‘He was just so real’: Why online scams are claiming victims among the educated and well-off

Nana*, Samantha*, Pan Han Ni and Kelly* are among those who fell victim to pig-butchering scams.

-

'Pig-butchering' or love-and-investment scam victims report being groomed over weeks

-

Among those CNA Insider spoke to: A finance professional who lost S$1.2 million, and an IT entrepreneur

-

Psychologists and victims share why we fall for scammers' tactics - and how to spot signs of a con

-

Part 2 of a CNA Insider investigative special on love scams

*Names have been changed

SINGAPORE: In May last year, Eliza* joined a Discord group set up for people to chat about investment. It seemed a safe space to the Singaporean legal professional in her 40s, who wanted to connect with others in a like-minded community.

When a private message popped up on her screen, she thought nothing of it. In a group of around 12,000 users, it was common practice to message one another privately. So she responded to the user named Andy.

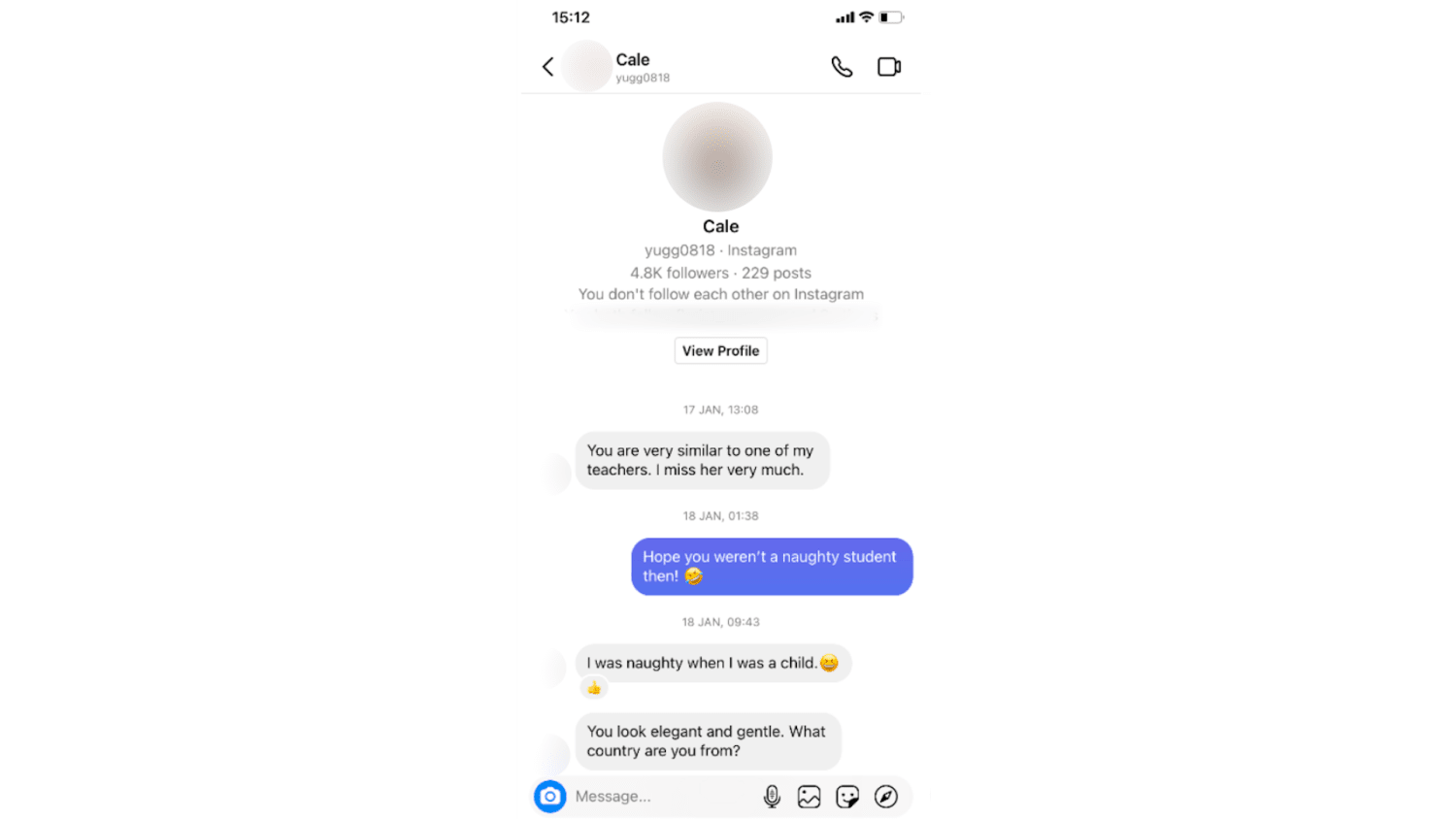

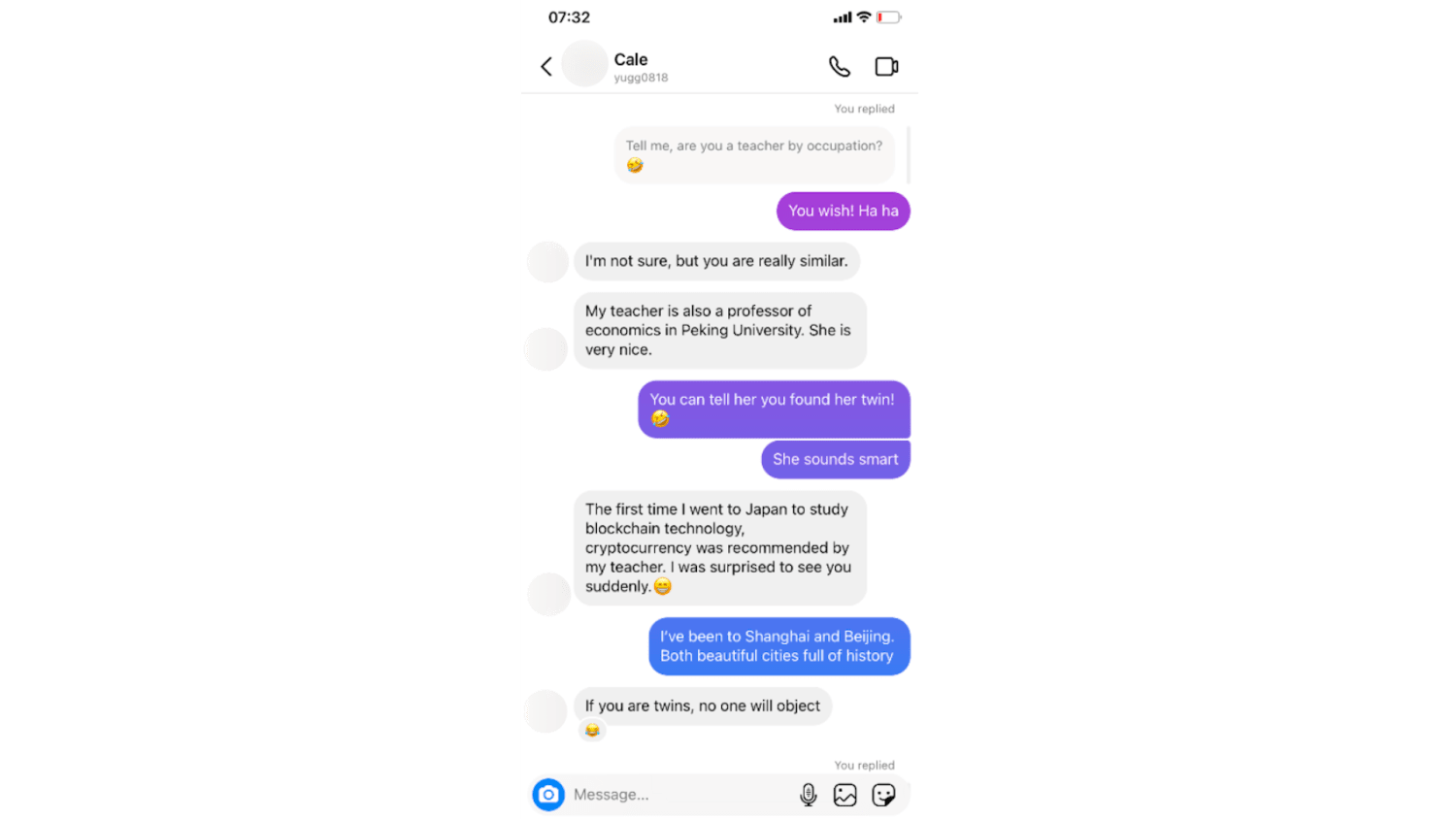

Over in Kuala Lumpur, Samantha*, 50, a professional in a public-listed company, was browsing Instagram in January this year when she received a message from a stranger. It was different from the “Hi, darling” messages she regularly received and reported as spam.

This one, from a man named Zi Ming, went, “You remind me of my teacher. I miss her very much.” Samantha, a divorcee, was surprised enough to respond, and over the next few months, the two developed an online relationship.

Part 1 of this special:

Over in Edmonton, Canada, Sajid Ikram was facebooking when a person he had never met appeared on his “people you may know” list. He added her as a friend out of curiosity and asked her how they knew each other.

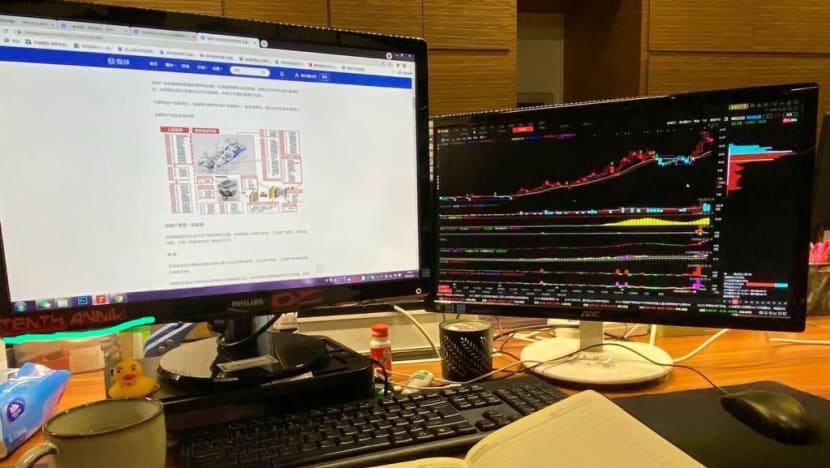

When the woman, named Nydia Chen, told him she was a cryptocurrency analyst, it seemed to him that her profile was suggested because they had similar interests.

He had a cryptocurrency portfolio worth a six-figure sum and was looking to move it somewhere other than ledger wallets so that it could be more easily available at short notice. When she suggested her platform, he thought, “Why not?”

The trio are separated geographically and motivated by different things. But they have something in common: The strangers who befriended them were all after their money.

Eliza, Samantha and Sajid are victims of pig-butchering scams, an emerging hybrid of romance and investment scams in which victims are groomed for weeks or months before they lose a fortune in bogus investment schemes or illegal gambling sites.

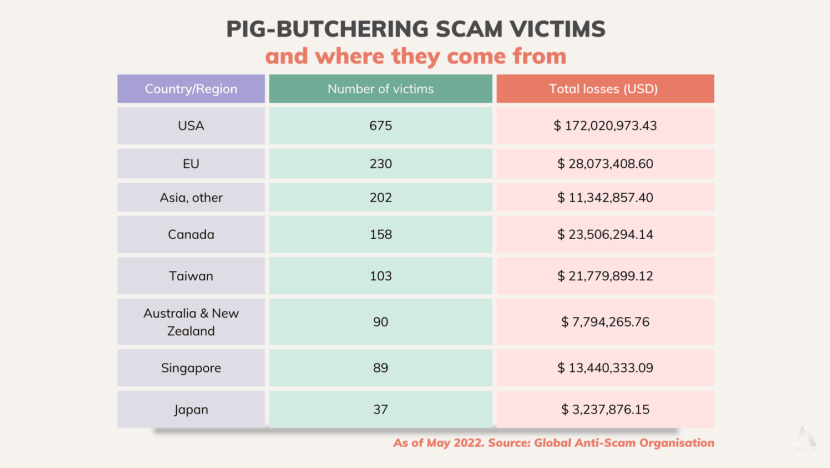

According to statistics from the non-profit Global Anti-Scam Organisation (Gaso), which focuses on pig-butchering scams, nearly 2,000 people have lost over US$310 million (S$440 million) in total since its formation in mid-2021.

In Singapore, scams were the top driver of crime in the first half of this year, with more than 14,000 cases reported, according to the Singapore Police Force (SPF) — an 85 per cent increase over the same period last year.

In its mid-year crime briefing, the SPF said the total amount cheated for the top 10 scam types increased from S$142.5 million to S$227.8 million. Of these, it was reported that investment scams (the SPF classifies pig-butchering scams as investment scams) accounted for S$108.8 million in the first half of this year, with 1,683 cases reported.

Watch: I Was Scammed Of $77k - Here’s What You Need To Learn From My Story (6.02)

And the scams, as the programme Talking Point discovered, are becoming increasingly sophisticated. So too are the targets, who are younger, more educated and financially savvy.

In the second of a two-part special on pig-butchering scams, CNA Insider spoke to more than 10 victims from Singapore, Malaysia, East Asia and North America to find out why people fall for them and who are most at risk. (Read part 1 here.)

Are you a victim of a scam, or think a loved one is? Here’s where you can get help:

For help wherever you are, contact the Global Anti-Scam Organisation or the Global Anti-Scam Alliance.

If you're in Singapore, call the anti-scam hotline 1800 722 6688 or go to www.scamalert.sg for scam-related advice. To provide information on scams, call the police hotline 1800 255 0000, or submit online at www.police.gov.sg/iwitness.

Share with us your story at cnainsider [at] mediacorp.com.sg (cnainsider[at]mediacorp[dot]com[dot]sg)CULTIVATING THE RELATIONSHIP

The scams, called “sha zhu pan” in Chinese, are convincing for a simple reason, as Lee*, a former scammer who spoke to Talking Point on condition of anonymity, put it.

“With our clients’ first investment, we make sure they earn some profits. Then we slowly cultivate the relationship and groom them, like fattening a pig,” he said.

“When we’ve managed to scam them out of all their money, and they realise it, we cut off all forms of contact — like butchering the pig.”

While the idea is simple, the execution is not, and the cultivation process is an elaborate one.

Samantha had imagined a scammer would tell her some sob story about needing money or ask many questions about her to target her. But Zi Ming, who told her he lived in Shanghai, was the opposite.

“He talked (online) so much about himself,” she recalled. “He could go on and on, and his messages were super long.”

They chatted almost daily for months, sharing jokes and making plans for their future. He was witty and intelligent, but most importantly, she described, he was not perfect.

“He admitted he could be overbearing or impatient at times. It made him seem very human and even more real.”

For nurse Pan Han Ni, 34, it was the little details mentioned by “Chen Xi”, the man she met in February through dating app Coffee Meets Bagel, that made him seem a real person.

He said he was from China but living in Singapore; he even specified a block and street in Yishun.

He could say things like he was drinking with friends in Little India, or when one day it was raining, that he had slipped in the rain while exercising. “It felt like he was really in Singapore,” said Han Ni.

When he found out that she enjoyed Korean food, he suggested meeting for a meal and even set a date two weeks later.

“I always felt like we were going to meet soon,” she said, adding that this gave her reassurance when he brought up investing and asked her to listen to him.

The scammers also showered their victims with care, often from the first few days.

Kayla*, who is in her early 30s, remembers that “Linus” started flirting with her four days after they first started chatting on WhatsApp. “Initially, I thought it was bullshit,” she said. “But he kept trying and trying. And he’d do things a typical partner wouldn’t.”

For example, he reminded her constantly to take care of herself and eat her meals. When they fought, he would call her and calm her down. He even started referring to her as his “wife”.

Listen: How a scammer makes a victim feel loved and cared for (Source: Gaso)

A translation of the conversation in Mandarin between a scammer and his victim, a nurse. (Recorded by a scam-baiter with the Global Anti-Scam Organisation)

Scammer: I’m finally hearing my wifey’s voice. Wifey, why are you rushing to go back to work? You should rest for two more days.

Victim: I just happened to have an operation.

Scammer: Even though you have an operation, you shouldn’t have to rush there this afternoon. How is your situation now, is your boss not aware of it?

Victim: He knows.

Scammer: If your boss recalls you, he really wants your life. If he calls you to come back in this situation, is he being humane? I’m asking you. Wifey, even though it’s only half a day, I hope that you will only return to work after you have fully recovered, OK? Look at yourself, initially you were recovering pretty well. After you went out for an afternoon, now you’ve come back in this state.

Showered with such deliberate attention, it’s not inconceivable that victims fall for someone they have never met. Said SPF psychologist Carolyn Misir: “The scammers contact them multiple times a day, with many reinforcing messages like, ‘I love you’ or ‘I care for you — have you eaten your lunch?’”

“A lot of victims tell us they fell in love very quickly,” she added.

Sometimes, however, romance does not enter the picture. When Eliza, who is married, rebuffed chat-group acquaintance Andy’s attempts to make a personal connection, he dropped the topic. Most of their conversations centred around investments and stock movements.

In their own words: Victims' stories

‘FOR OUR FUTURE’

Talk of investment and cryptocurrency can come as early as a few days into the conversation or after months, perhaps depending on the scammer’s patience.

In divorcee Samantha’s case, Zi Ming slipped it in subtly as they chatted. Every now and then he said he needed to go and make his cryptocurrency deals and resumed chatting later.

It was two weeks before he first invited her to invest on the platform he used — just a little, maybe US$1,000. And when she refused, he let it go.

“We got into a fight and didn’t (chat) for a day,” she said. “Then he came back and told me: ‘I’m not made for cold wars.’

“He came up with all these statements and words that softened my heart.”

Listen: Samantha on how Zi Ming pressured her to start investing

As for Kayla, who is in her early 30s, Linus told her how he was investing to “earn enough money … so (she wouldn’t) need to work”. His favourite phrase was “for our future”, she recalled.

“I want to bring you into (this investment) because you’re someone I love,” she quoted him as saying.

But don’t tell anyone else. I don’t want other people to know how we make money.

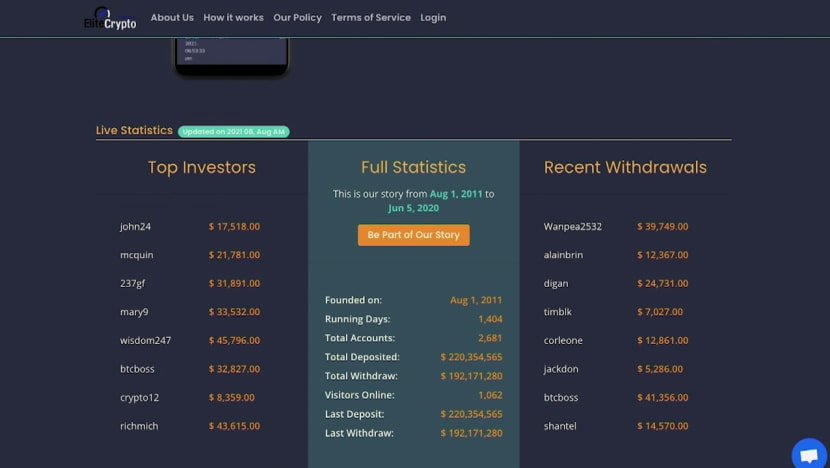

The scammers’ stories — and the expertise they showed — fooled even seasoned investors. Take, for example, Sajid, whose cryptocurrency portfolio had grown to eight times what it initially was.

When the Canadian met Nydia online, she told him she had developed a trading system that was about 80 per cent accurate, and the way she explained it, using game theory, “made sense to him”.

In their own words: Victims' stories

Eliza, too, was no greenhorn, in her words. She had been investing for 20 years, and when she started chatting with Andy, he impressed her with his knowledge of the stocks she talked about. “He was actually getting it right,” she said.

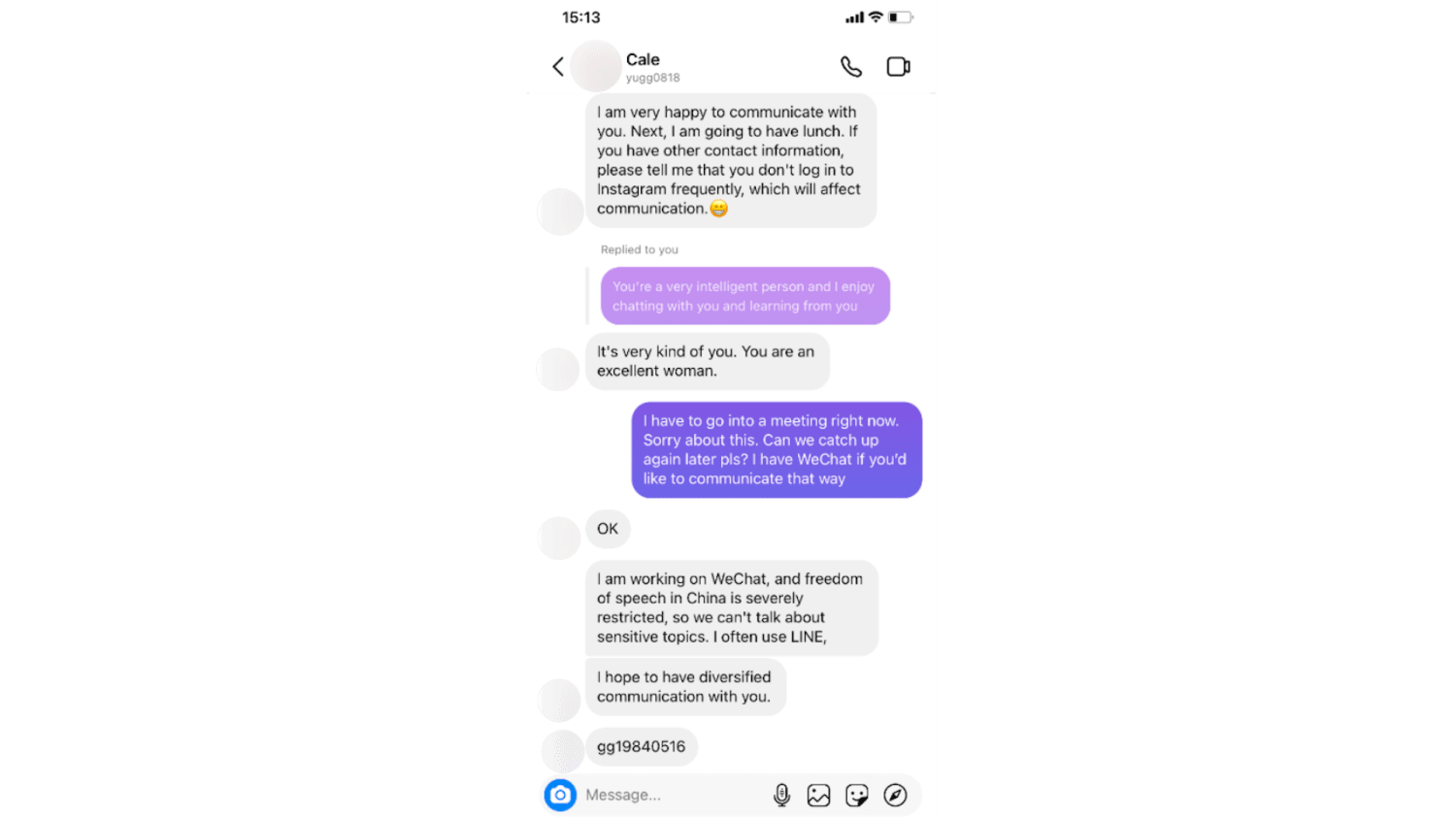

Financial consultant Kelly*, meanwhile, remembered being suspicious when the man she was talking to — after they’d connected on Instagram — asked her to try out a new platform.

The URL was gibberish, like what “a child (might be) typing on a keyboard”, she recalled.

“But he assured me it was fine,” she said. He suggested investing “a small amount first”, so she put in S$500.

She made a 10 per cent profit and was able to deposit the money in her bank account.

Then she put in S$2,000. Again, she was able to take it out with a similar profit. This gave her the confidence to believe the platform was above board, aside from the fact that the profits she saw on the platform were similar to those on her other legitimate investments.

In fact, all the victims CNA Insider spoke to were able to successfully withdraw their money as Kelly did, and sometimes it was even the scammers who encouraged them to do so.

‘A LOT OF EXCUSES’

The problems started when they put in more money.

Kelly’s money was not deposited into her bank account the third time she tried it. Worried, she approached the platform’s customer service for help. She was told her bank account details were wrong, so she keyed in the number again.

But the money was still not credited. She was told her account had lost credibility and that she needed to put in an equivalent amount of money to take it out. She complied.

When she tried to make a withdrawal again, the customer service asked for another top-up. “I’ve never heard of such (rules) before, anywhere in the world,” she said.

She realised it was a scam and had lost S$15,000 by then. “In a panic (trying) to get the money back, I’d thrown all logic out of the window,” she said.

Other victims cited similar experiences of the never-ending top-ups required of them.

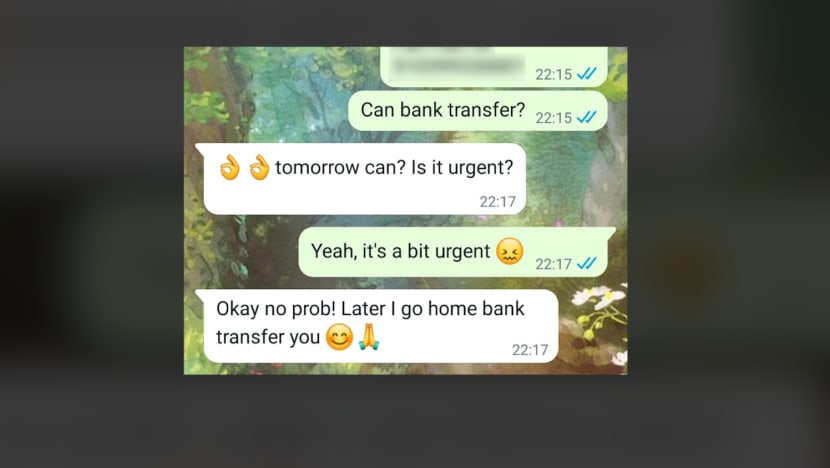

Han Ni, who was persuaded to invest in a “game” platform, had her account frozen for “violating a rule”. To reactivate it, she was told to put in half the amount she had in there: About S$35,000.

Then she had to put in another S$10,000 for “outstanding tax”. “Every time I contacted the customer service, they made a lot of excuses,” she said. “They were very formal and polite, but they kept repeating the same things.”

She remembers one time they said their system was down. Then they said they were processing many clients and her queue number was 986.

“You could get into the VIP green lane to (jump) the queue,” she recalled being told. But she would need to pay another S$10,000. “I felt like I’d put too much money in, so I decided to wait."

The next day, her queue number was 983.

THE SHOCK AND AFTERMATH

That's when she realised, with a shock, that she had already put in S$70,000 — and it was increasingly clear to her that it was a scam.

She had wiped out her savings and had borrowed about S$40,000 from her friends because of Chen Xi’s urgings. He even coached her on how to ask them for money.

“I had to start … again (from scratch),” said Han Ni, who now works two part-time jobs to pay her friends back and feels “so guilty” when having a meal. “If I have money to (buy food), then I should pay all the money back.”

For Kayla, the blowback also continued after she lost S$50,000 to 'Linus'. During their relationship, he had requested intimate photos and videos of her — and a day after she cut off contact with him, someone messaged her on WeChat threatening to forward the photos and videos to her friends.

She ignored him and deleted her social media accounts. “What can I do? Because of this, I end my life?” she questioned. “It’s very stupid.”

As for Kelly, after losing S$15,000, the financial consultant lost self-confidence in her professional skills. She also became wary of strangers approaching her on Instagram.

And yet — her vulnerabilities were what another acquaintance on social media used to scam her again. While she was contemplating leaving her job, he came across as "very supportive”, she recalled, and they continued to chat

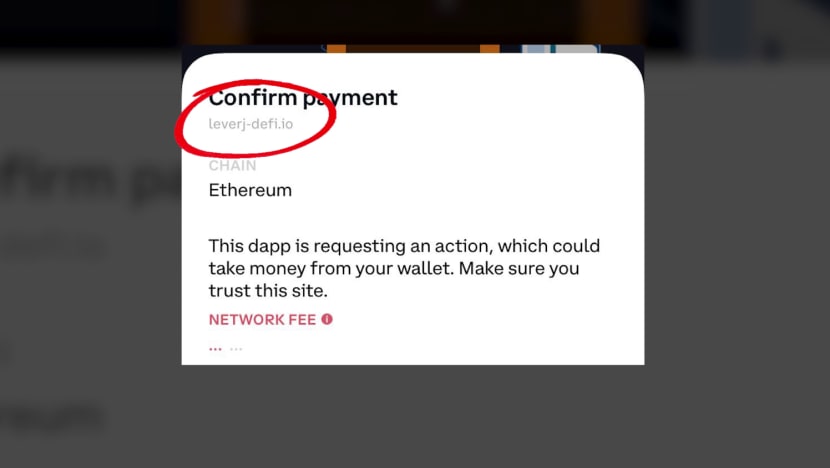

For over two months, he did not bring up investing. When he finally did, “I thought I was smarter this time round and did my checks,” she said. The apps and crypto exchanges he had recommended were in the App Store and Google Play Store, and she googled them to confirm their legitimacy.

He also gave her the URL for a mining website to link to her crypto wallet, and her initial search on this turned up nothing.

But this turned out to be the scam — which she only discovered after putting S$24,000 into her wallet and it vanished. After that, she could not function for a week, she recalled.

She couldn't bear to share what happened with anyone. She was eventually diagnosed with depression. She has also since left her job and now works in a different industry.

Watch: How I Got Scammed Twice: Love Scammers' Tactics You Need To Know (6.41)

LIES IN A MARRIAGE

The scams also claim casualties beyond those directly targeted. Victims are encouraged to borrow money from friends, as Han Ni was — and so others get sucked in too.

Jane* remembers when her husband, John*, who is in the financial sector, got caught up in a client’s love scam in 2018. The client, a close friend, wanted to borrow money to release a parcel purportedly stuck at Customs and filled with gold. She promised him 6 per cent of what she would get.

By the time he stopped transferring money to the scammers, he was S$1.2 million out of pocket.

Jane remembers the horror she felt when she discovered him borrowing money from a mutual friend. “We had more than S$600,000 in our bank account from selling our house, so why did he need money?” she recalled thinking.

He told her what had happened only after two to three days of questioning. The hardest part for her was dealing with the “trust issues” that emerged.

He promised to stop transferring money — but she had to transfer the money out of his bank account on his payday before he could give it to the scammers. It was a struggle she likened to playing “cat and mouse”.

“You realise you’re being lied to … many times,” she said. “So it wasn’t really (about) the loss of money but the trust, which money can’t buy.”

The thought of leaving him crossed her mind, but she recognised that “he was a good husband and father”. She realised divorce “wasn’t the way” and would not solve the underlying issue: He was not thinking straight this time.

“It started out (as) a bit of greed on his part, but it got to the point (where) he feared losing even more money if he didn’t make the transfers quickly,” she said.

“He felt that … giving (money) was the only way.”

Watch: I Fell For An Investment Scam: Here’s How They Tricked Me (12.30)

WHY EVEN SAVVY INVESTORS CAN BE SCAMMED

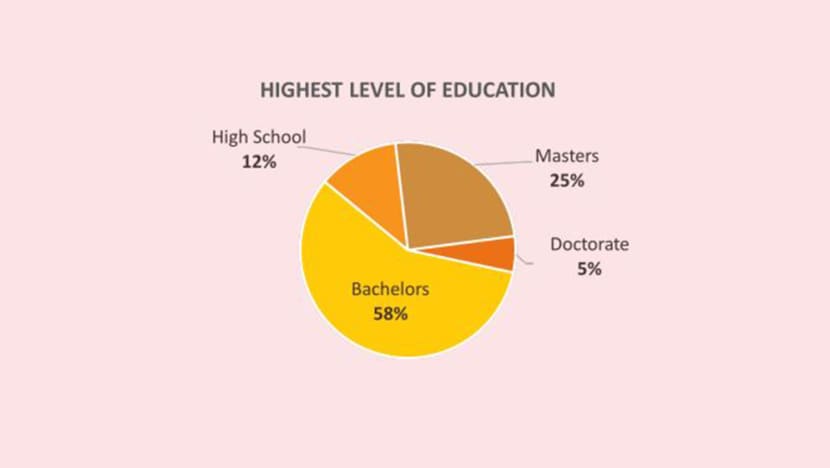

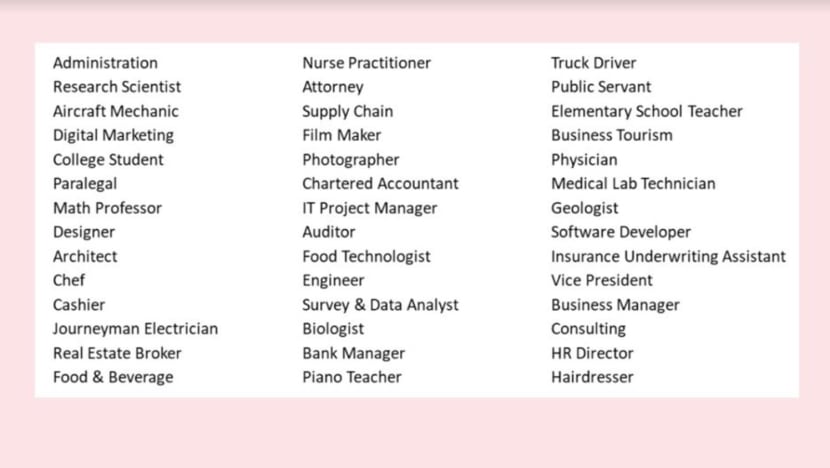

Are some people more vulnerable than others to this type of scam? According to a Gaso survey of 509 pig-butchering scam victims, they come from all walks of life, with nearly nine in 10 having at least a bachelor’s degree.

Sixty-six per cent of respondents were women, mostly in their late 20s to early 30s. Yuen stressed, however, that the survey was done on a voluntary basis and may not paint a fully representative picture of all victims.

SPF psychologists Misir and Lee Rong Cheng said scammers will try to target different scams at different groups; for example, more women may be targeted for love scams, while more men may be targeted for credit-for-sex scams.

“This doesn’t necessarily mean they’re then more vulnerable,” said Lee, a lead psychologist in the Police Psychological Services Department.

“It doesn’t matter who you are and what your background is,” added principal psychologist Misir.

“As long as the scammer is using the correct technique with you… technically, anyone can be persuaded.”

Mirroring. One of the persuasion techniques used to groom victims is mirroring. A scammer who knows a victim likes volunteer work, for example, will talk about being a volunteer.

“Or if (victims) value filial piety, (the scammers) will mimic the same thing,” Misir cited. “They’ll use this to induce a lot of liking in the grooming stage.”

Optimism bias. There are cognitive biases that scammers can leverage, like “optimism bias”, where people tend to think bad things are unlikely to happen to them — like being scammed.

Sunk cost fallacy. A scammer can also leverage what is known as the sunk cost fallacy — where victims may be asked to put small amounts of money into a scam, before a progression to more payments.

“(Victims) may think that if they (discontinue) what they’ve been doing, what they’ve put in would be wasted, so (they) might as well carry on,” Lee said. “This is something scammers are aware of and will nudge victims into doing.

Watch: How To Tell if You're Being Scammed: Love Scammers' Tactics Exposed (13.20)And if one is savvy about investing, this may actually work to one’s disadvantage, if scammers know to leverage that, Misir said.

“When they tell you something about investment, and you tell them you know about it … they can mirror (you) and follow up,” she cited.

“Scammers won’t give you some improbable number when they talk about a rate of return — they’ll tailor it to your experience … Then you’d say, ‘Oh, this sounds very believable’.”

Optimism bias also can happen, said Lee. “You may feel that because (you’re) so knowledgeable … it may be harder to fool (you).”

Why do some people get scammed more than once?

According to the psychologists, persuasion techniques and cognitive biases are “so inherent” in the way people process information, that scammers can leverage the same things — just framed or tailored differently.

This is not, they added, because these people are more gullible. “If you’ve been told your bank account has been frozen, that anxiety … doesn’t go away if someone tells me that the next time,” said Misir.

SPOTTING THE SIGNS OF A CON

Sophisticated as the scams may be, there are still several ways to spot them.

Common story tropes. When Samantha realised Zi Ming was a fraud, she wanted to know if scammers all worked in the same way. So she responded to one of the ‘Hi, beautiful’ messages she received on Instagram, to see what would happen.

“All the stories were the same, whether they were a Chinese, Korean or Caucasian man.”

For one thing, they often talked about earlier hardships they had suffered but overcome, and were now successful people, she cited.

Following that, they’d start talking about cryptocurrency. And they often had a lecturer they had worked with to come up with an algorithm to trade in cryptocurrency. “I wonder if they have a script,” Samantha remarked.

Watch: I Fell For A Love Scam: How They Made It Seem So Real (7.56)

No video call, no meeting. Another victim, Kim*, who lives in East Asia, said her scammer refused to do a video call. They had matched on Tinder, and she once tried to call him in the middle of chatting. He hung up immediately.

When she questioned him later, he made up some story about being on a video call with his ex-girlfriend once, which “caused her to (have) an accident on the road”. “She passed away, and (he) was very sad,” Kim related.

Kayla, meanwhile, recalled how Linus would say he could meet her but was never contactable close to the meeting. He would then reappear, apologise and say an urgent meeting came up.

“Never believe it,” she said. “They’ll never meet you.”

Scam platform red flags. While the platforms that scammers share with their victims can look realistic, Sajid highlighted several red flags as well, such as spelling or grammatical errors, particularly in the ticker or the site’s terms of service.

If the site has a 24-hour online customer service to communicate with customers needing to make a deposit or withdrawal, that is a “dead giveaway”.

Also, it is likely that the website is a recent one — less than a year old — so he suggests checking when its domain name was registered.

Friends and family members can help to raise a warning flag, too.

When nurse Han Ni attempted to borrow money from her friends, Chen Xi coached her to say simply that she needed it urgently. Most of the nine friends she borrowed from gave with no questions asked.

“I think it was because they trusted me,” she said. “A few asked me if something was wrong, but I just said I needed it urgently.”

One friend, however, missed her message that day. When he responded and asked probing questions — like whether she was in trouble and whether it was a scam — she had second thoughts.

“But … it was too late. I had already transferred the money,” she said. “If a lot of people had asked me (these questions), it would’ve made me pause and think twice before I went through with the investment.”

The two police psychologists highlighted the importance of taking “cognitive breaks” by stepping away from a situation.

“When something’s happening, and we’re engaged, it’s very easy to make all these decisions one after another,” said Misir. “But if you step back and check with a friend or family member, you lower your emotional involvement.”

Watch: Asia's Tinder Swindlers: Exposing Love Scam Rings In Cambodia (22.41)EX-VICTIMS FIGHTING BACK

These days, there is also help from Gaso, founded in July last year by a Singaporean victim of a relationship-investment scam. “Because of her experience, she wanted to prevent anyone else from going through the same thing she did,” said Yuen.

Most of its members were previously victims of pig-butchering scams.

Gaso, which runs online support groups for victims, hopes to raise awareness about such scams by posting victims’ stories online, together with information on what to do in such situations.

Gaso volunteers also do what is known as scam-baiting: They create fake social media profiles and reach out to potential love scammers. Once scammers send them a URL for an investment or mining platform, known as a black URL, it will be posted on Gaso’s website so people can do a Google search to check a URL’s legitimacy.

“There’s the revenge aspect of it, where they pretend the scammer is like their own scammer, and now they’re getting back at (scammers) by wasting their time,” said Yuen. Scam-baiting also helps Gaso understand scammers’ changing tactics, she pointed out.

Listen: When a 'victim' (who's a scambaiter) confronts their scammer (Source: GASO)

A translation of the conversation in Mandarin:

Victim: Baby, I want to ask you…The investment that you shared with me…

Scammer: Yeah, what’s up?

Victim: The bank actually called me. They told me that this was a scam, and they asked me not to transfer (money).

Scammer: (laughs) Why did they even say this was a scam? My uncle, with regards to this.. How should I put it, is more experienced than anyone.

Victim: But right now, because…

Scammer: My uncle is in this industry..

Victim: (The bank) has frozen all my accounts. They want to investigate.

Scammer: Frozen already? To investigate? This is really ridiculous. Think about it, I have been doing this for four years. The biggest amount I have withdrawn is one, two million (dollars). It’s probably because in Singapore, when it comes to such online investment, there are regional restrictions.

Kelly, who has become a Gaso volunteer and done some scam-baiting herself, says it has helped the healing process. “It helped me take a step back and realise that, actually, it could’ve been worse,” she said. “I didn’t borrow money from loan sharks, I didn’t have to sell my house … I can still have my meals.”

Through her work for Gaso, she has also realised the lengths to which scammers can go. “Our mindset is that ‘it’ll never be me; I’m not that stupid’,” she said. “But these scammers are trained, and everything you say to them is being analysed … And your profile has been studied.

Han Ni, meanwhile, is choosing to fight back by sharing her story publicly — even if she gets flamed. She explains that while she was going through her experience, “I suspected it was a scam, so I looked through the news but couldn’t find any cases that were similar to mine”.

“Now, I hope my story can alert other people. If I can reduce the (number of) victims by just one, I think it’s worth it.”

This is the second in a two-part special report on global pig-butchering scams by Southeast Asia-based syndicates. Read Part 1, on the elaborate setup of a scam headquarters, here.

Watch the Talking Point episode here.