Jetstar Asia to cease operations on Jul 31, over 500 workers to lose jobs

Jetstar planes are seen on the tarmac at Melbourne's Tullamarine Airport on Apr 12, 2020. (Photo: AFP/William West)

Australia's Qantas said on Wednesday (Jun 11) it will close Jetstar Asia, the group's Singapore-based budget airline, as it reels with rising supplier costs, higher airport fees and intensifying competition among low-cost carriers.

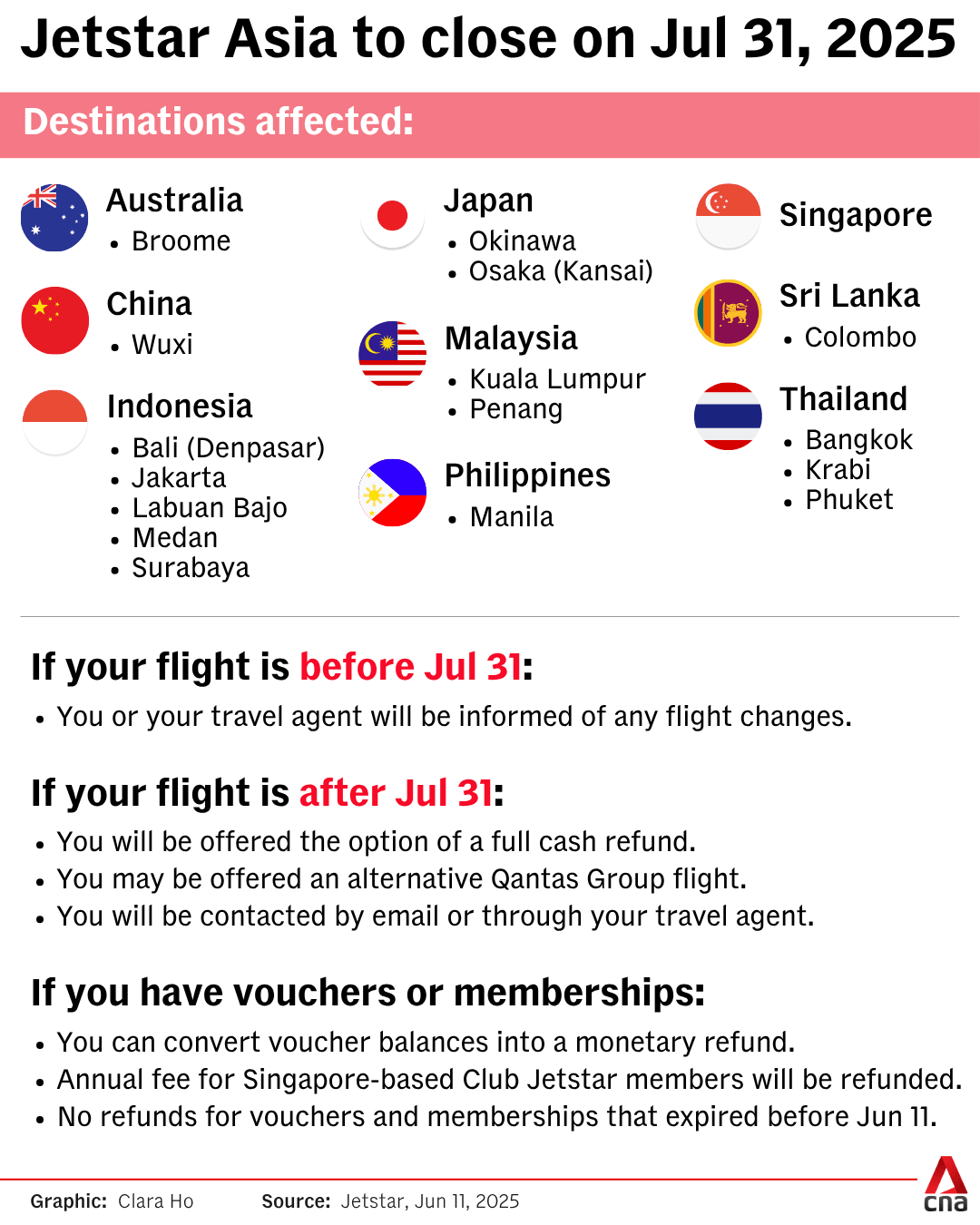

The airline will continue flights for the next seven weeks before ceasing operations on Jul 31.

It added that Jetstar Asia customers with existing bookings on cancelled flights will be offered full refunds, and that the Qantas Group will look to reaccommodate customers onto other airlines where possible.

A Jetstar Asia spokesperson told CNA that more than 500 people will be laid off as a result of the airline's closure.

Employees will be provided redundancy benefits as well as employment support services, while Qantas works to find job opportunities across the group and with other airlines in the region, Qantas said.

"We are committed to supporting team members who are impacted by this announcement the best way we can, this includes providing redundancy benefits, career transition support and roles and opportunities across the Qantas Group and with other airlines and aviation partners in Singapore where possible," added the Jetstar Asia spokesperson.

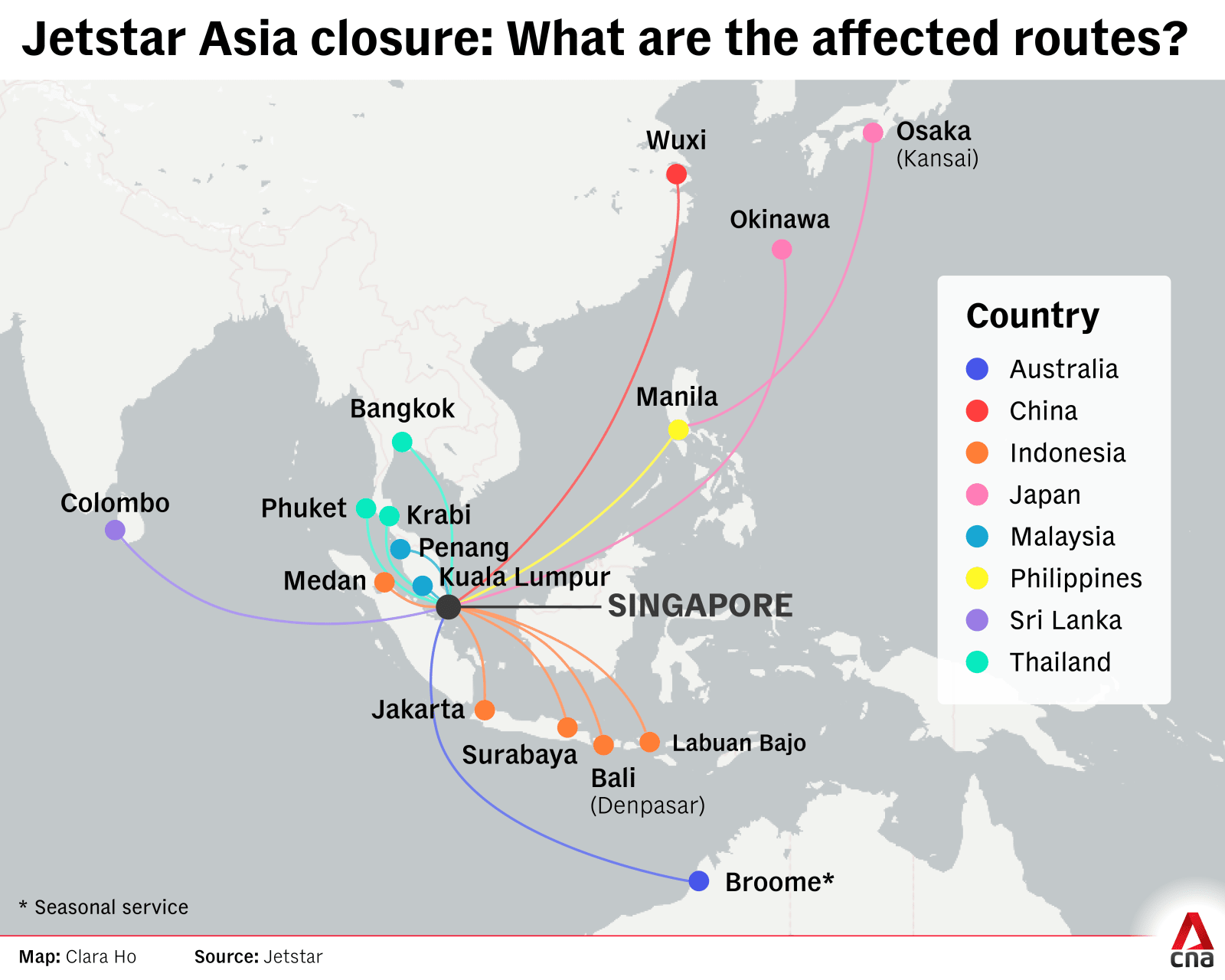

The closure of Jetstar Asia will see flights on 16 routes terminated.

The airline currently operates flights between Singapore and destinations in Malaysia, Indonesia, Thailand, the Philippines, China, Sri Lanka, Japan and Australia.

Jetstar Airways' domestic and international operations in Australia and New Zealand and Jetstar Japan will not be affected by the move.

Qantas added that 13 Jetstar Asia Airbus A320 aircraft will be progressively redirected to Australia and New Zealand.

CAG MONITORING ROUTES IMPACTED BY CLOSURE

Responding to queries from CNA, Changi Airport Group (CAG) said that while it was disappointed by Jetstar Asia's decision to exit Singapore, it respects the airline's commercial considerations.

CAG added that its priority now is to "ensure passengers are well supported and to minimise disruption during the transition period".

The airline, which began operations in December 2004, operates about 180 weekly flights and serves 16 destinations from Changi Airport, CAG said. Of these, 12 destinations are also served by 18 other airlines offering over 1,000 weekly scheduled flights.

"We will monitor the routes affected by Jetstar Asia’s exit, and where additional capacity is needed, we will actively engage other airlines to fill the gap," CAG added.

Jetstar Asia's exit will directly affect four routes out of Singapore - Broome (Australia), Labuan Bajo (Indonesia), Okinawa (Japan) and Wuxi (China) - as they are exclusively operated by the airline. CAG said it will work with other airlines to restore connectivity on these routes.

According to CAG, Jetstar Asia carried approximately 2.3 million passengers at Changi Airport in 2024, accounting for around 3 per cent of the airport’s total passenger traffic last year.

The carrier had expanded its fleet to 18 aircraft by 2019, but reduced this during the COVID-19 pandemic. It has since rebuilt to a 13-aircraft operation.

CAG added that it values its partnership with the Qantas Group and will "continue to collaborate with Qantas and Jetstar Airways to support their growth and presence at Changi Airport".

The Singapore Manual and Mercantile Workers' Union (SMMWU) said it is working closely with Jetstar Asia's management to negotiate for retrenched workers to receive fair compensation.

Jetstar Asia has been unionised with National Trades Union Congress (NTUC) affiliate SMMWU since 2009.

"SMMWU remains dedicated to supporting members and workers through this difficult transition by providing job placement assistance and career advisory services across various industries, and financial aid, where necessary," said the union’s secretary-general Andy Lim.

The union added that it will assist affected workers with job placement and career advisory services within the aviation and aerospace industry.

HIT BY RISING COSTS

Jetstar Asia continues to be negatively affected by rising supplier costs, high fees at airports and rising competition in the region, fundamentally challenging its ability to deliver returns comparable to the stronger-performing core markets in the group.

Qantas Group CEO Vanessa Hudson said the company has seen some supplier costs rise by up to 200 per cent, materially changing its cost base.

"I want to sincerely thank and acknowledge our incredible Jetstar Asia team who should be very proud of the impact they have had on aviation in the region over the past two decades," she said.

Qantas launched the airline over two decades ago in a bid to capitalise on the growing demand for low-cost air travel in Asia.

The low-cost unit has faced intensifying competition from Southeast Asian budget carriers, including Capital A's AirAsia and Singapore Airlines' Scoot.

The closure of Jetstar Asia is expected to cost about A$175 million (US$114 million), with approximately a third in the 2025 fiscal year and the remainder across 2026, Qantas said.

The move will also free A$500 million in capital for Qantas to invest in its fleet renewal plans.

"We are currently undertaking the most ambitious fleet renewal program in our history, with almost 200 firm aircraft orders and hundreds of millions of dollars being invested into our existing fleet," Hudson added.

Jetstar Asia is currently expected to post an underlying loss of A$35 million before interest and taxes in the current financial year.