Jetstar Asia closure could lead to higher fares for regional flights, say analysts

One analyst said the price increases are likely to be limited to the short term as passengers look for alternatives to their cancelled Jetstar Asia flights.

Jetstar counters at Changi Airport. (Photo: Facebook/Changi Airport)

This audio is generated by an AI tool.

SINGAPORE: Jetstar Asia’s closure could result in higher fares for flights out of Singapore to popular destinations around the region, analysts told CNA.

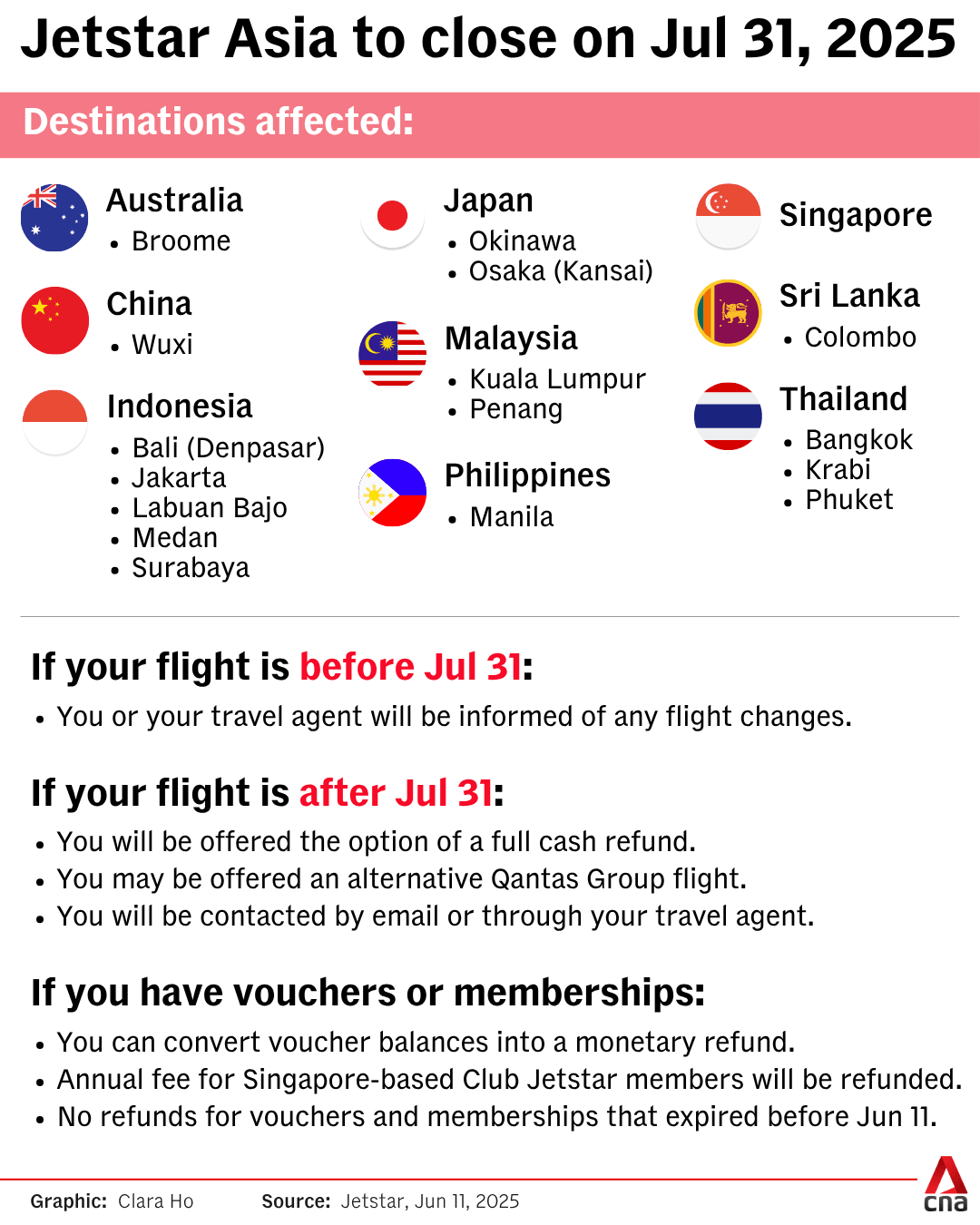

The Singapore-based budget airline announced on Wednesday (Jun 11) that it will be ceasing operations on Jul 31 following rising supplier costs, higher airport fees and intensifying competition among low-cost carriers.

"In general, the slight reduction in capacity, coupled with the demand, could drive (fares) up," said Mr Alfred Chua, Asia air transport editor for aviation publication FlightGlobal.

"I expect this could happen on the metro cities' routes (such as) Bangkok, Kuala Lumpur and Jakarta, where they compete with other low-cost carriers."

Mr Joshua Ng, a director at Alton Aviation Consultancy, said: "I think what we'll see (is) that in the near term, there's going to be a likely price increase as some of these passengers that Jetstar Asia was supposed to fly are now going to fly on other airlines."

As more seats on other airlines are filled, prices will rise, he added.

But in the medium to longer term, airlines would assess their strategies and potentially increase their flight frequencies to the routes that Jetstar Asia used to operate. This would cause prices to return to where they were before, Mr Ng said.

"This will be a matter of supply and demand in the market, where the prices of tickets will eventually shake out," he added.

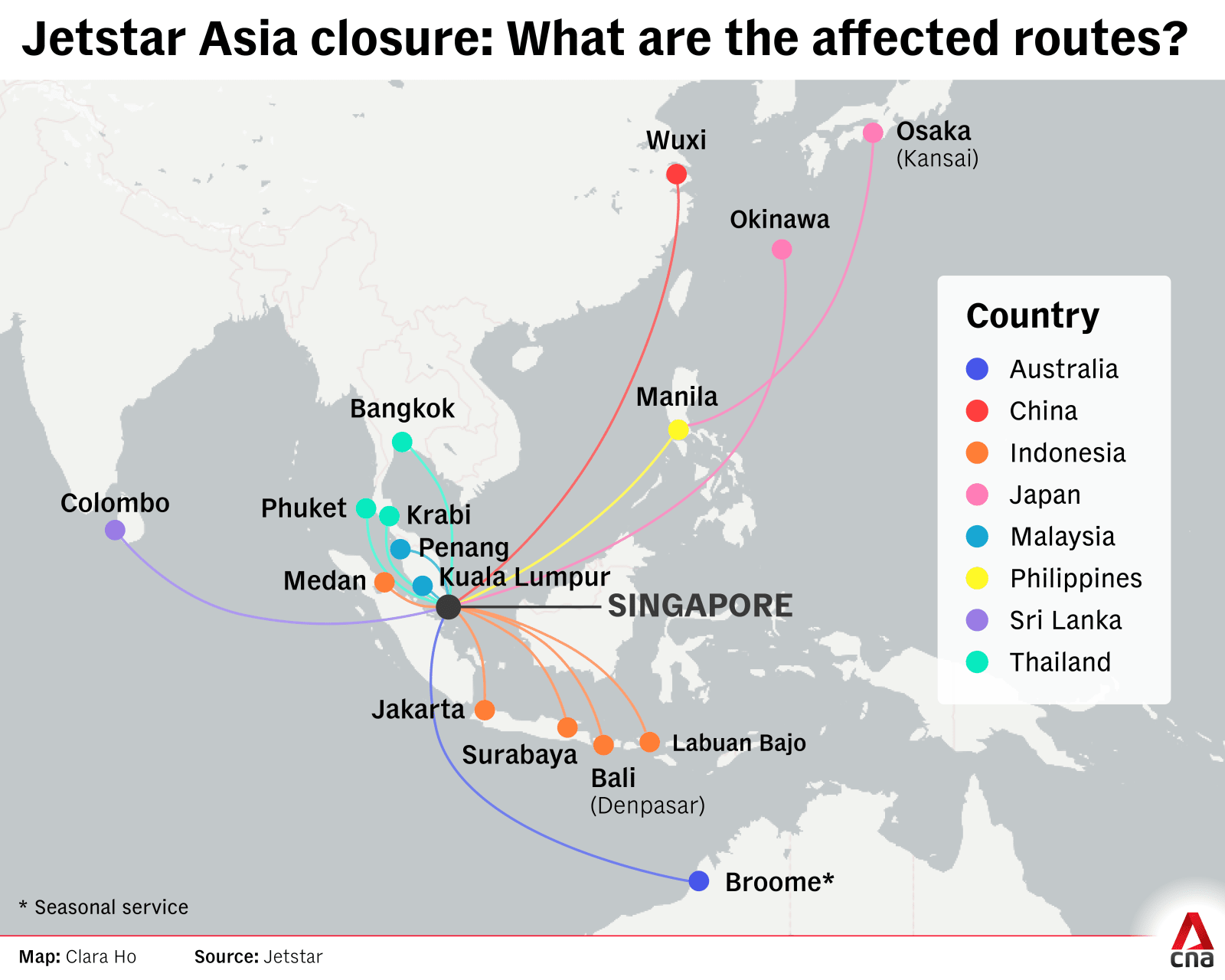

Apart from the prospect of rising fares, the loss of Jetstar Asia also means that there will be four exclusive routes that will no longer be served – as things currently stand.

Of the 16 destinations Jetstar Asia serves, 12 are also served by 18 other airlines, but four – Broome in Australia, Labuan Bajo in Indonesia, Okinawa in Japan and Wuxi in China – are not.

"Their exit will mean some of these points will be left without any direct links to Singapore," said Mr Chua.

"This in turn impacts, in some way, Changi's plans to grow its international city pairs."

During the groundbreaking ceremony for Terminal 5 last month, Prime Minister Lawrence Wong said that Changi Airport aims to grow its city links from over 170 currently to more than 200 in the mid-2030s.

Mr Chua said the closure of Jetstar Asia is unlikely to affect plans for Terminal 5 since it is not a very big player in Singapore. He added that the airline was also unlikely to move to the new terminal.

CAN THE GAP BE FILLED?

Mr Mayur Patel, head of Asia at aviation data consultancy OAG Aviation, said that the closure of Jetstar Asia will leave a temporary gap in Changi Airport’s passenger capacity and number of scheduled flights.

According to Changi Airport Group (CAG), Jetstar Asia operates about 180 weekly services at the airport.

In 2024, the airline carried approximately 2.3 million passengers at Changi Airport, accounting for about 3 per cent of Changi’s total passenger traffic that year.

"I would say those slots can be replaced, but that will take time under the current conditions," he said.

These conditions include supply delays in new aircraft, which have held airlines back on their expansion plans, as well as the relatively higher airport fees at Changi.

He said that some of the capacity may be replaced by Indian or Chinese carriers, which are seeing high traffic volumes from their respective markets into Singapore.

"There will be repivoting and shifting of airlines that will take up those slots," he said.

He added that Terminal 4, which Jetstar Asia operates out of, would "feel a bit empty" in the meantime.

Mr Chua added that for the unique city links served by Jetstar Asia, other low-cost carriers like Scoot could step in to fill the demand.

"I say Scoot because they have the Embraer E190-E2 (planes), which can help 'right-size' some of the thinner routes that a Jetstar Asia A320 was not able to fill," he said.

Scoot is set to have all nine Embraer E190-E2 jets – a smaller aircraft than the A320 – added to its fleet by the end of this year.

For other regional destinations that are not unique to Jetstar Asia, Alton Aviation’s Mr Ng said Scoot, as the other Singapore-based low-cost carrier, is the "obvious candidate" to step in.

It is also "quite conceivable" that airlines such as AirAsia and Citilink would want to take over Jetstar Asia’s slots from Singapore to Kuala Lumpur or Jakarta, he said.

HOW DID IT COME TO THIS?

Challenges facing Jetstar Asia, which is part of Australia’s Qantas Group, were touched on by the airline’s chief executive officer John Simeone in an interview with CNA last year.

He said that there has been increases in the company’s costs, which it was working on.

"It just means we are looking at our business as well as around what the opportunities are to make sure we continue to provide low fares," he had told CNA.

Mr Patel and Mr Chua said that the writing was on the wall when Jetstar Asia made the well-publicised move to Terminal 4 in 2022.

"As a member of the Qantas Group, the airline was meant to help feed traffic to the Qantas network through Singapore," said Mr Chua.

"Qantas operates from Terminal 1, as (do) most of Jetstar Asia's codeshare partners, and so the shift has made it less convenient for the connecting passengers."

In 2022, Jetstar Asia went public with its discontent with CAG’s decision, but eventually agreed to move to Terminal 4.

CAG said then that discussions had started in 2019 and that it had been experiencing tight capacity during peak hours. It added that moving Jetstar to Terminal 4 would "provide headroom" to support airlines' growth at Changi Airport.

Mr Ng said that before the COVID-19 pandemic, around 10 per cent of customers on Qantas flights had a connecting Jetstar Asia flight. That figure is now around 5 per cent.

Mr Patel said that the way the episode played out may have made Jetstar Asia feel like they were "not part of the ecosystem" at Changi Airport.

"That’s something Jetstar evaluated and (decided) they can put their assets somewhere else to get better returns," said Mr Patel. "Why focus on something where we don’t get acknowledged?"

COSTS

Mr Chua said that Jetstar Asia’s departure signals that Changi Airport may not necessarily be ideal for low-cost airlines to operate from.

Jetstar Group CEO Stephanie Tully said on Wednesday that the airline has seen "really high cost increases" at its Singapore base, including double-digit rises in fuel, airport fees, ground handling and security charges.

CAG and the Civil Aviation Authority of Singapore (CAAS) announced in November last year that airlines will have to pay higher landing, parking and aerobridge charges from April 2025.

They said then that they had engaged the major airlines on the revised charges, and would give a 50 per cent rebate on the increases for the first six months.

Mr Chua said: "Cost is one issue, but also the availability of slots, especially before we have a three-runway system, does not make sense for a small foreign low-cost carrier.

"The added cost, potential lack of attractive slots and connectivity, will not be favourable to smaller low-cost carriers."

Could this dull Singapore’s shine as a regional aviation hub?

Mr Chua said that Singapore will still attract new airlines, even with Jetstar Asia’s closure.

"Operating from other airports could be at lower cost, but it’s also not Singapore," said Mr Chua.

"There are no alternative ‘Singapore’ airports," he added. "If they want to operate to Singapore, it will be to Changi, and if they see there is demand for them to operate here, they will."

Singapore remains an attractive destination for business and leisure visitors, and people in Singapore also have a high propensity to travel, said Mr Ng.

"I would say that for airlines, whether you’re full-service carriers or low-cost carriers, Singapore is naturally high on the list of airports that they would want to serve," he said, noting that Changi Airport is the gateway to Singapore.

Airport fees and supplier costs may be higher, but it is probably worth it for the airlines, he said.

"I think it’s more than made up for by the demand and the potential demand for the flights that will be flown to and from Singapore."