analysis East Asia

As Xi meets top bosses like Jack Ma, what’s next for China’s tech sector amid US trade tensions?

Business magnates from the likes of Alibaba, Huawei, Xiaomi, BYD, and CATL joined President Xi Jinping's high-level meeting. Their presence underscores China’s emphasis on tech-driven economic growth.

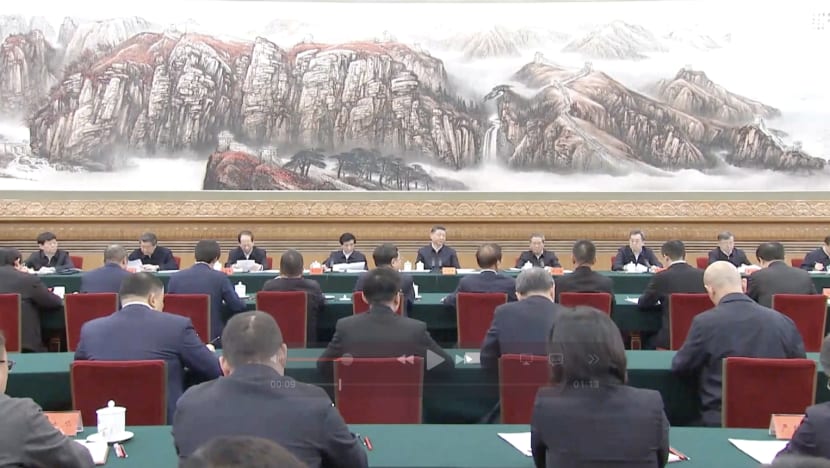

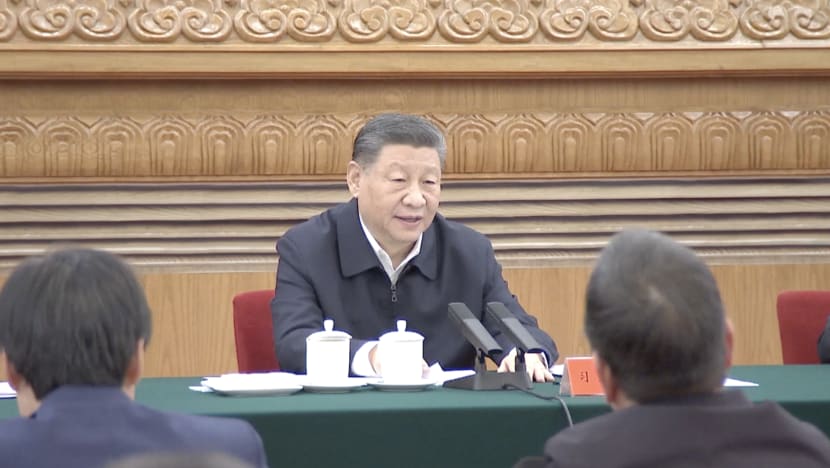

Chinese President Xi Jinping brought together the heads of leading businesses, including Alibaba co-founder Jack Ma, for the first time since 2018. (Photo: CCTV Plus)

This audio is generated by an AI tool.

SINGAPORE: Heightened private investment, expanded government funding and a more supportive regulatory landscape - these are what analysts expect for China’s tech sector, following a rare gathering between the country’s top leaders and private business luminaries.

The closely-watched event on Monday (Feb 17) effectively signals the end of a years-long tech crackdown and a possible “fresh start” for the industry, they further note, as Beijing looks to tech to bolster its economy against domestic headwinds and a second Donald Trump presidency in the United States.

Observers highlight how Alibaba co-founder Jack Ma - once seen as a cautionary example of how Beijing would clamp down on over-mighty tech giants - had a seat at the table, suggesting a shift in tone as the world’s No 2 economy strives to revitalise entrepreneurial confidence.

“Having this huge event where Jack Ma attended is big news because it's a signal to the market, hopefully, that maybe it's okay to try to be rich again and try to innovate,” Shaun Rein, founder and managing director of China Market Research Group (CMR), told CNA.

Analysts expect further clarity on China’s private sector strategy to emerge next month at the annual two sessions - the meetings of the country’s top legislature and political advisory body.

PROMOTING PRIVATE ENTERPRISE

Held at the Great Hall of the People in Beijing, the private sector symposium on Monday was attended by President Xi Jinping, with leading Chinese entrepreneurs present.

The attendance list included some of the biggest names in China’s technology sector - such as Ma, Lei Jun (founder and CEO of Xiaomi), Pony Ma (founder and CEO of Tencent), Wang Chuanfu (founder and CEO of electric carmaker BYD), and Ren Zhengfei (founder and CEO of Huawei).

Other business figures present included Zeng Yuqun (founder and chairman of battery giant CATL), Leng Youbin (chairman and CEO of baby milk formula supplier Feihe), Wang Xingxing, (founder of robotics firm Unitree) and Yu Renrong (founder and chairman of Will Semiconductor), as seen in footage from the meeting broadcast by state outlet CCTV.

According to state news agency Xinhua, the Chinese leader urged efforts to promote the healthy and high-quality development of the country's private sector.

“The private sector enjoys broad prospects and great potential on the new journey in the new era. It is a prime time for private enterprises and entrepreneurs to give full play to their capabilities,” Xinhua reported Xi as saying.

“The symposium sends a clear message: Beijing recognises that a strong private sector is essential to economic stability and technological leadership,” Marina Zhang, an associate professor at the University of Technology Sydney’s (UTS) Australia-China Relations Institute, told CNA.

Rein, who also authored a book called The Split: Finding the Opportunities in China's Economy in the New World Order, described the symposium as “momentous” and “huge”.

“Some people are calling it the ‘Southern Tour 2.0’,” said Rein, referencing the 1992 eponymous tour of southern China by then paramount leader Deng Xiaoping that revived market reforms.

“Importantly, it’s a signal that the Chinese government wants China’s private tech sector to develop again.”

Analysts noted the timing of the event - coming as China faces an array of domestic and external challenges.

On the home front, issues like slowing growth, weak consumer spending and an ageing population weigh heavily. Beyond its borders, the prospect of a renewed trade war with the US looms ever larger.

Xi first chaired a high-profile symposium for the private sector in late 2018, as trade tensions with the US boiled over into tit-for-tat tariffs. At the time, he pledged tax cuts and a level playing field while reaffirming that private companies would have access to financial backing.

Guo Shan, a partner at Hutong Research, said drawing private entrepreneurs back into the fold is crucial for economic momentum.

“Now, in this trade war 2.0, it’s very important for the president to meet with the private sector and (bolster its) confidence in China’s economy,” she told CNA.

According to UTS’ Zhang, the state is signalling a willingness to reset relations with the private sector by convening this symposium and directly engaging with major business leaders.

She added that it signals a “dual focus” in high-tech innovation, especially in hardware and AI, and broader private-sector economic activity.

“This aligns with Beijing’s evolving strategy of shifting away from consumer internet dominance toward deep tech, advanced manufacturing, and supply chain security.”

“FRESH START” FOR TECH?

Experts broadly read the symposium as a turning point in the state’s approach to private enterprise - especially in tech, where large firms have long been eyed with both admiration and suspicion.

They pointed out how Ma, the co-founder of Alibaba, was present at the meeting. In October 2020, he publicly criticised regulators, setting off a sweeping crackdown on China Inc that largely targeted the tech sector, curbing monopolies, unfair competition and data abuse.

For Ma, it resulted in the abrupt suspension of his Ant Group initial public offering. In the wake of that move, the tech magnate ceased making public appearances and refrained from commenting on major developments at Alibaba or Ant Group.

Although there were periodic reports of his activities - such as short video messages and sightings abroad - he effectively avoided mainstream events and conferences.

Other Chinese enterprises also saw their fortunes hit. Major food delivery platform Meituan was fined by antitrust regulators in 2021 for alleged monopolistic practices and ordered to improve protections for delivery workers.

That same year, China’s antitrust watchdog also blocked Tencent’s US$5.3 billion merger of game streamers Huya and Douyu in a landmark anti-monopoly case.

But signs of relaxation came a year later.

At a May 2022 meeting convened by China’s top political advisory body, the Chinese People’s Political Consultative Conference, then vice premier Liu He offered explicit assurances to tech companies.

He expressed support for their plans to list shares both at home and abroad, and underscored the need to bolster the platform economy and ensure its stable growth.

Hutong Research’s Guo views Ma’s attendance as proof that official objectives have been largely met. The proposed rules were meant to prevent and stop monopolistic behaviour in the platform economy, guide operators to operate in compliance with laws and regulations, and promote the sustainable and healthy development of the online economy.

“The market was just waiting for a signal to confirm that this completion is over, and finally, the tech companies can have a fresh start,” she said.

“I do think that the attendance of Jack Ma in this meeting marks a new start.”

CMR’s Rein believes the crackdown initially curbed monopolistic practices but went too far in shaking investor confidence.

“I actually agreed with the crackdown on Alibaba and Tencent in 2020, because (they) were basically a duopoly, and they stifled competition and innovation," he said.

“I just think that it cut a little too far to the bone and the government didn't explain to the international investor community enough (as to) why the crackdown.”

Zhang suggests that although Ma’s presence underscores a softer line, Beijing remains watchful. Ma did not speak at the event, according to a report by state news agency Xinhua.

“Jack Ma’s attendance does not necessarily indicate a full-scale reversal (in the government’s regulatory stance) … but it does suggest a softening of the once-harsh restrictions.”

“His presence is largely symbolic … rather than marking the end of tech sector scrutiny, his reappearance suggests that Beijing is pivoting from crackdowns to controlled engagement - likely as a means of rebuilding economic momentum while maintaining regulatory oversight.”

In his symposium speech, Xi stressed the adherence to “honest and law-abiding operations” and urged enterprises to “establish correct values and morals, and promote the healthy development of the private economy with practical actions”, Xinhua reported.

Zhang sees Ma’s appearance partly as a move by Beijing to show it can “engage with big tech firms despite past conflicts”, but notes that the absence of Baidu and Didi “sends an ambiguous message”.

“It is unclear whether they were deliberately excluded or if their absence reflects ongoing regulatory concerns.”

Similar to the 2018 meeting, the Monday symposium was attended by Xi and three other members of the apex Politburo Standing Committee - Premier Li Qiang, Wang Huning, head of China’s top political advisory body, and Vice Premier Ding Xuexiang.

The presence of top leaders could be a way to “assert party control over the private sector”, suggested Zhang.

“(It possibly reinforces) the message that while the private sector remains a critical pillar of China’s economic ambitions, it must align with national priorities - including self-reliance in key technologies and strategic industries.”

ASSESSING CHINA’S MOVES

CMR’s Rein predicts that the symposium’s signals will “cause the equity market to go up again,” bolstering confidence in both China’s A-shares and Hong Kong equities.

He pointed out that some international investors now view America as “too frothy”, while India has “dropped 20 per cent” in the last couple of weeks. This has prompted them to ask: “Where are we gonna go? Let's put money back into China,” Rein said.

Rein believes this shift is “creating excitement within China again”, as entrepreneurs sense that they can overcome “crippling” sanctions from the US and export bans, and make money.

Meanwhile, Guo cited DeepSeek - a tech success story predating the symposium - as proof that central policies and private innovation can go hand in hand, framing it as “a lot of work” from both the private sector and from central policies over the past few years.

The event aimed to reassure entrepreneurs “that more support to the tech sector will come”, not only on the supply side but also on the demand side, she added.

Pointing to Xiaomi, Tencent, BYD, and Huawei, Guo underlined that “it’s consumption that provides revenue to these companies and helps the Chinese companies to advance”.

Still, Zhang from UTS cautioned that state priorities around data security, antitrust enforcement, and digital assets remain.

“Recently, the government has been tightening regulations in the tech industry … this event could signal a recalibration of industrial policies - balancing market incentives with strategic national goals.”

Despite positive signals of a warming stance, analysts do not expect any immediate overhaul of existing policies.

Deeper collaboration between private firms and state-owned enterprises will take time, CMR’s Rein noted.

“What I hope is there’s gonna be collaboration between the private sector and state-owned enterprises, and that’ll be concrete,” he said.

“Second, I hope that there’s gonna be more money raised to be given to those sectors. I don’t think there’s concrete stuff. It’s more a signal to everybody to go out and invest, go out and innovate.”

He pointed out that the Chinese government already eased off on the tech crackdown a year ago, and began enacting regulatory reforms to support the sector.

“It’s just nobody believed it. That’s the problem … (people) needed a signal more than concrete actions.”

Analysts agree that the upcoming meetings of China’s legislature and top advisory body in March - known as lianghui in Chinese - will likely provide a better sense of Beijing’s strategy.

Lianghui would be more about stimulus size and sector examples, remarked Guo from Hutong Research.

Meanwhile, Rein expects “more concrete measures” to be announced during lianghui to bolster the tech sector as well as “incremental, targeted stimulus measures”.

“China faces a confidence problem, not a money supply one, so measures will help build confidence among entrepreneurs, businesspeople and investors that the government supports the tech and private sector as drivers for growth.”