As China touts openness in latest policy signals, is rhetoric truly matching reality for foreign firms?

Most foreign firms CNA spoke to are forging ahead with long-term business plans in the country, including expansion. Analysts say this reflects China's enduring weight in the world economy.

Visitors attend the 8th China International Import Expo (CIIE) in Shanghai on Nov 7, 2025. (Photo: AFP/Hector Retamal)

This audio is generated by an AI tool.

SHANGHAI: To doTERRA’s China president Owen Messick, the Trump-Xi summit in late October was nothing short of “a very big breakthrough” - a signal of much-needed stability after tariff shocks sent costs soaring and left the American essential oil maker struggling to keep products in stock.

Despite a bruising year of volatility, the firm is accelerating localisation, expanding its Shanghai research and development centre and looking to source more ingredients domestically.

“Every business wants the same thing. They want stability. They want to be able to plan for the future,” Messick told CNA.

A tariff truce, Beijing’s fresh development blueprint and renewed openness messaging have given foreign companies a sharper sense of policy direction - a cautious optimism that executives repeatedly voiced to CNA across exhibition halls and corporate offices in Shanghai.

Yet many have also described how realities on the ground have not fully caught up with the rhetoric, with regulatory hurdles, uneven implementation and uncertainty over how durable the current calm will be all weighing on everyday business.

“Most companies are just continuing (their) current plans,” Cameron Johnson, senior partner at Shanghai consultancy Tidalwave Solutions, told CNA.

“They’re not taking away stuff, but they’re not adding stuff, because … the global market, especially, is uncertain.”

The wildcard, he said, remains the US tariffs. “If the tariff rates are gonna be here for a long time, then you have to plan to move forward. If not, then you have to revamp,” he said.

SIGNALLING STABILITY

Foreign firms in China have spent much of the year operating in a climate of heightened volatility.

United States President Donald Trump took office in January, reigniting trade frictions with Beijing that at one point saw both sides ratcheting up tariffs to crippling levels in excess of 100 per cent.

While duties were later dialled down through an uneasy trade truce, the escalation sent costs rising across global supply chains and left companies grappling with an unpredictable policy environment.

A confluence of political signals and policy developments on both sides in recent weeks has thus stood out against this backdrop.

In late October, China’s political elite endorsed the country’s 15th Five-Year Plan (2026 to 2030), outlining a continued pursuit of opening up while simultaneously pushing for greater self-reliance and high-quality growth.

“Many multinational companies tell us that investing in China is not optional, but a must,” Chinese Commerce Minister Wang Wentao said in a press conference on Oct 24.

A similar refrain emerged less than two weeks later at the 8th China International Import Expo (CIIE) in Shanghai.

In his opening address on Nov 5, Premier Li Qiang called the expo “an entry point for the world economy into China and an important bridge linking China with the world”, describing openness and cooperation as “the golden keys to development and prosperity”.

In between the two events, the Busan summit on Oct 30 between Trump and Chinese President Xi Jinping - their first face-to-face meeting in six years - delivered an easing in Sino-US trade tensions.

Washington agreed to halve levies tied to fentanyl-related precursor chemicals, cutting the overall US tariff burden on Chinese imports to about 47 per cent from 57 per cent, according to US officials. Both sides also paused their most recent export-control actions.

FOREIGN FIRMS CAUTIOUSLY OPTIMISTIC

Foreign businesses operating in China have painted a mood of measured optimism over Beijing’s renewed rhetoric on openness, alongside the stabilisation of Sino-US relations.

The latest five-year plan, which promises fair competition and integration, gives “a lot of confidence for Singapore companies”, said Soo Wei-Chieh, executive director for international business at the Singapore Business Federation (SBF).

Speaking to CNA at the CIIE, Soo added that it reflects a commitment towards a more open and inclusive business-friendly environment.

“We all can do with more certainty,” he said.

Singapore has been a participant in the CIIE since the event’s debut in 2018, and this year it fielded 57 companies - one of its largest delegations since the pandemic.

The turnout, said Soo, reflects the “enduring interest” of Singapore companies in China, even as firms weigh the risks and regulatory uncertainties that shape operating decisions.

According to an SBF survey, China is the third-largest overseas market for Singapore businesses after Malaysia and Indonesia.

Across the expo, smaller economies were looking for similar tailwinds.

Lucky Million Elephants, an import-export manufacturer from Laos, has been using the CIIE to showcase the country, said its China general manager Ran Manjun.

The China-Laos Railway, she noted, has cut transport time and costs, making Lao products and tourism more visible to Chinese consumers.

“There’s still a vast market waiting to be explored,” she said, while acknowledging the pressure to raise service and product standards as more players enter the market.

Other foreign firms at the expo touched on the easing of US-China tensions following the Trump-Xi summit.

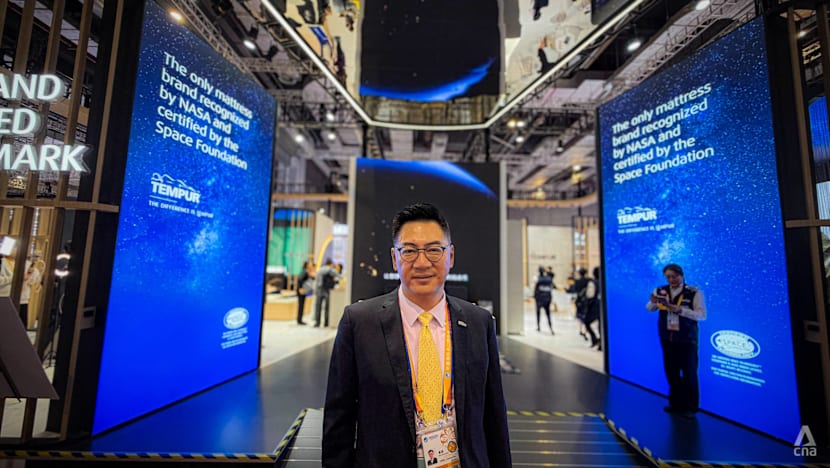

It is a “very good signal” for the business environment, said David Yuen, the managing director of Danish sleep-technology company Tempur’s China operations.

Since first entering China in 2009, Tempur has expanded into more than 100 cities, with hundreds of stores and a China-specific line that’s assembled locally to match domestic preferences.

“For international brands like ours, the Chinese market as a whole has always maintained a very open attitude … whether in terms of regulation or government support, the policies are actually quite strong,” Yuen said.

“On a regular basis, district-level governments or neighbourhood offices come to visit enterprises, learn about our situation,” Yuen added.

“The market here is huge,” he told CNA, adding that a “long road of growth” lies ahead in the high-end and light-luxury segments.

Consumer-facing brands echoed that sense of opportunity.

At suns Singapore, a lifestyle brand inspired by Peranakan culture, head of jewellery design Liu Zilong said purchasing power has risen steadily over the past three years.

“My feeling is that the consumption capacity and purchasing power here are getting stronger,” she told CNA.

The brand’s Peranakan-inspired jewellery now draws consistent interest, according to Liu. “People really recognise our designs and the cultural elements of our brand,” she said.

RHETORIC VS REALITY

Yet for some firms, optimism is tempered by the realities of doing business on the ground.

Soo from SBF highlighted how regulatory questions around digital rules, intellectual property protection and profit repatriation continue to surface. The federation regularly relays feedback from Singaporean firms through its policy advocacy channels.

“Opportunities always come with a certain amount of risks,” he said.

For others, the barriers are starker. In medical technology companies, market entry can lag for years.

Benny Hagag, vice-president of global strategic development at Insightec, a global medical-technology company known for its MRI-guided focused ultrasound treatments, was explicit.

“We believe that if the regulatory landscape was a bit easier and more direct, it would have been easier for us to work, expand and accelerate,” he told CNA. The company has had a sales office in China for “many years”, according to Hagag.

Hagag noted how China does not accept US Food and Drug Administration or European Union approvals for medical tech products, meaning companies must go through a separate review process by Chinese regulators.

This requires “very significant” investment, Hagag said. “We are almost a generation behind on the technology itself because of it,” he said, adding that treatments cleared in the US or Europe “are going to take another three years” to reach China.

Still, Insightec’s long-term calculus regarding China has not changed.

Hagag pointed to the company’s joint venture with Chinese pharmaceutical giant Fosun Pharma two years ago. “Millions. We invested millions in the business,” he said.

The company’s China strategy is centred on localisation: “It’s about thinking about what is right for China - how do we build the product, the solution, and the delivery for the Chinese patient,” Hagag said.

For some companies, tariffs remain a direct operational strain. Singapore-based Three Star Brand, which makes medicated oil, has long relied on Chinese distributors. But higher import costs have squeezed margins.

“Ingredients, especially ingredients and boxes … will be about 20 to 30 per cent higher,” Loh Wei Ze, a marketing manager at Three Star Brand, told CNA.

“This eats into our margin, definitely,” Loh said, highlighting that the firm’s products are priced at around S$5 (US$3.80).

Still, the sheer scale of China’s 1.4-billion-strong consumer base keeps the company returning, Loh acknowledged.

BANKING ON CONTINUITY

Analysts said that rain or shine, continuity in China is still the guiding principle for foreign companies, whether they are already rooted in China or looking to scale internationally.

“To isolate China from the rest of the world is almost impossible. China already accounts for close to 20 per cent of the global economy,” said G Bin Zhao, founding chairman of the Global CEO Institute, an executive training and business strategy think tank.

The US-China trade war over the past few years, he added, has only reinforced that point.

“The cost of decoupling is extremely high - for everyone.”

Johnson from Tidalwave Solutions echoed this view. “If you’re not in China as a foreign firm, you really are not a player in global markets,” he said.

According to him, executives are watching two cues: whether the US or Europe slips into recession, and whether tariffs become permanent.

It’s no longer enough to simply sell into China - global firms have to keep pace with how fast local players evolve, he added.

“A lot of foreign firms come here to learn from Chinese competition,” he said. “They’re here to take advantage of ecosystems, to learn what the next-generation technology or consumer preference can be.”

Domestic competition is forcing global reinvention: Volkswagen is developing an artificial intelligence chip in China to power its locally made smart cars; Starbucks had to overhaul its digital operations after coffee chain rival Luckin reshaped the market.

“China is really starting to force some of that innovation … globally,” Johnson said.

Analysts said that China is likely to continue opening its economy to foreign businesses - but at its own pace and on its own terms.

“China’s current import-export policy no longer focuses solely on promoting low-cost exports, as in previous decades,” said Huang Qifan, former Chongqing mayor and an outspoken economic strategist, at the 2025 Singapore-China Business Forum held on Nov 7 in Shanghai.

“We now encourage both exports and imports.”

The latest edition of the World Openness Report - jointly compiled and published annually by two state-affiliated think tanks - showed China’s score rising incrementally by 0.5 per cent compared to the previous year, while the World Openness Index drifted downwards by 0.05 percent year-on-year.

China continued to rank 38 out of the 129 economies tracked, and its score places it “among the world’s most open jurisdictions”, the report stated.

Singapore placed first, followed by Hong Kong and Ireland. The United States ranked 27th. The index measures openness through indicators ranging from tariffs and investment to immigration and tourism.

“The world’s openness will rely more on emerging forces in the future,” said Liao Fan, director of the Chinese Academy of Social Sciences’ Institute of World Economics and Politics, at the conference unveiling the report.

According to the latest data from the General Administration of Customs, China’s imports rose 1.4 per cent in October, the fifth straight month of expansion.

“In the past, foreign investment was encouraged in visible sectors - manufacturing, real estate, retail,” Huang, the economic strategist, said.

“But in the last decade, under a strategy of comprehensive, multi-channel openness, China has greatly expanded access in services, education, healthcare, culture, and finance.”

At the same time, structural limits remain.

China’s trade surplus is unlikely to reverse, said Zhao from the Global CEO Institute, adding that the country is “not yet a wealthy nation” and therefore cannot rely on borrowing to support consumption.

“Even looking toward 2035 and beyond, China will still maintain a trade surplus position,” he said. “Perhaps the gap will narrow somewhat, but in the long run, China will not import more than it exports.”

China’s persistent surplus has become a renewed flashpoint with the West, stirring warnings that weak domestic demand and export-oriented industrial policies could trigger a “China shock 2.0” - a wave of Chinese goods that displaces workers and squeezes manufacturers abroad.

In the meantime, foreign firms are pressing on, adapting their strategies to the market realities of the world’s No 2 economy.

At doTERRA, senior executive Messick said that despite tariff shocks and supply shortages, the company’s leadership keeps sourcing more locally, investing more deeply and building long-term infrastructure.

“We hope that continues,” Messick said of China’s pro-investment policies.

China understands that its modern growth has been driven by reform and opening, said Global CEO Institute’s Zhao. “This has been the greatest source of its expansion,” he said.

“That is why … (China) must continue to adhere to opening up … this is not only an economic necessity in the short term; more importantly, it is a strategic need for achieving (its) 2035 goals.”

Huang, the former Chongqing mayor, put it more simply.

“China’s door to the world will not close,” he said. “It will only open wider - and with higher-level, deeper and broader openness.”