JB set to see new and upgraded shopping malls cashing in on RTS Link, but some are concerned

Shopping malls in Johor Bahru city centre are being built or undergoing facelifts ahead of the RTS Link being operational in a year. However, will there be enough sustained footfall for them to survive long-term?

Johor Bahru City Square mall is undergoing a multi-phase transformation which is set to be completed in the fourth quarter of 2027. (Photo: CNA/Zamzahuri Abas)

This audio is generated by an AI tool.

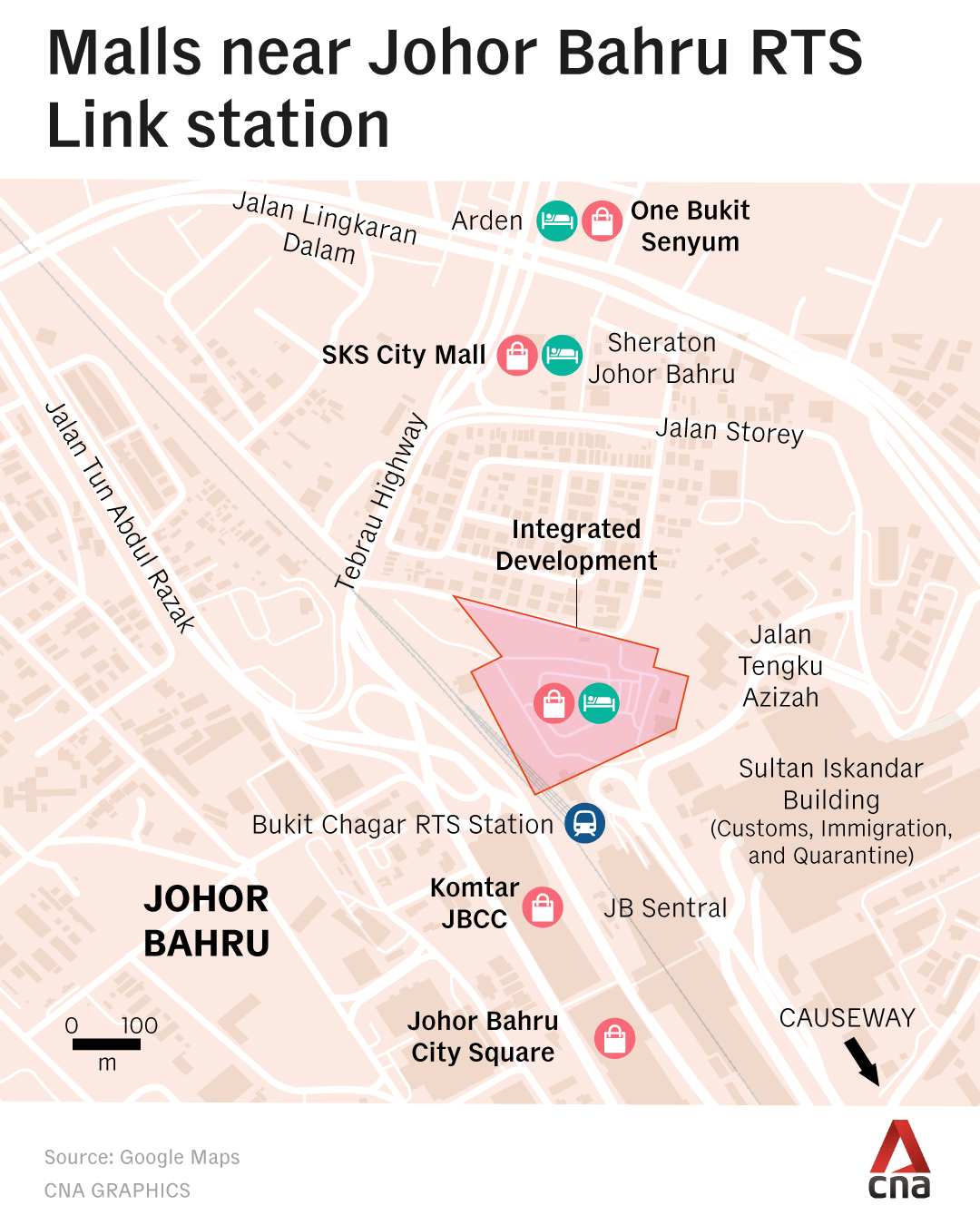

JOHOR BAHRU: The landscape around downtown Johor Bahru looks set to transform in the near future with a slew of high-rise shopping malls - which are integrated with hotels and apartments - opening or undergoing facelifts ahead of the Johor-Singapore Rapid Transit System (RTS) Link starting operations by early 2027.

Johor Bahru City Square mall, a popular hotspot for Singaporeans, is going through a major redevelopment and expansion to include a hotel.

New shopping centres opening soon include the likes of SKS City Mall - adjoined to the newly opened upscale hotel Sheraton Johor Bahru - and the One Bukit Senyum (OBS) Mall, which will be adjacent to the upcoming high-rise condominium project Arden@One Bukit Senyum.

Experts told CNA that these retailers are targeting the anticipated increase in visitors from Singapore due to the RTS Link, with the new rail service seen as a critical factor that could propel the southern Malaysian city into a retail resurgence.

The RTS Link, which is set to be operational from January 2027, will connect Singapore’s Woodlands North station to Johor’s Bukit Chagar station and ferry up to 10,000 passengers an hour each way.

Singaporean Winston Chew, who visits Johor Bahru to shop for household items around once a month, told CNA that the increase in retail options “can only be a good thing for visitors”.

“More malls near the town area is good because next time when the RTS (Link) is ready, we can just walk (from the station) to these malls, do our shopping, and be on our way home,” added the 42-year-old, who spoke to CNA at Johor Bahru City Square mall last Monday (Nov 10) as he was purchasing a screen protector for his phone.

According to a report released by Maybank Investment Bank in October, Johor is rapidly emerging as a premier retail and industrial hub - driven by catalysts such as the RTS Link and continued spending by Singaporean visitors capitalising on a favourable exchange rate.

The report added that Johor retail assets are poised to benefit from “sustained tenant demand” and “potential valuation uplift”.

However, with the expected increase in the scale of passenger traffic and higher concentration of shopping options in Johor Bahru’s already dense city centre, local residents have flagged concerns that traffic congestion in the small lanes around the vicinity could worsen, along with the availability of parking.

Some residents and observers have also raised questions about these malls’ long-term viability, given that several others in the vicinity - such as Danga City Mall, JB Waterfront Mall and Pacific Mall - had failed to take off in the past.

Nanthakumar Loganathan, a tourism and business expert from Universiti Teknologi Malaysia (UTM), said that the area near the RTS Link serves as a key transit point for commuters, and it should not be too saturated with “huge malls” that could lead to traffic bottlenecks.

“Right now, this area needs to meet the basic needs of travellers who use the RTS Link, including Malaysians (who commute to Singapore daily for work),” said Loganathan.

“So there should be affordable food options, short-term accommodations, and not big shopping malls that could crowd the area and trigger traffic and parking issues,” he added.

RETAIL REVIVAL?

The new offerings at the revamped and upcoming malls in the city centre close to the RTS Link are targeted largely at Singaporean visitors who are in Johor Bahru for day trips or short-term stays, said experts.

Johor Bahru City Square’s facelift plans are set to include an expansion in retail space by around 22,000 sq ft - from around 547,000 sq ft to about 569,00 sq ft.

New additions include a new 15,000 sq ft Kids Adventure Park and integrated hotel apartments above the mall.

The mall, opened in 1999, has been a central retail landmark for Singaporean visitors as it is just a short walk away from the Johor Bahru-Singapore Causeway.

The mall’s owner Allgreen Properties, a member of the Kuok Group, said that the mall’s expansion is set to be completed in the fourth quarter of 2027. It added that the redevelopment will be rolled out in five phases, with the mall remaining operational throughout.

Another Singapore visitor who frequents Johor Bahru for shopping - Muhammad Muhaimin Jalal - told CNA that he is looking forward to the facelift as he believes Johor Bahru City Square is “lagging behind” some of the other newer malls like Mid Valley Southkey and Paradigm Mall which are about 15-minute drive away from the Causeway.

“I think (City Square) could do with a refresh - hopefully (add) more services like hair salons, kids' playgrounds, better unique restaurants,” said the 40-year-old civil servant.

“I think there is no point going to (international brand) retailers that have outlets in Singapore as the prices are more or less the same,” he added.

He said that malls near the RTS Link station like City Square and Komtar JBCC will appeal to visitors more soon because of their accessibility.

“If everything is in one mall, hopefully next time there’s no need to travel further away, you can just walk (to City Square) after getting down from (the) RTS Link,” he added.

Local small businesses are also looking forward to the opening of new malls in the area as they are hoping to reap the benefits of spillover business.

Over at the construction site for SKS City Mall near Jalan Storey, about 500m by foot from the RTS Link station, Manoj Nyana Segaran, a manager for a motorcycle repair shop, told CNA that he is optimistic that once completed, the mall would bring vibrancy to the area.

His shop is located across the road from the mall, with the adjoined Sheraton Hotel newly opened in October.

“Customers will come because they can park their bikes here for repair and head to the mall across the road to makan or shop,” said Manoj, using the Malay word for eat.

The SKS City Mall is slated to open next year and encompasses 280,000 sq ft across 4.5 floors, at the base of Sheraton Hotel tower.

Its retailers are set to include upscale supermarket Village Grocer, indoor children's playground Jungle Gym, local cookie chain All About Chew, as well as local restaurant chain Oriental Kopi.

Minimart owner Jamal Ibrahim, whose store is located across the road, told CNA that he has already seen business surge after the Sheraton Hotel opened in October.

“They (guests) would walk from the hotel to buy snacks because it is most likely cheaper here than ordering from the hotel directly,” said the 81-year-old whose minimart has been operating along Jalan Storey for 30 years.

Yet another mall opening in the area soon is One Bukit Senyum (OBS) Mall, which will be located at the junction of Jalan Tebrau and Jalan Lingkaran Dalam, about a 1km walk from the RTS Link station.

The mall’s developer Astaka Holdings described it as a “lifestyle retail” shopping centre. It will be part of a RM1.2 billion (US$290 million) mixed-use development alongside residential skyscraper Arden, and is expected to be completed by 2030.

In August, the developer inked an agreement appointing Singapore real estate giant CapitaLand Investment Limited as a retail adviser, covering asset planning, pre-opening and post-opening stages of the project.

However, Astaka Holdings did not disclose details on gross floor area or retailers expected at OBS Mall.

In addition, the Bukit Chagar RTS Link station itself is set to be a mixed-use development costing RM2.6 billion with a mall, hotel and apartments.

The 1.71-ha development, a public-private partnership between Malaysia’s Mass Rapid Transit Corporation (MRT Corp) and local conglomerate Sunway Group, is set to be built over about eight years.

Real estate consultant and urban planning analyst Tan Wee Tiam, who is executive director with Johor boutique firm Olive Tree, told CNA that the revamp of retail malls in the area and new malls coming up are an example of the “market moving in anticipation of the most disruptive cross-border connectivity upgrade Johor Bahru has ever seen” - the RTS Link.

“With the RTS set to go live soon, pedestrian traffic and urban vibrancy in the city core are expected to scale dramatically. As a result, footfall to JB will increase drastically,” said Tan, referring to the city by its popular acronym.

“This new gateway will effectively turn the surrounding district into a high-velocity catchment funnelling daily commuters, weekend explorers and international visitors into one highly concentrated urban node,” he added.

However, some mom and pop stores operating in malls have voiced concerns that they may be phased out as the developments undergo upgrades or seemingly target high-end retailers.

A pushcart retailer at City Square mall, who does eyebrow shaping and wanted to be known only as Lum, told CNA that following the mall’s redevelopment, she will no longer be able to operate there.

“I’ve been told to relocate, and likely have to find a new home,” said Lum, who has been operating in City Square mall for 20 years.

“I think I might move to KSL mall (located about 3km away in Taman Abad) but the foot traffic there is much less than here. It is also further from the RTS so likely fewer customers,” she added.

Salesperson Mira Muhammad Zahid, who works for another retailer which sells local perfume products on a pushcart in City Square mall, told CNA she is also unsure if the business will be permitted to operate again as the current lease expires in five months.

“It’s all uncertain now, we have to wait and see what happens,” she told CNA.

Retail expert Loganathan said that it will be unfortunate if such stores are no longer part of the malls in the prime area as they form the essence of Malaysia's retail scene and are something unique for Singapore visitors as they are “(of) high quality and more affordable”.

“Johor needs to integrate local products, culture, and attractive services for visitors. Building large malls that feature international brands is not advisable since Singaporeans do not come to Johor to (merely) buy branded goods and products,” he added.

WILL CONGESTION DAMPEN RETAIL POTENTIAL?

Meanwhile, locals have raised concerns that a higher concentration of malls in the city centre would worsen traffic jams and a lack of parking spaces.

In end-2024, the Johor state government identified 77 congestion hotspots in the greater JB area, with transportation committee chairman Fazli Salleh saying that it will be implementing measures to ensure that operations of the RTS Link station will bring economic, social and technological impact to the city.

A Johorean who works in Singapore and wanted to only be known as Low told CNA that the parking spaces in Johor Bahru city centre are already limited and he expects this issue to worsen with more malls opening up.

“It’s already difficult to get a (parking) lot at City Square mall or in the other public car park spaces, I think the issue is only likely to get worse,” said Low, who currently rides a motorcycle from his home in Skudai to the city centre, before taking public transport across the border.

Singaporean Muhammad Muhaimin told CNA that he typically avoids driving into the JB city centre as the traffic is congested, particularly amid construction works for the RTS Link.

“More malls in the area would only make (congestion) worse. But perhaps with the RTS Link, Singaporeans will drive over less and this will reduce the bottlenecks. But for this to happen, the malls have to be accessible to the RTS Link station (via a walkway or shuttle bus),” he said.

In response to queries from CNA, Johor Bahru City Square owner Allgreen Properties said that it is “reviewing circulation and accessibility within the mall to enhance the overall visitor experience”.

“This includes exploring improvements to parking capacity and traffic flow to ensure greater convenience for our visitors,” it added.

Experts suggested one way to reduce congestion in downtown Johor Bahru is to improve public transport connectivity from other parts of the town to the city centre and to implement congestion toll charges to dissuade drivers.

In February, Malaysian transport minister Anthony Loke said that the government was mulling congestion charges for busy cities in the country like Johor Bahru, George Town and Kuala Lumpur.

The authorities are also planning to integrate the RTS Link with a public bus-tram network.

In February, the Malaysian government said that an elevated autonomous rail rapid transit (ART) system will be built in southern Johor to ease the area's public transportation woes.

The Johor state government said in 2024 that the proposed rail network would stretch 30km and transport passengers from the Johor Bahru city centre to the suburbs via three lines: The Iskandar Puteri, Skudai and Tebrau lines.

However, on Wednesday, the Regent of Johor Tunku Ismail Sultan Ibrahim said he is "deeply concerned" about potential traffic congestion that would arise once the RTS Link begins operation, adding that the federal government has not presented a "comprehensive solution" to manage the expected surge in commuters, particularly around the Bukit Chagar area.

He questioned why the federal government has stated that there are insufficient funds to cover maintenance costs of a fully elevated ART system in Johor when Penang has been able to secure a Light Rail Transit project, which "is significantly more expensive than the ART system".

Meanwhile, real estate consultant Tan suggested that malls tweak parking policies by allowing parking only after 7am to prevent long-term commuter parking by those who travel to Singapore, freeing up spaces for retail customers.

Loganathan said that the state government could prepare an integrated parking facility in the city centre to accommodate Malaysians who park longer term before travelling to Singapore for work.

“Also, integrating rail and domestic bus services is a solution to this problem, so locals can consider using them to get to town,” he added.

Accessibility aside, another question that inevitably comes up is the long-term viability of these malls, given that others in the area had failed to take off in the past, albeit mostly 20 to 30 years ago.

Minimart owner Jamal noted that the SKS City Mall is located on the same site as Pacific Mall which was abandoned in 1997 due to reported financial issues.

“The (Pacific) mall never materialised, but let’s see if things will be different this time round with SKS,” he added.

Experts CNA spoke to stressed that the outlook is fundamentally different now because the RTS Link and the Johor-Singapore Special Economic Zone are strong catalysts.

Tan told CNA: “Unlike past cycles where malls were built ahead of demand, the current wave of growth is infrastructure-led and policy-enabled … History is unlikely to repeat itself.”

“Many previously underperforming retail assets including Pacific Mall and Danga Bay have already undergone or are undergoing, major revitalisation, signalling renewed confidence from capital injections and operators. This marks a clear shift from abandonment to reinvention, backed by stronger market fundamentals than before,” he added.

He also noted that the upcoming malls are typically linked or close to high-rise residential and serviced apartment developments.

“This means future retail and lifestyle demand will no longer rely predominantly on weekend visitors; it will also be driven by a growing, built-in residential catchment that will live, work, spend and socialise within the district daily,” said Tan.