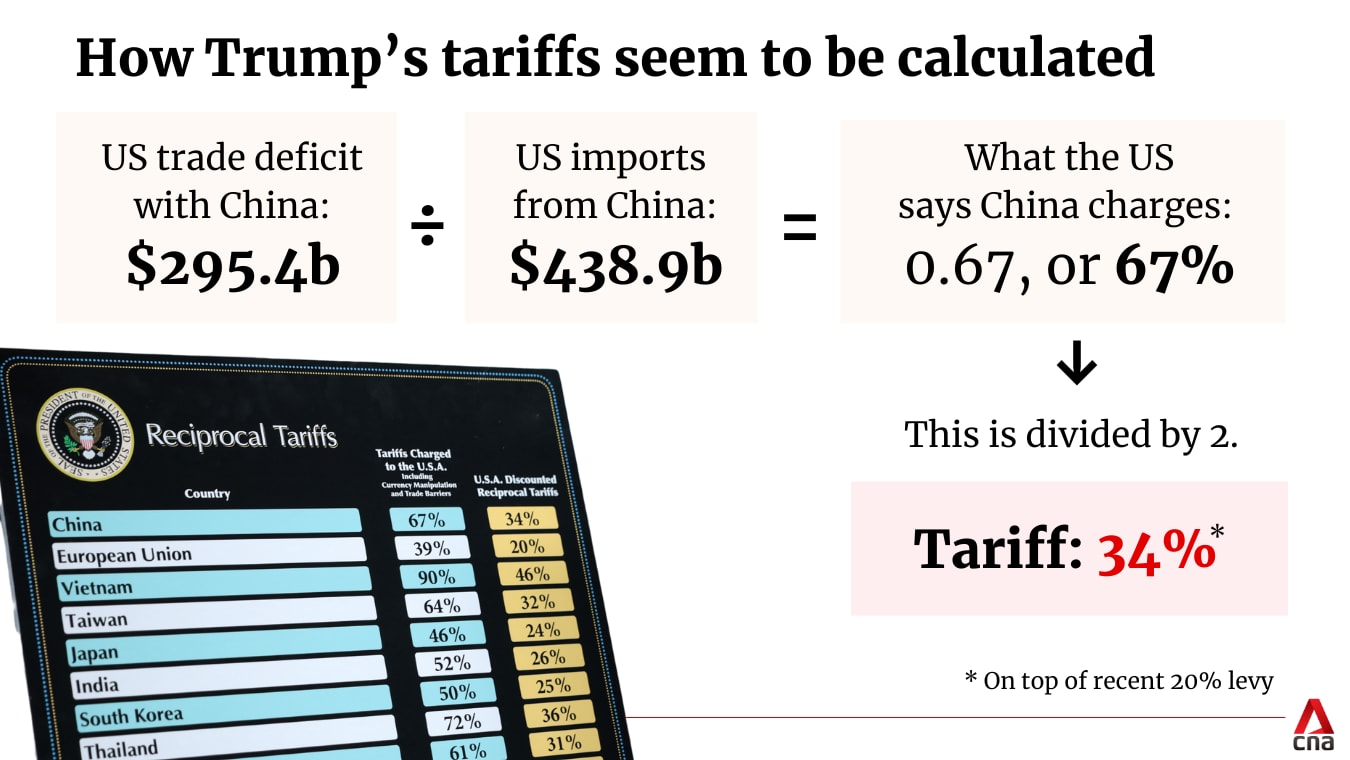

China, the world’s second largest economy and a major US trading partner, will be hit with a 34 per cent tariff, on top of the 20 per cent levy previously imposed on the country, bringing the total new levy to 54 per cent.

Beijing has vowed countermeasures and its response will be calibrated, experts say - tough enough to signal resolve but also careful not to derail China’s fragile economic recovery.

“I do think that in these circumstances, the best way for Beijing to react is to do some retaliation and boost the economy,” said Guo Shan, partner and research economist at Hutong Research, who also noted that Trump’s tariffs were “more hawkish than expected”.

“The tariffs are higher, not only for China, but also for other Asian and European countries.”

Stephen Olson, a visiting fellow at the ISEAS-Yusof Ishak Institute, said he “fully expects China to respond with forceful, but proportionate countermeasures”.

Chinese policymakers will seek to avoid actions that could jeopardise the country’s already fragile post-COVID economic recovery or further shake investor sentiment, Olson added.

He said Beijing’s goal now will be to deliver a political and economic message without escalating into a full-blown trade war that risks spiralling out of control.

“This won’t necessarily be limited to tariff increases. It could also include measures to make life more difficult for US companies that depend on the China market,” Olson said.

The global trade war has “escalated much faster than anticipated”, said Su Yue, principal economist for China at The Economist Intelligence Unit (EIU), adding that levies on China were initially expected “to reach this level by 2027”.

“Given the high unpredictability of Trump’s trade policies, there’s still room for further increases.”

VULNERABLE SECTORS

Beijing previously responded to tariffs imposed by the Trump administration earlier this year, announcing 10 to 15 per cent tariffs on fuel and US agricultural products like soybeans, wheat and chicken.

The new tariffs will not impact all Chinese industries equally, economists say, but the pain will be widespread.

Low-margin, export-dependent sectors, especially those already under financial strain, are likely to face the worst.

“Given how high tariffs already are, virtually every industry will be impacted, but those already struggling with negative profit growth recently will bear the brunt,” said EIU’s Su, who said sectors like furniture, textiles and electronics would be particularly vulnerable.

The sharpest and most immediate shock would be dealt to Chinese e-commerce exporters, Guo said, following Trump’s decision to shut down a crucial trade loophole that had fuelled the rise of Chinese-owned platforms with global reach, such as retail giants Shein and Temu.

More than 1 billion parcels from China entered the US in 2023, with Shein and Temu likely accounting for a combined 30 per cent of that volume, according to a report by the US congressional committee on China.

Around 1.36 billion Chinese shipments entered the country in 2024, US Customs and Border Protection data showed.

Analysts say the move will be especially disruptive for smaller sellers operating through Chinese e-commerce platforms, which target US shoppers and consumers directly - a business model relying on ultra-fast, low-cost shipping to undercut US retailers.

Under the new rules, such products face not only tariffs but also customs delays, compliance hurdles, and higher logistics costs.

“It will definitely slow the (parcel screening) process and exporters will probably see their packages being stopped at the border for investigation for a very long time,” said Guo. “This would be a bigger headache which they previously did not really have to bother with.”

Chinese companies already seeing “razor-thin” profit margins would have little room to absorb additional costs, according to EIU’s Su, who adds that the new tariffs will “ultimately likely be passed on to US consumers partially after part of the cost is absorbed by US retailers”.

Over the years, some Chinese manufacturers have been rerouting shipments through Southeast Asian countries to circumvent US tariffs - leveraging free trade agreements and integrated production chains across countries like Vietnam, Cambodia, Thailand and Malaysia.

However, that escape route will likely no longer be a “cost-effective alternative” as nations in the region also face hefty US tariffs now hitting both ends of this supply chain.

“Rerouting Chinese exports may fail in countries like Vietnam, where exports were previously rerouted in part, and are (now) also being hit hard,” said Josef Gregory Mahoney, professor of politics and international relations at East China Normal University.

Chinese firms will likely pivot to new markets, in the months ahead, Mahoney added.

MEASURES AHEAD

Targeting US exports, particularly agricultural and energy goods, could be one option for Beijing, says EIU’s Su. “Such measures would primarily hurt US exporters, including key Trump supporters.”

But China’s scope for maneuver is not unlimited. Hutong Research’s Guo noted that the current political climate in Washington, especially with strong anti-China sentiment in Congress, leaves little room for compromise.

“These tariffs make a deal quite difficult because any exchange right now will be seen as a political compromise from Beijing’s side,” she said.

Unlike countries such as Vietnam and India, which are already in talks with Washington to try and reduce tariff levels, China has little expectation of a similar diplomatic opening, Guo adds.

“We do think in general, for these countries, there is some room for them to get a tariff down - but it’s not really for China.”

Mahoney expects Beijing to respond with “a mix of reciprocal tariffs, legal challenges and increased diplomacy - working with other countries to formulate effective responses”.

China may also leverage the moment to expand its influence and partnerships across Asia, amid shared frustrations with the US and aggressive tariffs.

“Given the high level of tariffs aimed at the mainland and Taiwan, as well as other East Asian, Southeast Asian and South Asian economies, Beijing sees this as a broad strategic opening to improve ties and further integrate Asian economies,” he said.

STIMULUS AT HOME, DIPLOMACY ABROAD

The US tariffs come at a challenging time for China’s recovering economy, with officials ramping up efforts in recent weeks to boost weak domestic consumption and spur growth.

Figures released in March showed Chinese exports rising just 2.3 per cent in the first two months of 2025, well below expectations for a 5 per cent increase.

The divergence may see Beijing transitioning away from export-led growth as a long term objective.

“The new tariffs will put more pressure on Beijing to accelerate policies and laws that will protect and help grow private Chinese enterprises,” said Mahoney, adding that such initiatives were already underway.

“It might also encourage more attention to stimulating domestic demand.”

All eyes now will be on an upcoming Politburo meeting in late April, which could see Chinese leaders announcing fresh stimulus packages to remedy the situation, analysts say.

“We may expect more policy announcements, more implementation of existing policies and there could be more announcements of stimulus,” said Guo.

A potential new stimulus package could be “one to two trillion yuan more” than previous packages announced back in March, which had yet to be implemented, she adds.

Chinese exporters have also been increasingly offshoring production and exports to mitigate risks. “Exporters are definitely nervous,” Guo said. “Beijing is supportive of firms offshoring now because it’s an inevitable trend.”

She adds: “It’s clear that China is welcoming investors from ASEAN, Japan, Europe, and the US - basically everyone around the world.”

“As long as they are interested in the Chinese market, they are welcome to have a good trade and investment relationship with China.”

Beijing is also working to shore up relationships abroad, analysts say, highlighting intensified engagement with both regional and global partners in recent weeks.

That extends to overtures to Europe, where Chinese officials have been discussing international trade cooperation and how to manage disputes.

“There will be more time between China and Europe to figure out how to deal with each other,” noted Guo.

Experts note that Beijing has been turning to diplomacy not only as a hedge against further escalation with the US, but also as a way of deepening trade integration with partners also been hit by Washington’s widening tariff regime.

China, Japan and South Korea recently agreed to enhance cooperation and accelerate negotiations on their trilateral free trade agreement - a move that would have been unlikely between the three East Asian rival powers just months ago amid ongoing historical frictions.

“That was a remarkable breakthrough in relations,” said Mahoney.

China is also leaning into its leadership role within the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade bloc which also includes all 10 ASEAN states.

The bloc would serve as a natural platform for China in fostering closer cooperation with other countries also facing challenges from Washington’s tariffs.

“RCEP member countries will naturally deepen trade ties with one another,” said EIU’s Su, highlighting that China’s relative economic stability could make it a more attractive partner in the months ahead.

But she also highlighted limits that came with diplomatic realignment. While several nations have expressed interest in deepening economic ties with China, the RCEP alone was unlikely to fully absorb shock from a weakening global economy.

“Weak consumption will prevent China from replacing the US as a source of demand anytime soon,” she said.

For now, Beijing appears intent on showing that it still has room to manoeuvre - and is willing to play the long game.

As Mahoney puts it: “The possibility of a grand bargain with the US, or some (other) dealmaking, might still be possible, but it seems rather far at present.”