Commentary: New CPF life-cycle investment scheme bridges existing gap – execution will be key

The voluntary scheme will be welcomed by those keen to grow their retirement savings but lack the investment know-how, says SMU’s Benedict Koh.

A view of the logo of the Central Provident Fund Board. (File photo: CNA/Ooi Boon Keong)

This audio is generated by an AI tool.

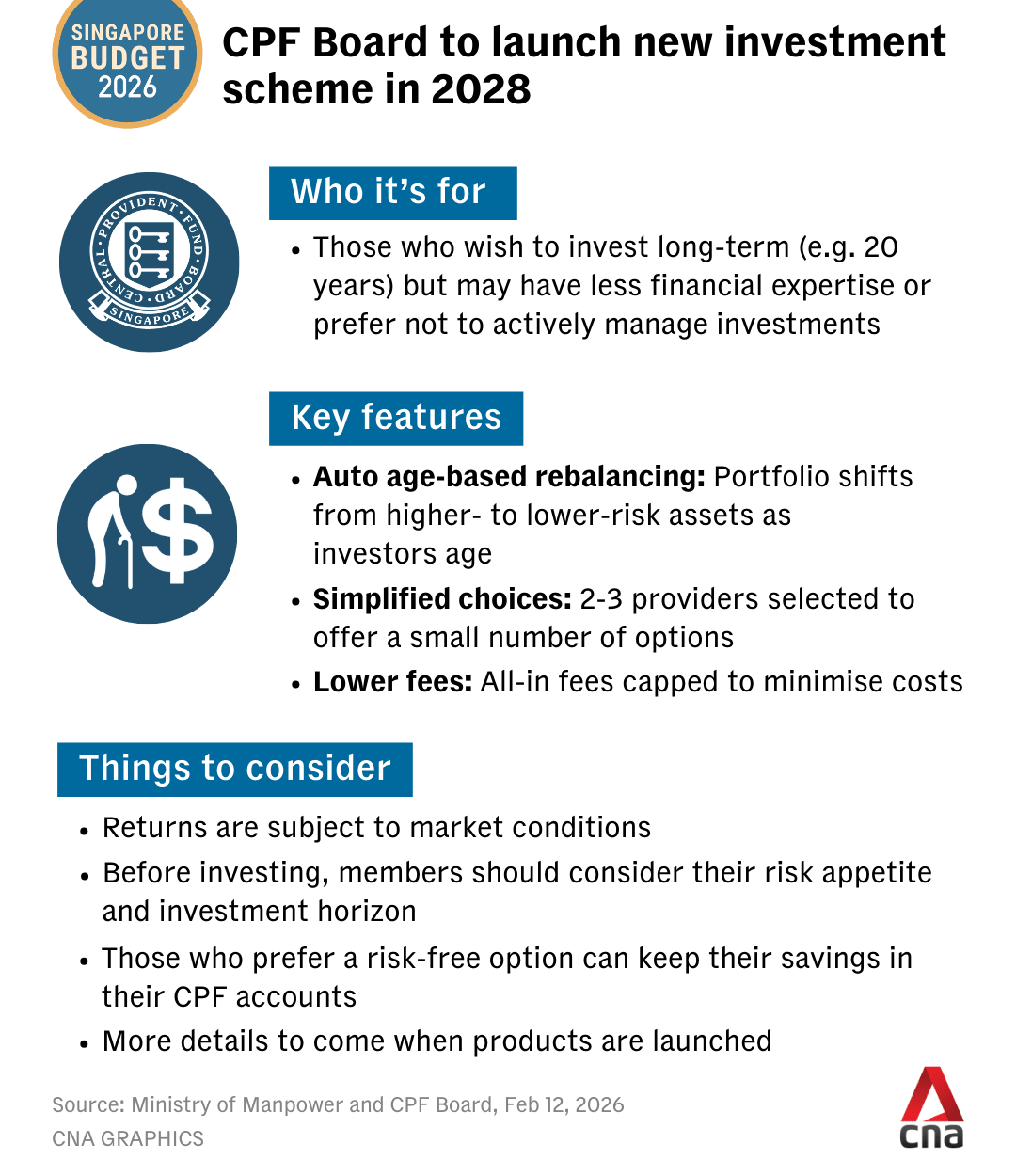

SINGAPORE: The recent Budget 2026 brought several pieces of welcome news for Singaporeans, including a new life-cycle investment scheme for Central Provident Fund (CPF) members. This is set to benefit those keen to grow their retirement savings but lack the investment know-how.

For years, CPF members have faced a difficult choice – leave their savings in CPF accounts earning a steady and modestly attractive interest of between 2.5 per cent and 4 per cent, or venture into investing through the CPF Investment Scheme (CPFIS).

Currently, the CPFIS offers more than 700 products, including unit trusts and insurance products. But too many choices can cause paralysis.

The new voluntary scheme, set to be introduced in 2028, has the potential to bridge this gap. If designed well, it could empower more Singaporeans to grow their retirement savings with greater confidence.

BRIDGING A GAP

As announced, the new scheme will offer simplified, low-cost and diversified life-cycle investment products.

These are expected to work on a glide path mechanism that automatically rebalances investors’ portfolios towards less risky assets, such as bonds, as they approach a target retirement age. The new investment scheme hence removes two of the biggest obstacles facing retail investors – market timing and portfolio rebalancing.

Through the scheme, investors need not decide when to enter or exit markets, nor worry about adjusting their holdings according to diverse market conditions as they grow older.

WHO WILL BENEFIT?

CPF members fall broadly into three groups.

First, the risk averse whose preference for certainty makes them comfortable leaving their savings in CPF accounts earning guaranteed interest.

Second, the financially-savvy who have the expertise to utilise the CPFIS to grow their savings and would be well-placed to continue managing their own investments. Some may even switch to this new investment scheme if they find the constant monitoring of financial markets and portfolio rebalancing too onerous and time consuming.

That said, this group may be in the minority going by the proportion of members with active CPFIS investments. As of September 2025, 28.1 per cent of those eligible for CPFIS have tapped on their Ordinary Account funds, while 22.1 per cent did so with their Special Account monies.

The third group – and perhaps the group most significant to this new scheme – consists of those who have a higher risk appetite but lack the expertise to navigate the myriad of CPFIS options.

For them, life-cycle funds could be a game-changer by offering structured guidance without requiring members to become financial experts.

The principles of finance tell us that the growth of one’s retirement nest egg depends on three key drivers - the amount committed to investment, the rate of return and the holding period of investment. This means that while everyone can benefit from this upcoming investment scheme, young CPF members are likely to reap the most benefit as they have a long runway to retirement.

DESIGN CHOICES WILL BE CRUCIAL

While the concept is promising, execution will be crucial. The CPF Board will soon invite expressions of interest from industry players and several factors should guide the evaluation of these proposals.

1. Balance between flexibility and protection

Conventional wisdom suggests that younger investors can tolerate greater risk, but risk appetite varies widely across individuals. A one-size-fits-all glide path based solely on age may not reflect this diversity. Offering a small range of fund options, such as aggressive, moderate risk and conservative variants, could provide flexibility without overwhelming members with excessive choice.

The geographical exposure of funds and types of assets is another consideration.

While a globally-diversified fund can potentially offer higher returns, they introduce geopolitical uncertainties and currency risks. On the other hand, domestically-focused funds may feel more familiar but limit the returns earned.

The CPF board also needs to consider if life-cycle funds can invest in higher-risk asset classes, such as commodities, real estate and private equity.

Next, life-cycle funds work if investors stay invested over the long term to ride out market cycles. This raises the question of whether rules governing the purchase and sale of life-cycle funds may be needed.

For example, should funds impose a lock-up period or penalties for early withdrawal, as well as limit opportunities of frequent switching between funds?

A lock-up period is consistent with the long-term investing approach, but CPF members may resent the lack of control over their own investments. Striking a balance of having adequate flexibility and protection from timing the market will be important.

2. Keeping costs low and safeguards strong

Over long investment horizons, even small differences in annual charges can significantly erode retirement savings.

Hence, investment fees must be kept low to ensure CPF members benefit meaningfully from the new scheme. Capping the all-in fee, which includes the total expense ratio, wrap and distribution fees, is a move in the right direction.

Equally critical are safeguards, such as ring-fencing of CPF funds invested in this new scheme. Appointing a custodian to hold the assets purchased by life-cycle fund operators is one way to provide CPF members the peace of mind that their savings are protected.

3. Clear communication

Clear communication and education about the benefits and limitations of life-cycle funds will also be paramount.

While the new life-cycle investment scheme ticks the boxes in terms of cost and risk management, they do not guarantee returns or insure against capital loss in a market crash. Investors must be aware that these are still risky investments that can incur losses in black swan events, such as a global financial crisis.

Proper risk profiling and investor education should therefore be a must for selected fund operators.

Singapore’s CPF framework has long emphasised safety and adequacy and the new scheme represents a prudent evolution that balances opportunity with protection.

Its success will depend on the details. But the direction is clear – retirement planning must remain safe, while becoming more accessible and responsive to the needs of a more financially-aware generation.

Benedict Koh is Associate Dean and Professor of Finance at Singapore Management University.