Singapore the 'LV destination' for concerts, but will rising costs, competition derail that?

Concerts have made a roaring comeback over the past year, with a string of A-listers performing – some even for multiple days – in Singapore.

People queue overnight at a community centre basketball court for Taylor Swift concert tickets, outside a post office in Singapore, on Jul 6, 2023. (Photo: Reuters/Edgar Su)

SINGAPORE: With good infrastructure, easy connectivity and a track record in making large-scale events work, Singapore is a popular concert tour stop for international artistes.

So much so that it has a reputation akin to a luxury brand which promises a smooth performance and a good time not just for the audience, but the celebrity and those working on the tour.

“There are some who call Singapore the ‘LV destination’ of Southeast Asia,” said Ms Gabriela Chan, the marketing manager of concert promoter CK Star Entertainment in Singapore. “LV” refers to luxury label Louis Vuitton.

“It’s a very different image and experience that the country offers,” she added, citing factors such as venues with state-of-the-art facilities, supportive policies, and a clean and safe environment.

“All these matter for the artistes and touring agencies, and that’s why Singapore remains attractive.”

After the COVID-19 pandemic, concerts have made a roaring comeback, with a string of A-listers performing – some even for multiple days – in Singapore.

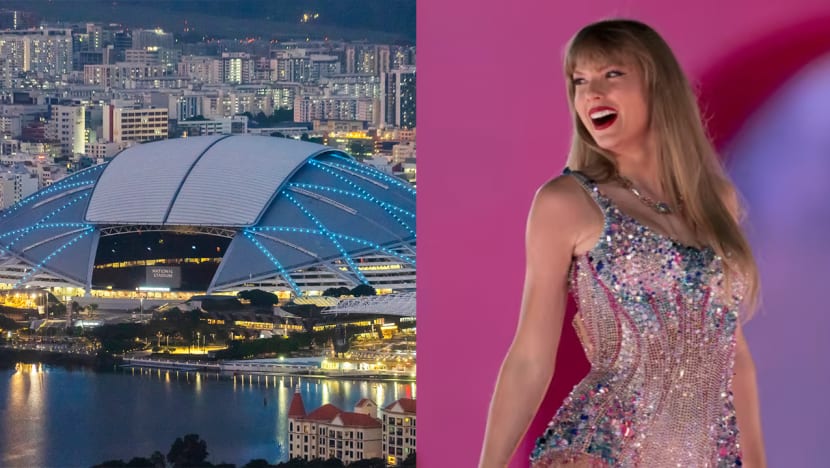

These include Mandopop star Jay Chou and K-pop group Blackpink who have enthralled tens of thousands of fans at the National Stadium. At neighbouring Indoor Stadium, Hong Kong's "Heavenly King" Jacky Cheung performed a record 11 nights in July.

The National Stadium is set to host British band Coldplay for six shows next January, followed in March by American popstar Taylor Swift also for six shows. Singapore will be the only stop that Swift is making in Southeast Asia.

Both concerts ignited a buying frenzy, with hundreds of thousands of tickets selling out within hours. Additional tickets for Coldplay that were released earlier this month have also been snapped up.

Adding to the concert calendar are upcoming performances by Taiwanese rock band Mayday and British musician Ed Sheeran.

This string of concerts isn’t just music to the ears of fans. Singapore’s local economy stands to benefit as well, with concert promoters and associated businesses seeing a brisk recovery and spillover effects for others in the tourism and hospitality sectors.

Still, industry players have cited challenges such as rising costs and manpower shortages. Some are also worried about a slide in consumer demand if the global economy weakens further.

Regionally, other countries are also hoping to muscle in on Singapore's concert market with their huge domestic audience.

CONSUMERS WILLING TO SPLURGE

Like most parts of the world, demand for live concerts in Singapore hit a high over the past year.

It's not just artistes – both die-hard fans and casual listeners are keen to return to live shows and have so far been undeterred by pricey tickets.

Local concert promoters did not reveal how much ticket prices have risen. For example, GHY Culture & Media – the organiser of Jay Chou’s world tour in Singapore and elsewhere like Malaysia and Thailand – only said ticket prices saw a “marginal increase” as inflation drove up operating costs.

“Live entertainment remains popular because it offers a unique and immersive experience that cannot be replicated by other forms of entertainment,” said GHY’s regional senior group director of concert organisation and management Adeline Low.

More than two years of missing out on live entertainment also means consumers are willing to splurge on some “luxury” items such as concerts, said IMC Group Asia’s chief operating officer Romell Song.

Beyond local concertgoers, the slew of international acts is also attracting fans from around the region, including Malaysia, Indonesia and the Philippines, concert promoters said.

This means the resurgence in live concerts can benefit the local economy on multiple fronts.

Doing a back-of-the-envelope calculation, an associate professor in marketing estimated that Taylor Swift's concert leg in Singapore could yield S$67 million (US$48.8 million) in ticket sales.

This was based on her six sold-out shows, with an average ticket price of S$250 and assuming about 45,000 seats available each night, said Associate Professor Lau Kong Cheen from Singapore University of Social Science’s (SUSS) business school.

It is “a huge amount” that does not even take into account another big revenue generator – merchandise sales, he added.

Contracts between the artistes, touring agents and local promoters will vary. In some cases, half of the sales revenue, after deducting relevant taxes and ticketing costs, may go to payment for the venue, local contractors involved in the production and backstage operations, and other service providers engaged for the show, said Assoc Prof Lau.

Visitors who are in town for a concert will also spend on accommodation, shopping, food and beverage, thereby boosting these other industries.

Beyond monetary benefits, the wave of A-list concerts helps to add to the image of Singapore as a travel destination.

“With this happening, it creates a lot of a buzz about Singapore. People will be curious – like, why is Singapore the only stop for Taylor Swift in Southeast Asia – and it may give them a reason to want to come here,” Assoc Prof Lau told CNA.

“This branding is important because when travel was very much restricted over the last two to three years, some tourists may have forgotten about Singapore.

“By creating this vibrant image, it will help put Singapore back in the minds of international tourists. As more come and go back home to tell their friends about us, that creates the ripple effect for more to want to come and visit.”

INDUSTRY RECOVERY UNDERWAY

Going by earnings results, some concert organisers in Singapore are already reaping the benefits of the recovery.

The live entertainment and events industries were among the hardest hit by the pandemic – they were the first to be shuttered and the last to resume full-scale operations.

The turnaround is “clearly evident” for those listed on the Singapore Exchange, said Mr Paul Chew, head of Phillip Securities Research.

Unusual, which organised Jacky Cheung’s concert here in July, reported an eightfold increase in annual revenue for the financial year 2023. The firm swung back into profitability with earnings of S$1.8 million, and said in a bourse filing that business is “back to normal”.

GHY saw a 58 per cent increase in revenue for the first half of the year, helped by its concert production business which produced sold-out Jay Chou concerts in Malaysia and Australia. The company remains in the red due to foreign exchange losses but said it is eyeing a turnaround this year.

“Concerts have been sold out and some even extended. By using the same location and equipment, gross margins will be even higher than previously,” said Mr Chew, adding that other margin drivers include advertisements and sponsors, as well as “room to raise prices” given the pent-up consumer demand.

But concert promoters disagree, saying that staging shows at bigger venues and for multiple nights do not necessarily translate into economies of scale and guarantee profits.

“You may be able to divide some costs over multiple shows, but some costs may also increase in tandem with the number of shows,” said IMC’s Mr Song.

These costs, such as artiste fees, rental for the venue and equipment, as well as manpower, could also go up “non-linearly so concert promoters still have to go into the details”.

More broadly, overall operating costs – from rental of venues, equipment and manpower to services like ticketing and lodging for the artiste and the touring team – have gone up by double digits from before the pandemic.

Hotel costs, for one, have risen by 30 per cent, said CK Star Entertainment's Ms Chan. Manpower costs have jumped between 25 and 50 per cent – with backstage runners and translators among the jobs that have seen the highest increase.

Rental of production equipment is also now more expensive, with the exit of several production companies during the pandemic and the recent surge in demand.

This scarcity of resources – from manpower to touring and concert equipment such as lighting, set productions and AV systems – could drive up production costs further and “potentially be a problem” for the concert industry, said GHY’s Ms Low.

As for raising ticket prices, Mr Song said that while there is “some small premium to be enjoyed” amid pent-up demand, there is a limit as to how much prices can be raised before consumers walk away.

“It would be wrong to fleece the consumer because we still want their trust over a long period of time,” he said.

“We must be cautious to think that because of the general optimism projected by quite a few sell-out concerts in Singapore, these times are invariably rosy for the industry.

“The general principles of doing business still apply and audiences in the region are discerning.”

REGIONAL COMPETITION

Meanwhile, neighbouring countries with an inherent advantage – their large domestic markets – are also eyeing a slice of the booming concert market.

CK Star Entertainment, which also operates in Indonesia, has noticed more live shows and concerts taking place outside Jakarta.

“The government is putting in effort to bring these events to other cities so instead of having all the concerts in Jakarta, we see Bali being added as a tour stop now for some artistes and it freshens things up,” said Ms Chan.

Indonesia also has “very aggressive” corporate sponsors, which are undoubtedly a “major incentive and help” for promoters, said Mr Iqbal Ameer, founder and group chief executive of Livescape Group. Based in Malaysia, the concerts and events organiser has offices in Singapore and Indonesia.

“In the past, artistes will choose either Singapore or Indonesia but nowadays, it’s getting very common to see a lot more artistes including Indonesia as a stop for their world or Asia tour,” said Ms Chan.

Another vibrant market that is becoming a music festival hotspot is Bangkok.

“Festivals are part of Thailand’s culture, like Songkran, so you know it's a place to go for a good time,” said Mr Iqbal, adding that Bangkok now sees at least one mega music festival each month.

Still, land transport and air connectivity, as well as government policies, remain a consideration for those looking at holding an event in these countries, concert promoters said.

Elsewhere in the region, Malaysia also has a large domestic multi-lingual market and good venues to boot, although recent events may have dented some market confidence.

The government halted a music festival in the capital Kuala Lumpur in July, after the frontman of British pop rock band The 1975 kissed a male bandmate onstage and criticised the country’s anti-LGBT laws. The 1975 is also banned from performing in Malaysia.

“People were worried when it happened,” said Mr Iqbal. “I’m not saying that events are not going to happen after this but it's making everybody think twice.

“An artiste is going to think twice before coming. A sponsor is going to think twice before they sponsor an event. The fans are going to think thrice before buying a ticket, and this doesn’t make it easier for event organisers who have just survived the pandemic.”

The country’s Arts, Live Festival and Events Association sounded more upbeat, with its chairman describing the cancellation as an “isolated incident”.

“I think most artistes understand that if they are in a country, they will need to follow the guidelines of that country,” said Mr Para Rajagopal. “What The 1975 did is not something that should be done.”

There have also been opposition against concerts and performances held by foreign artistes, with the most recent coming from the political leader of Islamist party Parti Islam Se-Malaysia who called for the cancellation of Coldplay’s concert in Malaysia.

Such calls are undeniably “bad press”, but Mr Rajagopal said they remain the “minority”.

“That’s how it's been all this while and I think people understand how politics are played – not just in Malaysia but everywhere.”

The bigger issue facing concert promoters in Malaysia, said Mr Rajagopal and Mr Iqbal, is the roll-out of a 25 per cent entertainment tax that threatens to eat into the industry's wafer-thin margins. The Arts, Live Festival and Events Association said it will continue to call for a review of the tax.

By comparison, Singapore is seen as “a relatively safe venue” for concerts given supportive policies, said Assoc Prof Lau.

The country continues to retain a “sweet spot” in the region, although concert promoters said Singapore can do more to spice up its variety of concert venues.

“We definitely have the best facilities and venues, but we don’t have more unique types of event spaces,” said Ms Chan. “Different sizes, layouts and requirements can help to make it more interesting for the artistes and audiences, who might already be very familiar with our usual concert venues.”

One interesting alternative is the Pasir Panjang Power Station, which has recently hosted a range of events such as music concerts and President Tharman Shanmugaratnam’s election meeting.

And there can be more.

“That's obviously not a standard concert hall or theatre-style venue. It’s more of a standing space, but it’s big enough and it’s these kinds of spaces that can allow us to be more creative,” Ms Chan said.

“We see there's some competition but for now, there isn’t a big impact on Singapore because Singapore is still an attractive location.”

Echoing that, Assoc Prof Lau said: “Each country has a different selling point. There will always be competition but our strategic location and being an English-speaking nation with good infrastructure and transport should put us in a very sweet spot for now.”